Bitcoin Miners Face Challenges as Hash Rate and Difficulty Soar

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin miners are grappling with mounting challenges as the network’s hash rate and difficulty levels reach unprecedented heights, resulting in intensified competition and increased operational costs. The looming halving event, set to cut block rewards in half, adds further pressure, prompting some miners to consider selling their BTC holdings to cover expenses.

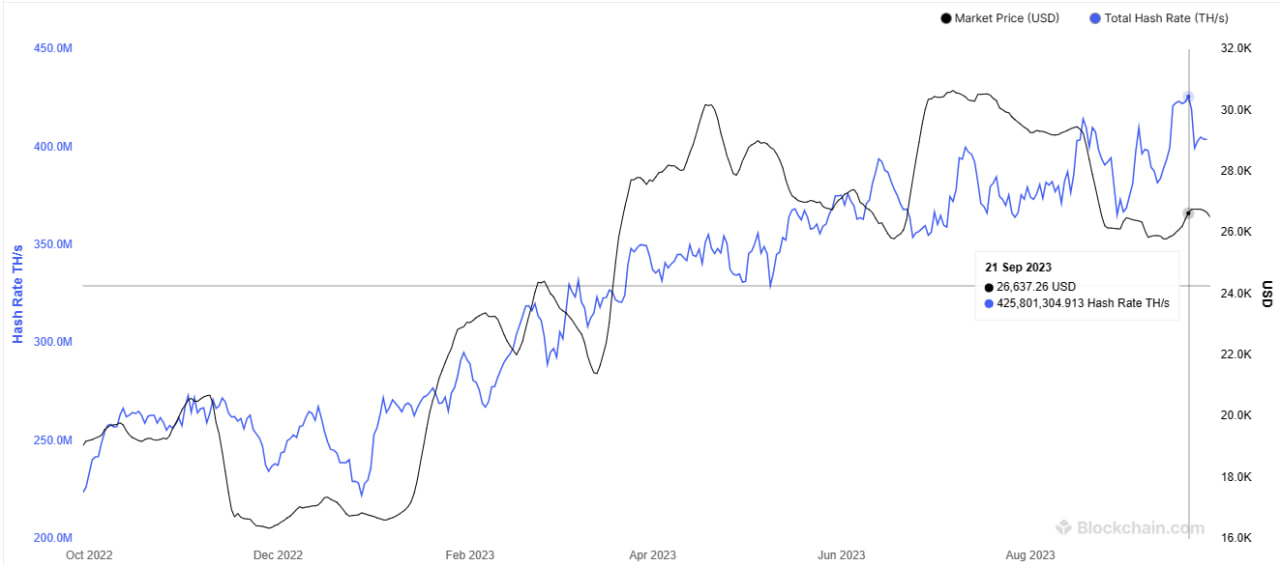

According to Blockchain.com, the hash rate, a metric reflecting the Bitcoin network’s computational power, has surged to a record 425 exahashes per second (EH/s), marking a 68% increase since the year’s outset.

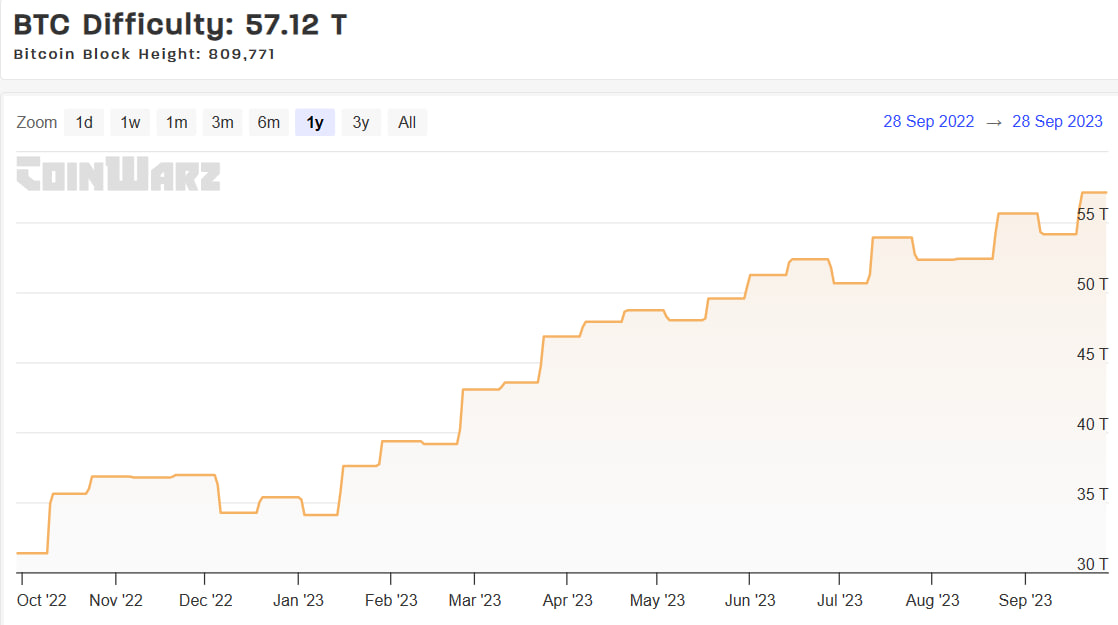

This surge, while bolstering network security, also heightens competition among miners, driving up the network’s difficulty to an all-time high of 57.12T, a 63% increase this year.

Mining Bitcoin Becomes Resource-Intensive

The increased difficulty has made Bitcoin mining more resource-intensive and less profitable, particularly in the face of rising energy costs. The hash price, denoting revenue per unit of hash power, has plummeted to $0.06 per terahash per second per day, an 85% drop from April’s peak of $0.40.

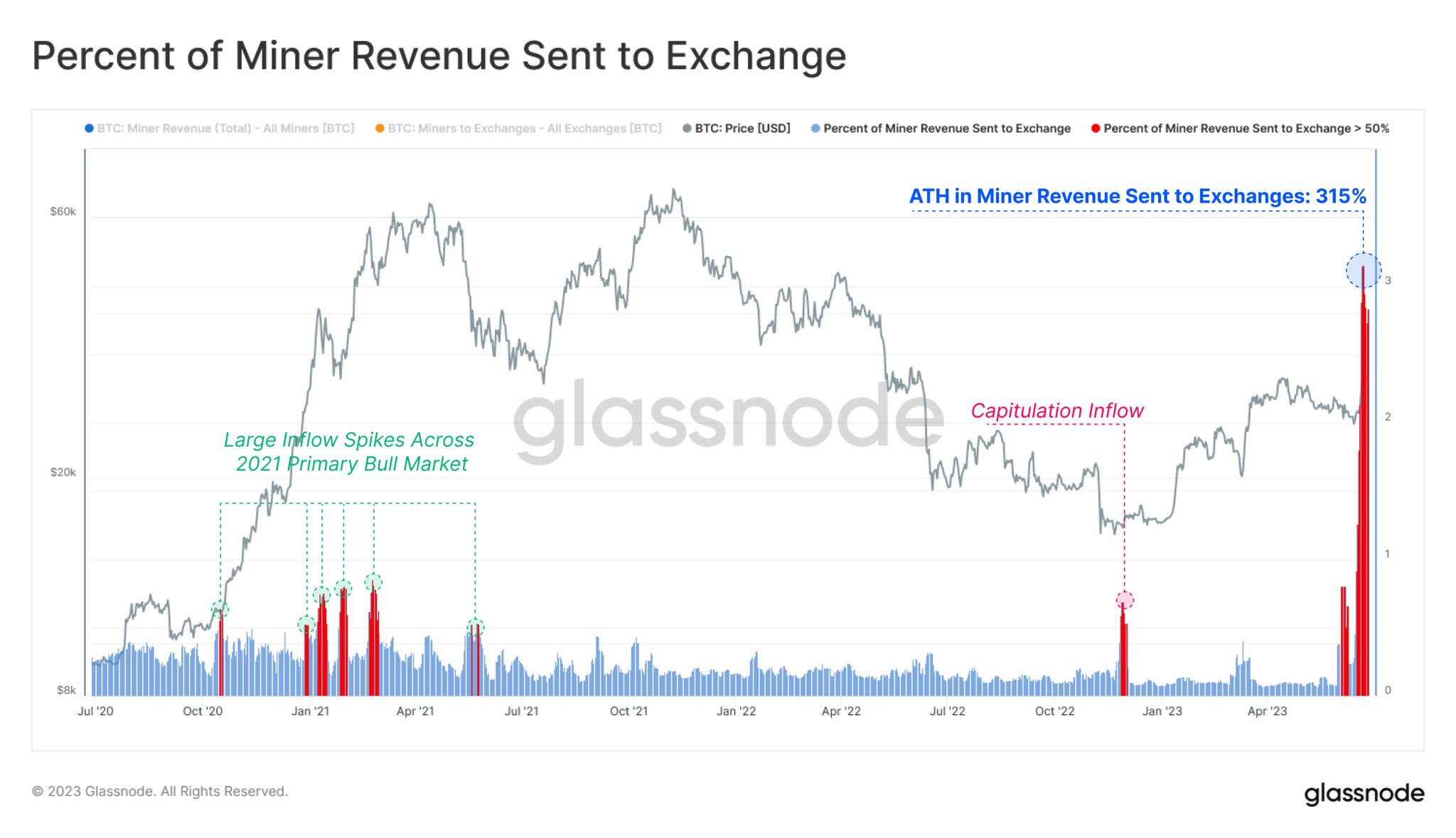

To manage these challenges, some miners have been forced to send a record $128 million worth of BTC to exchanges, suggesting their intention to liquidate assets and generate immediate cash flow, according to data from Glassnode. The potential selling pressure from miners could adversely impact Bitcoin’s price, which has struggled to break above $30,000 for an extended period.

Hope on the Horizon for Bitcoin Miners: The Halving Event

Despite the current scenario, certain analysts remain optimistic. They anticipate miners will resume accumulating BTC after the impending halving event, scheduled for April 2024. This event will cut the block reward from 6.25 BTC to 3.125 BTC, increasing the scarcity and value of newly minted bitcoins.