Crypto Inflows Soar as Confidence in Digital Assets Strengthens

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

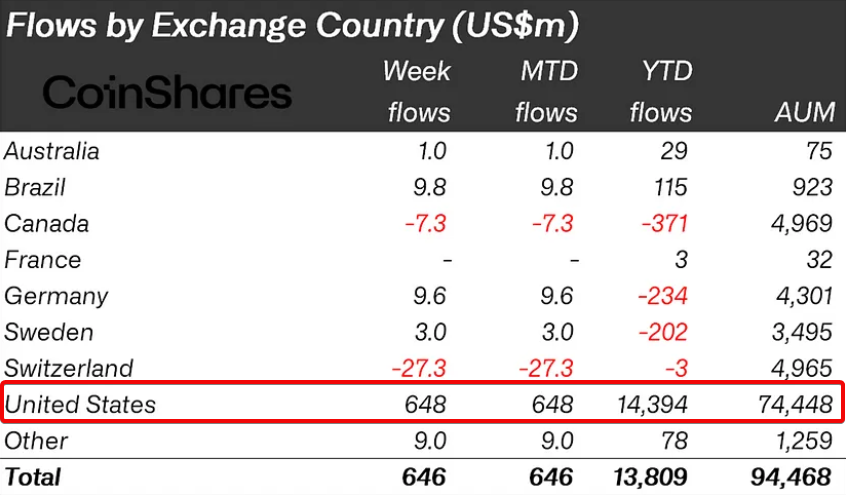

The digital asset market has demonstrated remarkable resilience and growing confidence, as seen in a significant surge in crypto inflows, which reached a staggering $646 million in the last week alone, according to a recent report from CoinShares. This surge brings the year-to-date inflows to an unprecedented $13.8 billion, surpassing the previous record of $10.6 billion set in 2021.

Despite these impressive figures, there is a noticeable shift in investor behavior. Exchange-Traded Fund (ETF) investors, who were previously bullish, are now showing signs of restraint, with weekly inflows not matching the highs of early March. Additionally, trading volumes have seen a dip, falling to $17.4 billion last week from the peak of $43 billion at the beginning of March.

The US Recorded Almost $650 Million in Crypto Inflows Last Week

The investment landscape remains divided across regions. The United States leads the charge with an additional inflow of $648 million. Brazil, Hong Kong, and Germany also contributed positively, with inflows of $10 million, $9 million, and $9.6 million, respectively.

On the other hand, Switzerland and Canada experienced outflows, losing $27 million and $7.3 million, respectively, indicating a more cautious stance among investors in these countries.

Bitcoin continues to be the centerpiece of investor interest, amassing inflows of $663 million. Conversely, short-bitcoin investment products, which bet against the market, have seen outflows for the third consecutive week, totaling $9.5 million. This trend suggests a waning pessimism among investors who previously held bearish views.

Ethereum, the second-largest cryptocurrency by market capitalization, has faced outflows for four weeks straight, amounting to $22.5 million. However, other alternative coins (altcoins) like Litecoin, Solana, and Filecoin have bucked the trend, with inflows of $4.4 million, $4 million, and $1.4 million, respectively, signaling a diversified interest in the broader crypto market.

Bitcoin Open Interest Taps Record High

In related developments, Bitcoin Open Interest (OI) has reached a new all-time high, coinciding with Bitcoin’s recent rally to $72,000.

Bitcoin: Open Interest hits all-time high, with a value of $18.2Bhttps://t.co/Nr0Sb2DNb0 pic.twitter.com/NhYQIPzhCW

— Maartunn (@JA_Maartun) April 8, 2024

OI, which measures the total active Bitcoin derivatives contracts across exchanges, serves as a barometer for capital flow into the market. A rise in OI typically prompts investors to open more positions, potentially increasing Bitcoin’s price volatility.

As of the latest update, Bitcoin’s price stands at $70,680, marking a 24-hour decline of 1.4%.

When trading the crypto market, it doesn’t have to be “hit or miss.” Safeguard your portfolio with trades that actually yield results, just like our premium crypto signals on Telegram.

Interested in learning how to day trade crypto? Get all the information you need here