Bitcoin ETFs Experience Outflow Streak Ahead of Mining Reward Halving

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

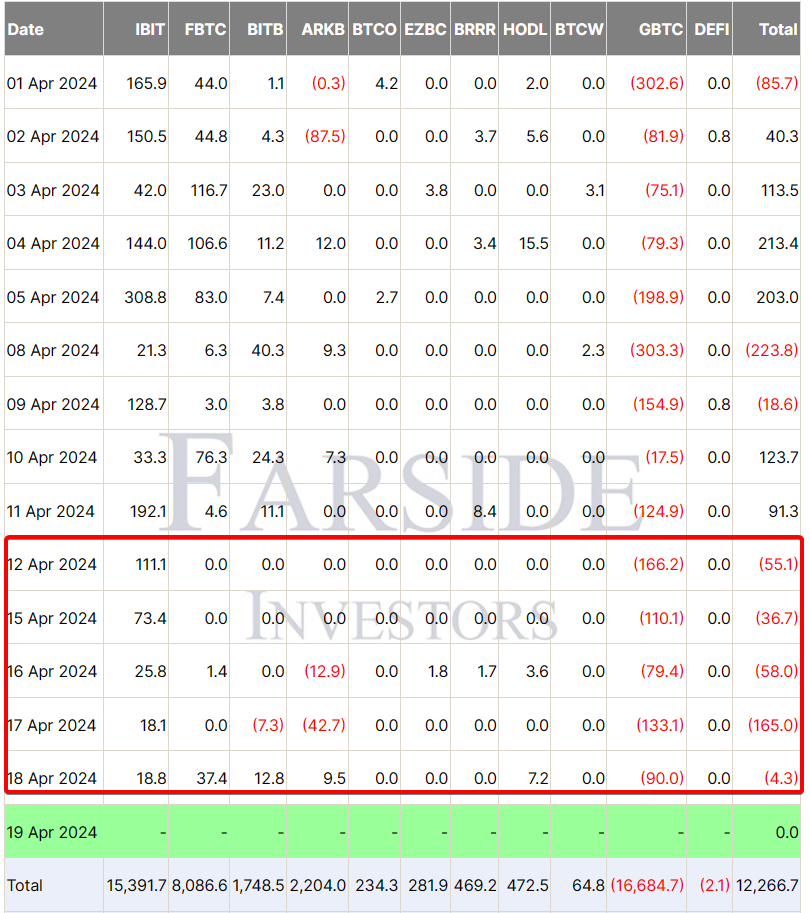

Spot Bitcoin (BTC) exchange-traded funds (ETFs) based in the U.S. are undergoing a notable trend, catching the attention of market participants. In the last five days, these ETFs have witnessed a consistent outflow, totaling $4.3 million as of Thursday. This development comes as the cryptocurrency community anticipates the upcoming mining reward halving, an event historically associated with a bullish market.

Net Outflows for Bitcoin ETFs Exceed $319 Million in 5 Days

According to industry reports from Farside Investors, as reported by CoinDesk, a net outflow exceeding $319 million has been observed from these ETFs since April 12. Among them, Grayscale’s Bitcoin Trust (GBTC) has seen a significant decrease, losing $166.2 million in a single day (on April 12). However, the negative trend was partially offset by inflows into Fidelity’s FBTC and BlackRock’s IBIT.

Grayscale’s underperformance can be attributed to its fee structure since its inception. While the outflows from GBTC are not overly concerning, the recent slowdown in inflows into other Bitcoin ETFs is noteworthy. For example, BlackRock’s IBIT experienced only $18.8 million in inflows on Thursday, a sharp contrast to the $308.8 million peak earlier in the month.

Matrixport’s market update highlights a slowdown in key liquidity drivers, such as the growth of stablecoins and inflows into U.S.-listed Bitcoin ETFs. This suggests a saturation in demand for these financial products, as not even a 10-15% dip in Bitcoin prices has sparked significant net inflows.

Bitcoin is currently trading at $64,400, reflecting a 12.7% decrease from its all-time high of over $73,797 last month.

Several factors contribute to this downturn, including impending U.S. tax payments, reduced expectations of Federal Reserve rate cuts, and geopolitical tensions, particularly between Iran and Israel.

The impending halving event, scheduled for late Friday, will reduce the per-block coin emission from 6.25 BTC to 3.125 BTC, halving the rate at which new Bitcoins are created. While past halvings have resulted in significant price rallies, the extent and duration of these increases have varied.

Despite the prevailing belief in the crypto community that the halving will drive Bitcoin’s long-term upward trajectory, financial giants like Goldman Sachs and JPMorgan offer differing views. JPMorgan, in particular, has hinted at the possibility of a more pronounced price correction post-halving.

As the market observes the halving with a mix of excitement and caution, the movements in Bitcoin ETFs provide insights into investor sentiment leading up to this critical event. The coming days will reveal whether historical patterns persist or if the market is charting a new path.

When trading the crypto market, it doesn’t have to be “hit or miss.” Safeguard your portfolio with trades that actually yield results, just like our premium crypto signals on Telegram.

Interested in learning how to day trade crypto? Get all the information you need here