GBTC Faces Investor Exodus Amid ETF Uncertainty: JPMorgan

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

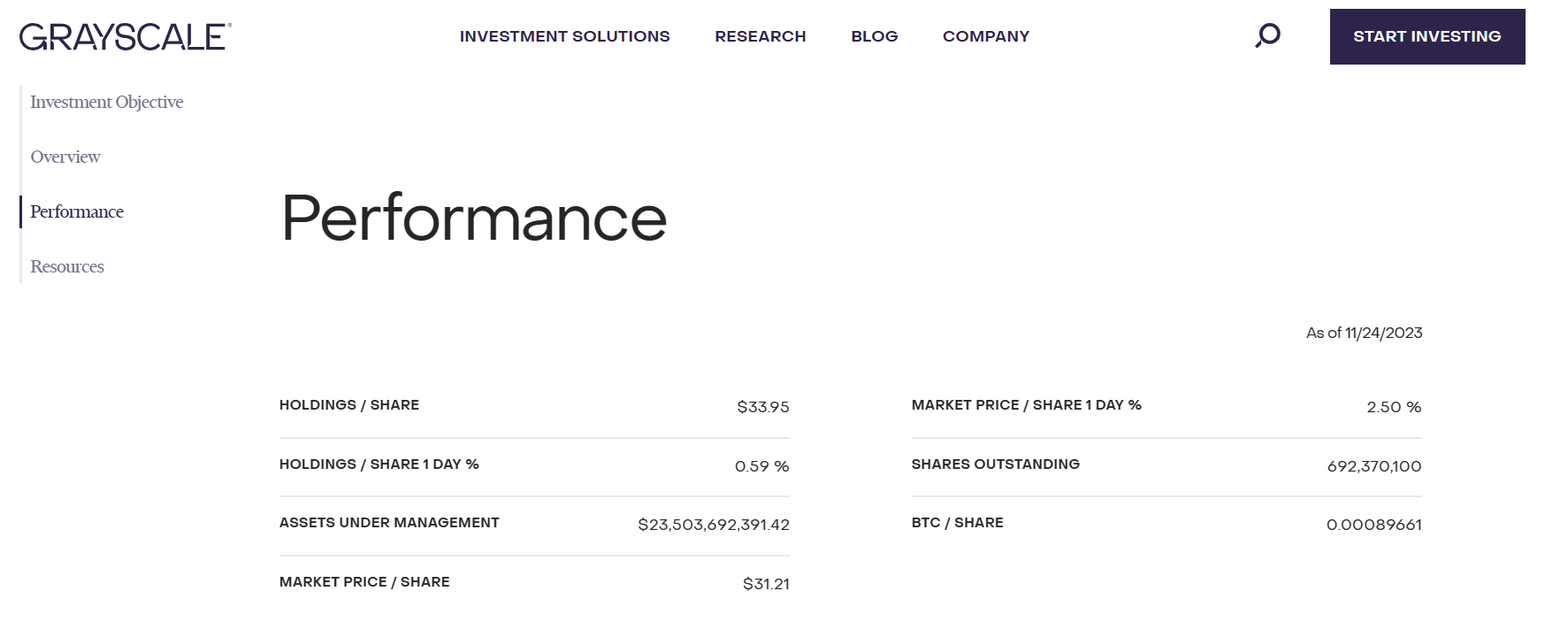

In a potentially pivotal moment for the cryptocurrency market, Grayscale Bitcoin Trust (GBTC), the world’s largest bitcoin fund, is experiencing a surge in investor caution as they await the decision for its conversion into an exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC).

According to a recent JPMorgan research report, a substantial influx of approximately $2.5 billion has flowed into GBTC this year, with investors banking on the ETF conversion. However, this influx might pose a double-edged sword.

Many GBTC shares were acquired below the net asset value (NAV) of the underlying bitcoin, setting the stage for potential profit-taking once the conversion to an ETF materializes. The report, led by analyst Nikolaos Panigirtzoglou, warns that this mass exit from the Bitcoin space could exert downward pressure on Bitcoin prices.

JPMorgan suggests that approximately $2.7 billion might shift into other bitcoin instruments, like the recently established spot bitcoin ETFs, potentially mitigating the negative impact. Nevertheless, the bank maintains a cautious outlook on bitcoin’s price, anticipating that a portion of the $2.7 billion might exit the bitcoin space entirely.

GBTC Is Not Designed to Compete With ETFs

The JPMorgan report raises concerns about GBTC’s future post-conversion, emphasizing that if it doesn’t aggressively lower its 2% annual fee to compete with cheaper alternatives, it could face a more significant loss than the estimated $2.7 billion. GBTC has been trading at a discount to NAV since February, signaling waning demand for its shares.

Despite GBTC’s move to convert into an ETF, the SEC has not yet provided a response. Simultaneously, the regulatory body has extended the review period for various bitcoin ETF applications. The cryptocurrency community watches with bated breath as the market navigates the uncertain waters of potential ETF approval and its repercussions on GBTC and bitcoin prices.