Bitcoin ETFs Attract Billions of Dollars in Two Days of Trading

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The launch of the first spot bitcoin exchange-traded funds (ETFs) in the U.S. has been a huge success, attracting billions of dollars in trading volume and inflows in just two days.

These innovative ETFs revolutionize investor access to the cryptocurrency market by enabling the direct purchase and sale of shares that mirror Bitcoin’s price. Sidestepping intermediaries and intricate structures, Bitcoin ETFs present a more streamlined and efficient means of exposure to Bitcoin, especially in a market that recently flirted with the $1.8 trillion valuation.

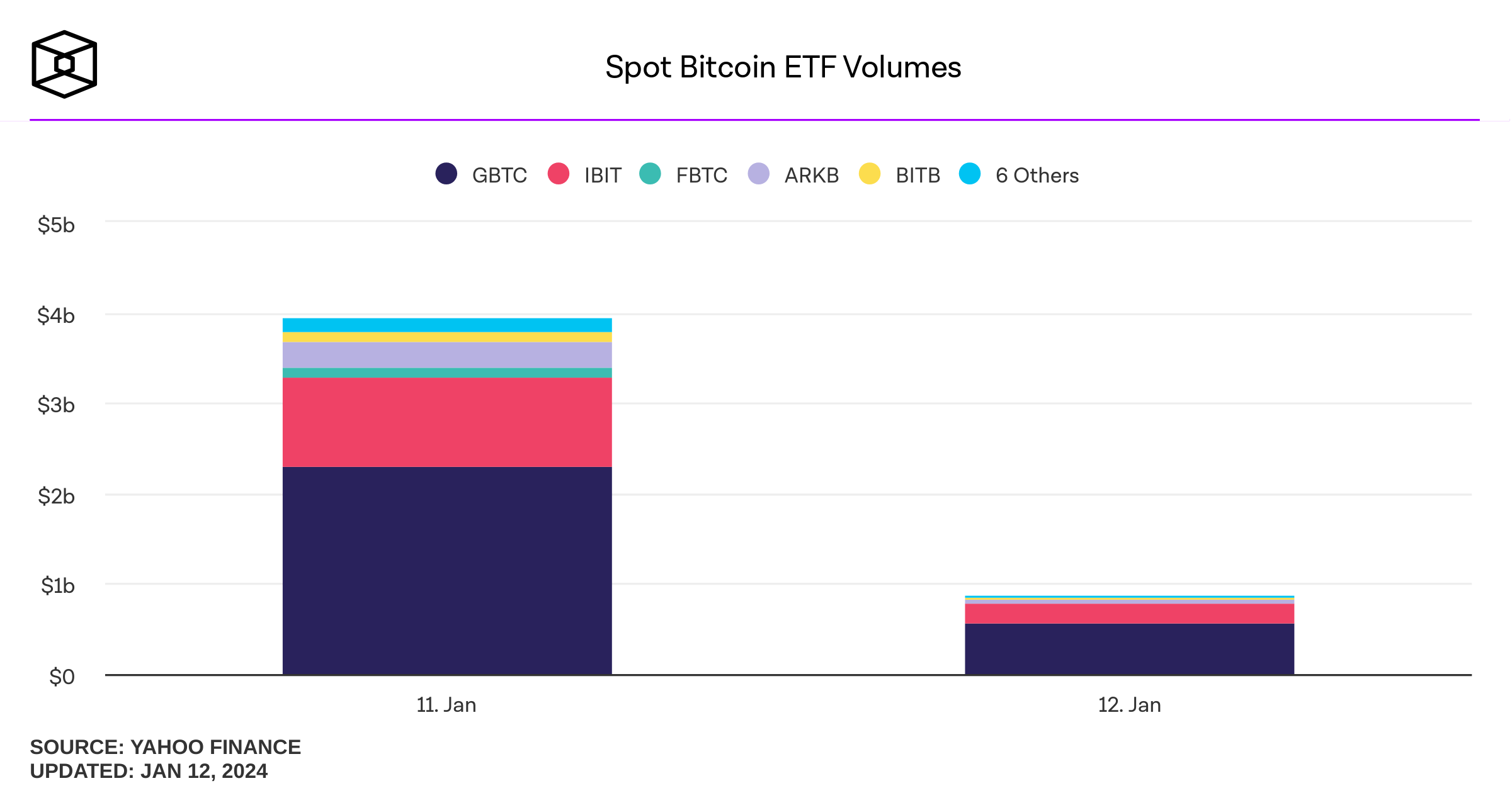

As reported by Yahoo Finance and The Block, the greenlighted Bitcoin ETFs orchestrated a staggering $4.6 billion in trading volume on their inaugural day, swiftly followed by an additional $2.2 billion on day two, culminating in a remarkable total of nearly $7 billion. However, this surge in ETF activity coincided with a dip in Bitcoin’s price, which slipped to $43,000 on Friday from its recent zenith of $49,000.

Among the endorsed ETFs, BlackRock’s iShares Bitcoin Trust dominated Thursday’s trading, amassing over $1 billion in volume and positioning itself among the top 25 performers on their debut day, as noted by Bloomberg Intelligence senior ETF analyst Eric Balchunas. On Friday, Grayscale’s GBTC took the reins, boasting an impressive $2.3 billion in volume.

Update: Day Two volume so far about $900m for the Nine Newborns (which is great, total outlier for a normal launch) also good to see it spread around. $GBTC is up to $1.2b on its own. We also got flow update for them of 'only' -$95m yest. Likely see a much bigger # tonight tho. pic.twitter.com/1bQwI9Ucvz

— Eric Balchunas (@EricBalchunas) January 12, 2024

In terms of capital inflows, preliminary Bloomberg data suggests that Bitwise’s BITO emerged as Thursday’s victor, securing $238 million in fresh capital. Fidelity’s FBTC followed closely with $227 million, and BlackRock claimed the third spot with $111 million. It’s worth noting that these figures are subject to change pending additional data.

UPDATE: We don't have to wait till tonight for $GBTC Flows. Just -$95 million. A fraction of what I and many were thinking. This means yesterday was a huge success in my opinion. Likely going to see an inflow number for $BRRR from Valkyrie too!

Day 1 Net flows sit at $625 mln pic.twitter.com/V3RE9nfFN7

— James Seyffart (@JSeyff) January 12, 2024

The Road Ahead for Bitcoin ETFs in the U.S.

The advent of spot Bitcoin ETFs marks a pivotal moment for the cryptocurrency sector, underscoring the broader acceptance and integration of digital assets by mainstream investors and regulators.

This milestone not only signals a new era but also opens the floodgates for heightened innovation and competition, with more ETF providers and products anticipated to join the market in the near future.