Spot Bitcoin ETFs Trading Volume Surpasses $200 Billion Mark

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

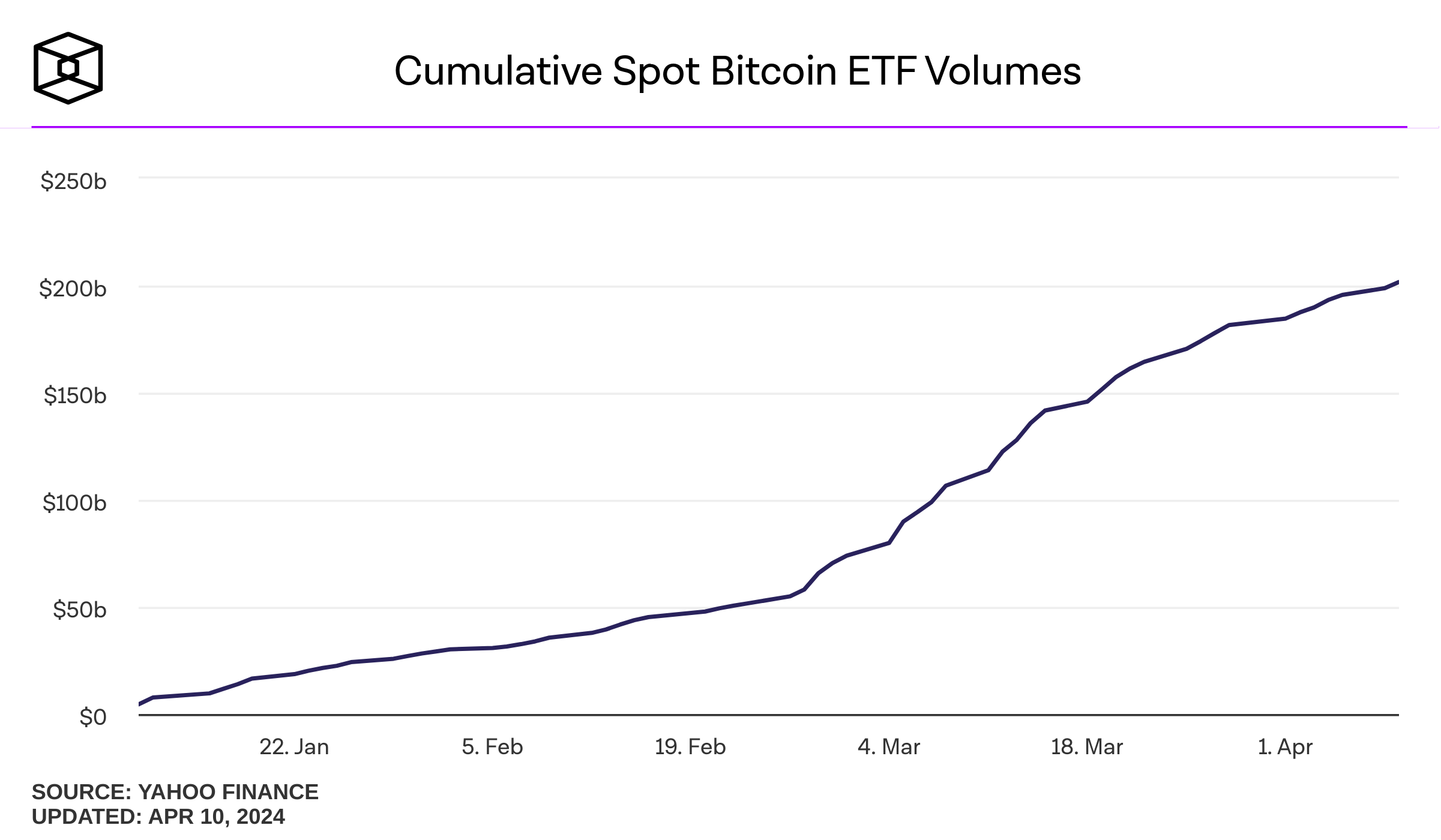

In a remarkable display of growth, the cumulative trading volume for U.S. spot Bitcoin exchange-traded funds (ETFs) has surged past the $200 billion mark. This milestone was achieved in less than three months following the Securities and Exchange Commission’s approval for ETFs from financial giants such as BlackRock, Fidelity, and Bitwise, among others.

The surge in trading volume underscores the growing interest in cryptocurrency as an investment vehicle. On March 8, the total volume crossed the $100 billion threshold, and by the close of trading yesterday (March 9), it had nearly doubled to reach $201.7 billion, according to The Block’s data dashboard. However, Tuesday’s trading volume of $2.9 billion marked a significant decrease from the peak of $9.9 billion on March 5.

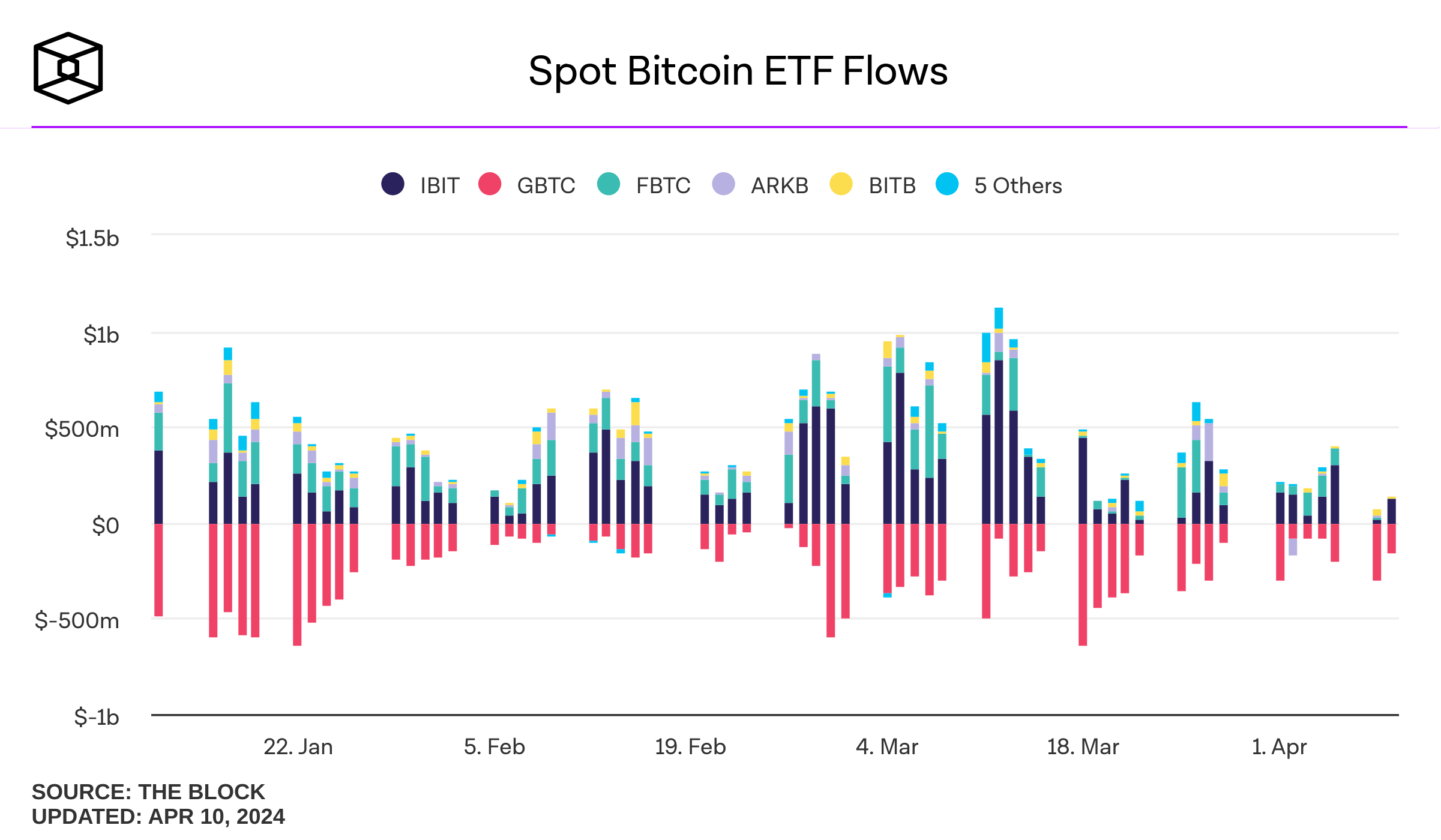

Leading the trading volume was BlackRock’s IBIT, which generated $1.4 billion, followed by Grayscale’s GBTC and Fidelity’s FBTC with $677 million and $488 million, respectively. BlackRock’s IBIT has achieved a 50% market share, a notable achievement considering the competitive landscape.

On the other hand, Grayscale’s GBTC, which once dominated the market with a 50.5% share at the launch of spot Bitcoin ETFs on January 11, has seen its share shrink to 23.5%. This decline is aligned with significant daily outflows from the fund, mainly due to its relatively high fees and commissions.

In contrast, BlackRock’s IBIT has seen its market share swell from 22.1% to 52% before settling at 48.1% as of yesterday. Fidelity’s FBTC holds the third spot with a 16.9% market share.

Bitcoin ETFs Record Net Outflows

Despite the impressive trading volumes, the spot Bitcoin ETFs have experienced net outflows, with $18.6 million exiting on Tuesday, following a substantial $223.8 million on Monday. Grayscale’s GBTC witnessed the largest outflow of $154.9 million, overshadowing BlackRock’s IBIT, which saw the highest inflow of $128.7 million.

Bitcoin ETF Flow data – 09 April 2024

All data in. $19m net outflow on the day pic.twitter.com/bDLruGOfbZ

— BitMEX Research (@BitMEXResearch) April 10, 2024

Overall, the trend for the spot Bitcoin ETFs has been a slowdown in inflows since reaching a daily peak of $1.05 billion on March 12, coinciding with Bitcoin’s approach to its latest all-time high of $73,797. The combined ETFs currently boast net inflows totaling $12.4 billion.

This slowdown in inflows comes as Bitcoin’s price experienced a 5% drop from a high of $71,731 to a low of $68,200, marking the second consecutive day of net outflows for the funds since March 22, according to The Block. Despite this, Bitcoin’s trading price has seen a slight uptick to $69,410, reflecting a 0.4% increase over the past 24 hours and an impressive 64% growth year-to-date.

When trading the crypto market, it doesn’t have to be “hit or miss.” Safeguard your portfolio with trades that actually yield results, just like our premium crypto signals on Telegram.

Interested in learning how to day trade crypto? Get all the information you need here