Binance Announces Mass Delisting of BUSD Trading Pairs

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

In a bid to uphold a high-quality trading environment and safeguard its users from low liquidity and trading volumes, Binance, the world’s leading cryptocurrency exchange, has unveiled plans to delist several spot trading pairs on September 8th.

Trading Pairs on the Chopping Block

The affected trading pairs set for removal include AUDIO/BUSD, BAT/BUSD, BSW/BUSD, CITY/BUSD, CVX/BUSD, FORTH/BUSD, JUV/BUSD, and MOB/BUSD. Subsequently, the following pairs are scheduled for delisting: OGN/BUSD, OMG/BUSD, PLA/BUSD, POLS/BUSD, REI/BUSD, RSR/BUSD, SCRT/BUSD, TVK/BUSD, as well as ADA/BIDR, MATIC/BIDR, UTK/BUSD, and ZIL/BIDR.

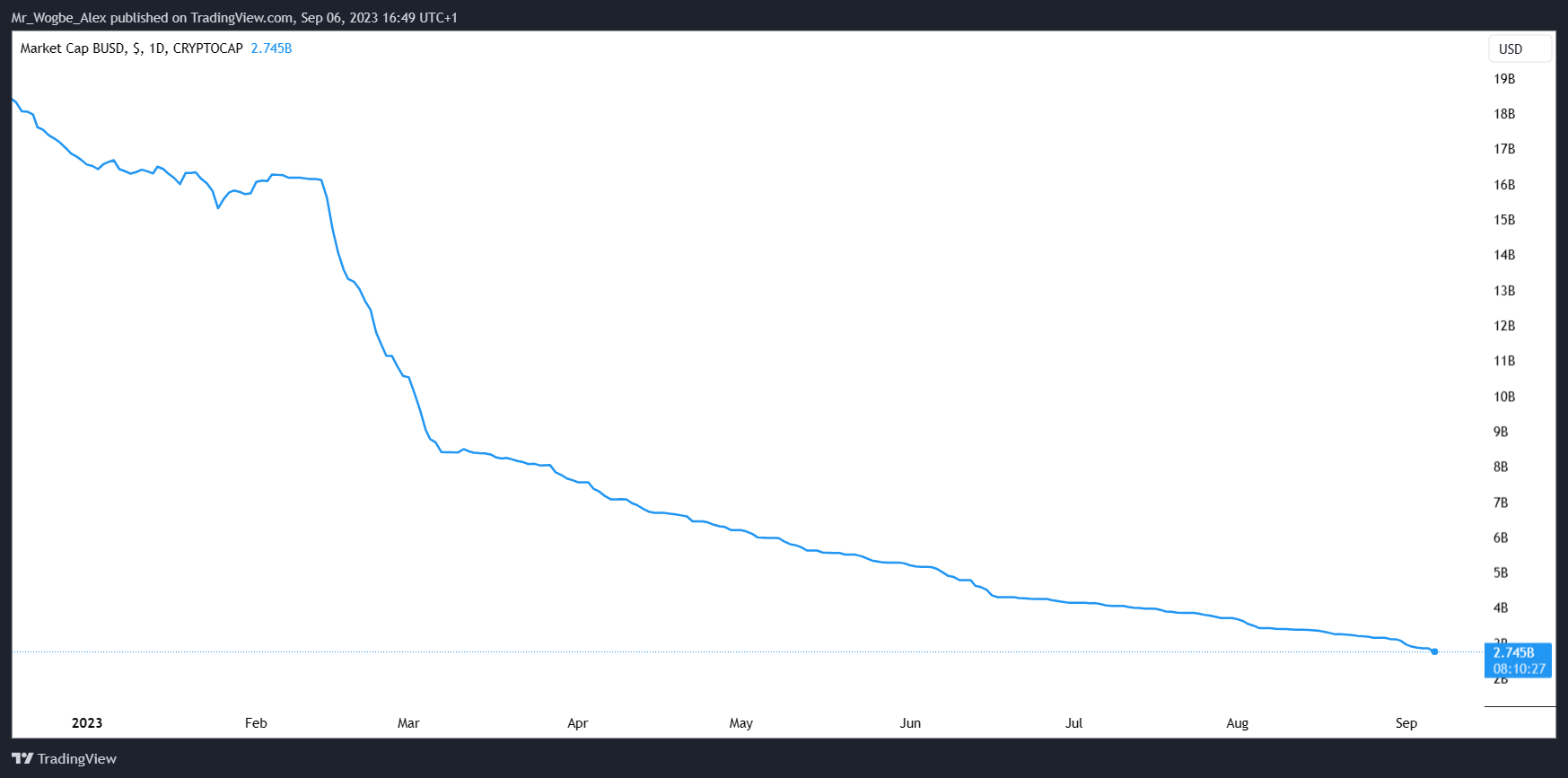

Most of these trading pairs are denominated in Binance USD (BUSD), a renowned stablecoin pegged to the US dollar and issued by Paxos Trust Company. BUSD, boasting a market capitalization exceeding $2.7 billion, has, however, encountered regulatory hurdles this year. The New York Attorney General’s allegations of Paxos violating state laws by issuing BUSD without proper authorization have shaken confidence, leading to a staggering $14 billion loss in BUSD’s valuation since March.

Binance Issues Guidance to Users

Binance has reassured users that despite the delisting, they can still engage in trading these pairs on alternative markets like BNB or BTC. To facilitate a smooth transition, Binance advises users to cancel their open orders linked to the affected pairs ahead of the delisting date. Unattended orders will be automatically canceled by the system.

Final Word: Adapting to Regulatory Pressures

Binance’s decision to delist these pairs aligns with its ongoing efforts to navigate the intensifying regulatory landscape. Recent months have seen the exchange reduce its leverage limits, temporarily suspend some fiat withdrawals, and introduce mandatory Know Your Customer (KYC) verification for all users. These proactive measures underscore Binance’s commitment to bolstering compliance and enhancing user protection standards.

Interested in learning how to day trade crypto? Get all the information you need here