Uniswap (UNI/USD) Market Is Basing at $4, Conjecturing Bounces

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Uniswap Price Prediction – October 19

In a way of movement consolidation by bears in the transaction deals involving Uniswap versus the US Dollar, as the crypto-economic market is basing at $4, conjecturing bounces output.

A notable swing high must take a configuration capable of opening a way back to the upside from its current support line of $4 after witnessing the cryptocurrency market attempt to rebuild its formation from a lower-trading spot. The process of buying dips that are likely to occur in the long run should be ongoing.

UNI/USD Market

Key Levels:

Resistance levels: $4.50, $5, $5.50

Support levels: $3.50, $3, $2.50

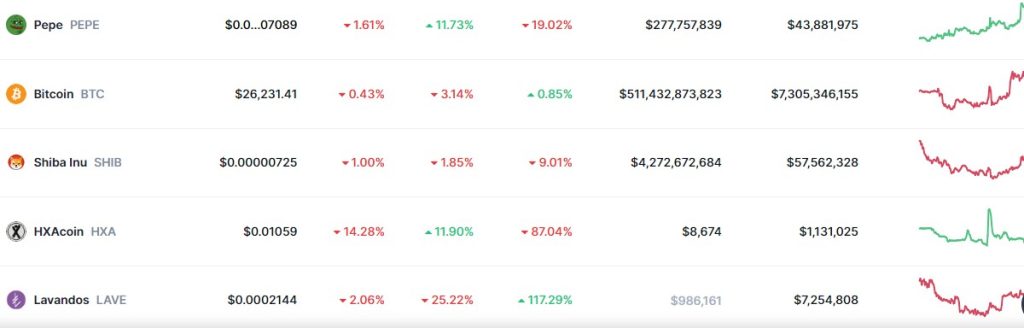

UNI/USD – Daily Chart

The UNI/USD daily chart reveals that the crypto market is basing around the line of $4, conjecturing bounces between that point and the support level of $3.50.

The stochastic oscillators have been placed southbound from 33.2349336 to 8.6024715, showing that the selling force is tentatively ongoing. The Bollinger Bands from the lower trend line are at $3.7880159, the middle part is at $4.2044140, and the upper side is at $4.6208121. As it is, long-position pushers should be on the lookout for pushing back for recoveries in no time.

In what direction will the UNI/USD market turn in the shortest amount of time?

An over-left falling gravity has continued to surface with a slowing motion input in the operations of the UNI/USD trade as the price is debasing at $4, conjecturing a bounce signal.

The vein of trade suppositions being nursed in the crypto business is suggesting that sellers need to be cautious of going southward further along the pathway of the lower Bollinger Band as buyers are expected to start making re-appearances in the market. The underlying support to the point of $3.50 and its underneath will serve as better lower spots to surge back upward.

As the cryptocurrency has been haggling about $3.8815436, maintaining a negative percentage rate of 1.36, the UNI/USD market activities have continued to depreciate in relation to the value of $4. It is not a good idea psychologically to follow any additional lows from the current trade axis. If a rebound is required, the middle Bollinger Band trend line is foreseen to serve as the key trading area that bears should avoid.

UNI/BTC Price Analysis

In contrast, Uniswap is massively basing itself on the path of the lower Bollinger Band trend line against Bitcoin, conjecturing bounces.

The lowest portion of the Bollinger Band trend lines is stretched downward and southward. No notable bullish candlestick has emerged to counteract the dropping forces, which is a hint that sellers are still holding fast. Instead, candlestick formation has been bearishly complacent. The placement of the stochastic oscillators is between 25.3157895 and 16.1328819. At this level, sellers have to exercise caution while opening new positions.

Note: Cryptosignals.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

You can purchase Lucky Block here. Buy LBLOCK