SEC to Revisit Grayscale’s Spot Bitcoin ETF Application Following Court Order

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The U.S. Securities and Exchange Commission (SEC) is gearing up for a significant review on November 2, 2023, as it revisits Grayscale’s application for a spot Bitcoin ETF.

This development comes after a mandate from the U.S. Court of Appeals for the D.C. Circuit on October 23, 2023, ordering the SEC to reconsider its prior denial. The court had highlighted that the SEC hadn’t sufficiently explained the differences between Grayscale’s proposal and the approved Bitcoin futures ETFs.

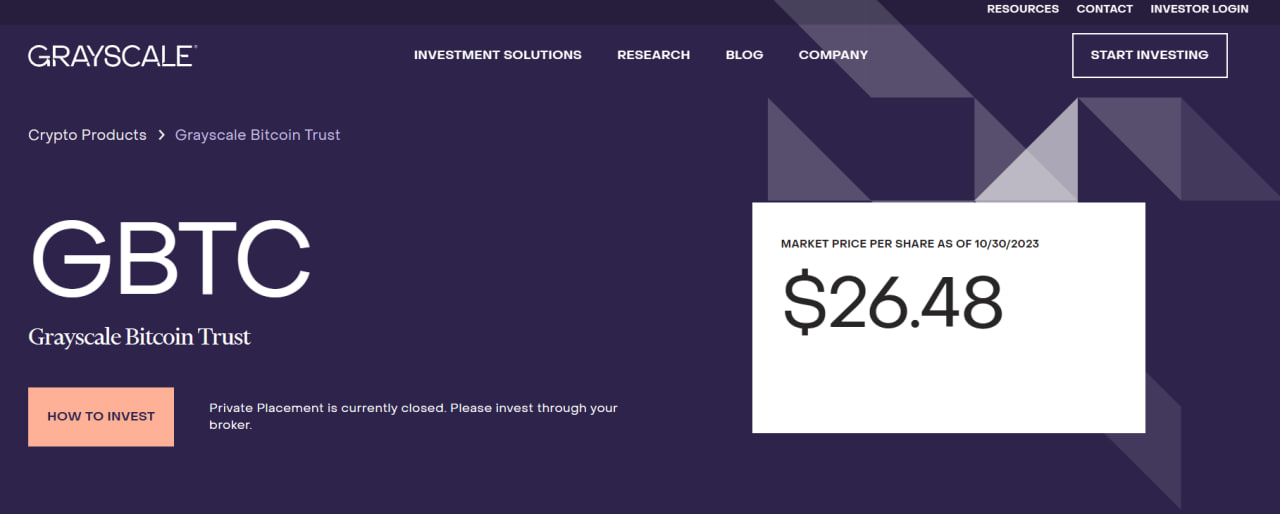

Grayscale, renowned as the world’s largest digital asset manager with assets exceeding $21 billion, currently manages the Grayscale Bitcoin Trust (GBTC), which is accessible only to accredited investors. However, GBTC faces the challenge of trading at a premium or discount to its net asset value (NAV), potentially shortchanging investors.

Grayscale’s aspiration is to transform GBTC into a spot Bitcoin ETF, a move that could open the doors for retail investors to buy and sell shares directly linked to Bitcoin’s price. Moreover, this transformation aims to address the NAV premium/discount issue and reduce the associated fees.

Should the SEC grant approval, Grayscale’s spot Bitcoin ETF would mark a groundbreaking development in the U.S. market, potentially luring both institutional and retail investors into the cryptocurrency space. Nevertheless, the SEC has been cautious in endorsing such products, citing concerns related to market manipulation, custody, and investor safeguards.

All Eyes on the Upcoming Meeting on Grayscale’s Bitcoin ETF Application

The forthcoming closed meeting between SEC officials, commissioners, and counsel, scheduled for November 2, will also delve into additional topics such as the settlement of administrative proceedings and the resolution of litigation claims. Grayscale’s proposal for a spot Bitcoin ETF stands as a significant pivot point in the cryptocurrency landscape, where regulatory approval could redefine the investment landscape and bridge the gap between traditional finance and the crypto sector.