Bitcoin ETFs Closer Than Ever; Could Attract $14.4Bn In 1st Year

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Cryptocurrency enthusiasts are eyeing a potential game-changer in the form of Bitcoin spot exchange-traded funds (ETFs). These investment vehicles offer a fresh gateway for crypto investors to participate in Bitcoin’s price movements without directly owning the digital assets, mitigating concerns related to security, storage, and regulation.

However, obtaining approval for a spot Bitcoin ETF in the U.S. has been a formidable challenge, with the Securities and Exchange Commission (SEC) consistently rejecting applications due to fears of market manipulation, fraud, and a lack of effective surveillance. The SEC has thus far greenlit only crypto ETFs tracking Bitcoin futures or stocks of companies indirectly linked to the crypto realm.

Despite these setbacks, a silver lining has emerged as several prominent financial institutions have recently submitted applications for spot Bitcoin ETFs. Most notably, BlackRock, the world’s largest asset manager and an ETF industry leader, has stepped into the arena. This development has sparked optimism among cryptocurrency enthusiasts that the SEC might finally grant approval for a spot Bitcoin ETF.

Galaxy Digital Says Bitcoin ETFs To Attract $14.4 Billion

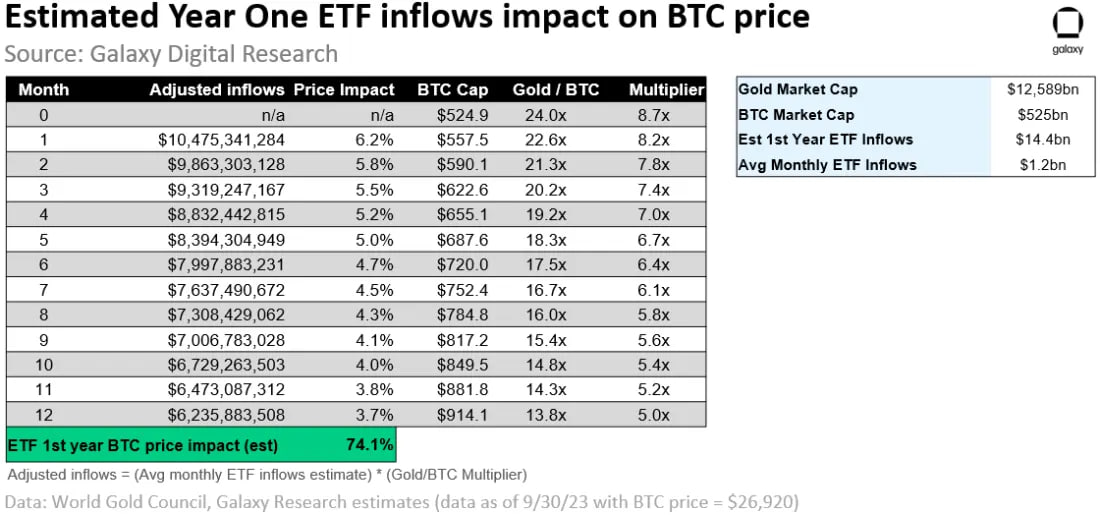

Galaxy Digital, a crypto-focused investment firm, has projected that a spot Bitcoin ETF could draw $14.4 billion in assets during its inaugural year of operation.

Additionally, the report suggests that such an ETF could boost Bitcoin’s price by a substantial 74% during the same period. Galaxy Digital contends that a spot Bitcoin ETF surpasses the current offerings, like trusts and futures, which collectively manage more than $21 billion in value.

Beyond the financial figures, a spot Bitcoin ETF could further revolutionize the crypto landscape by appealing to both institutional and retail investors. It offers a package of advantages, including lower fees, enhanced liquidity, and greater transparency when compared to existing alternatives. Consequently, the potential adoption of a spot Bitcoin ETF could validate Bitcoin as a legitimate asset class and bolster its overall acceptance.

While the SEC’s decision on these applications is still pending, many market analysts believe that approval is inevitable. The surging demand for crypto and ongoing innovations in the sector make it increasingly likely that a spot Bitcoin ETF will be greenlit. If that occurs, it could be a pivotal moment for both the cryptocurrency industry and the ETF market, heralding a new era for digital asset investments.