Crypto Exchanges Vie for Control in the US Amid Regulatory Woes

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

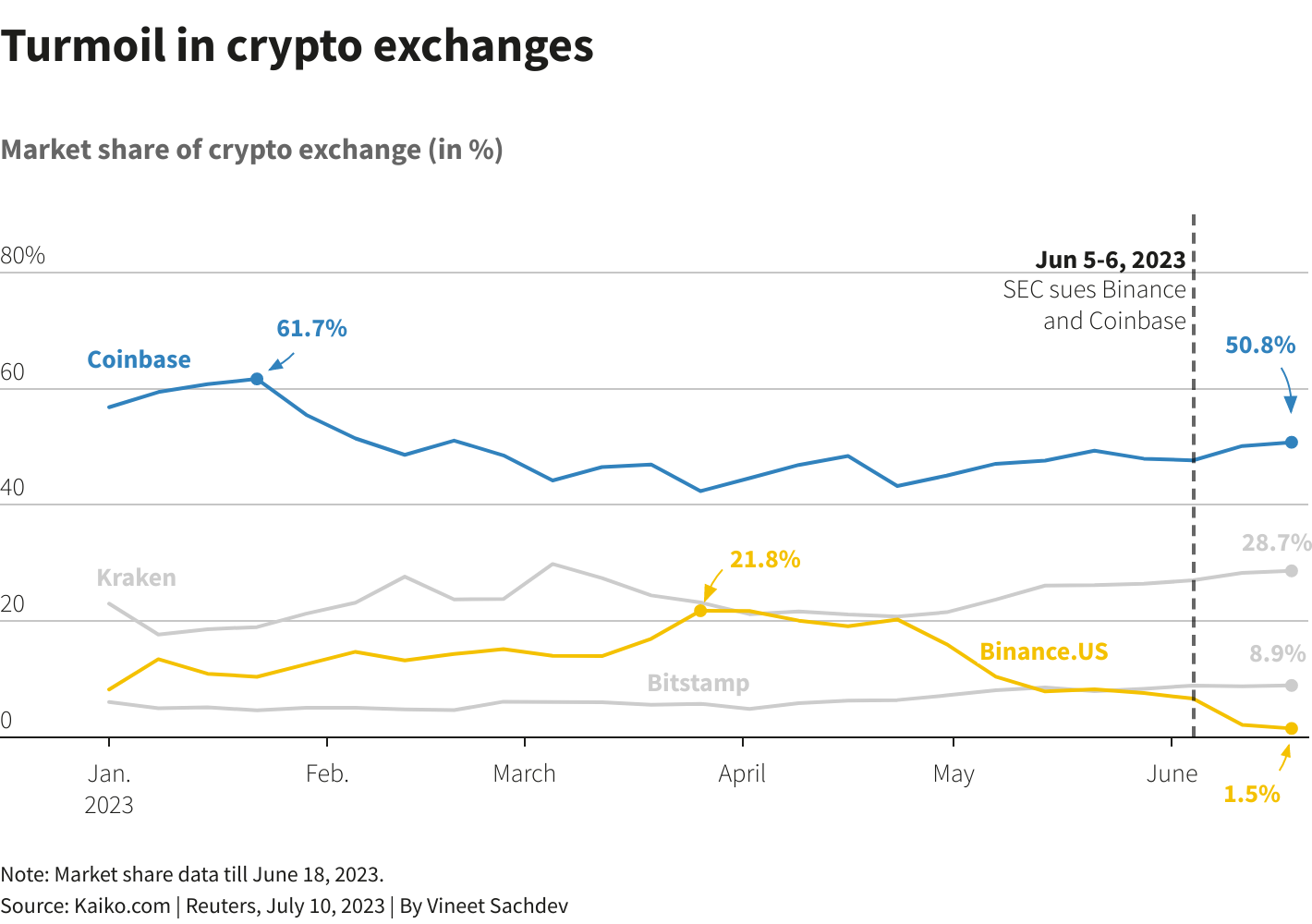

A battle for dominance among crypto exchanges is underway in the United States, the world’s largest crypto market. Recent regulatory crackdowns have sent shockwaves through the sector, prompting significant shifts in market share among the leading exchanges.

A Reuters report showed that Coinbase and Binance.US, two prominent players in the US crypto market, have faced setbacks this year, witnessing a decline in their market dominance. Coinbase, once commanding a high of 62% in January, has seen its market share dwindle to around 51% as of June 18. Similarly, Binance.US, which held a substantial 22% market share in March, now sits at a mere 1.5%, according to data from Kaiko.

Regulatory Challenges and Competitors’ Rise

Both Coinbase and Binance have found themselves embroiled in legal disputes with the US Securities and Exchange Commission (SEC), accused of violating securities laws. Nevertheless, these platforms firmly maintain their innocence. The regulatory hurdles faced by these exchanges, coupled with the fallout from FTX’s collapse last year, have contributed to a period of turbulence within the crypto space.

Amidst the chaos, rival platforms have seized the opportunity to gain ground and challenge the established players. Kraken, Bitstamp, and LMAX Digital have made substantial strides in market share since the beginning of the year, with gains reaching up to 5.66% based on Kaiko’s data representing the global market share of US-operating exchanges.

Kraken, in particular, has emerged as a strong contender, capturing approximately 29% of the market and surpassing Binance.US in the process. Ravi Doshi, co-head of trading at Genesis Trading, emphasizes the significance of dominating the US market. The majority of trading volume occurs during US trading hours, as the country boasts the highest concentration of capital and institutional interest in the crypto space.

The Battle for Market Supremacy Among Crypt Exchanges Continues

As regulatory pressures persist, the competition for dominance in the US crypto market shows no signs of abating. Established players and emerging contenders alike are locked in a fierce battle, each striving to attract investors and institutions eager to capitalize on the vast potential of cryptocurrencies.

As the crypto sector adapts to changing regulations and seeks to build trust with investors, the race for dominance promises exciting developments. Investors and enthusiasts alike eagerly await the outcomes as these platforms vie to revolutionize the financial landscape and embrace the opportunities presented by digital currencies.

You can purchase Lucky Block here. Buy LBLOCK