Crypto Investment Rebounds as Weekly Inflows Reach $29 Million

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

In a remarkable turn of events, the crypto market is embracing a renewed wave of investor confidence, as unveiled by the latest edition of the Digital Asset Fund Flows Weekly Report curated by CoinShares. This week’s data showed that crypto investment inflows saw a significant influx of $29 million into various digital asset investment products, casting aside the shadow of the past three weeks, which saw a consistent stream of outflows.

CoinShares analysts are attributing this remarkable shift in sentiment to the latest twist in the tale of the US inflation narrative. Recent data has defied expectations by delivering a slight dip, sending ripples of optimism across the market. This unexpected economic pivot has effectively dampened the prospects of a looming interest rate hike in September, thus breathing fresh life into the crypto market.

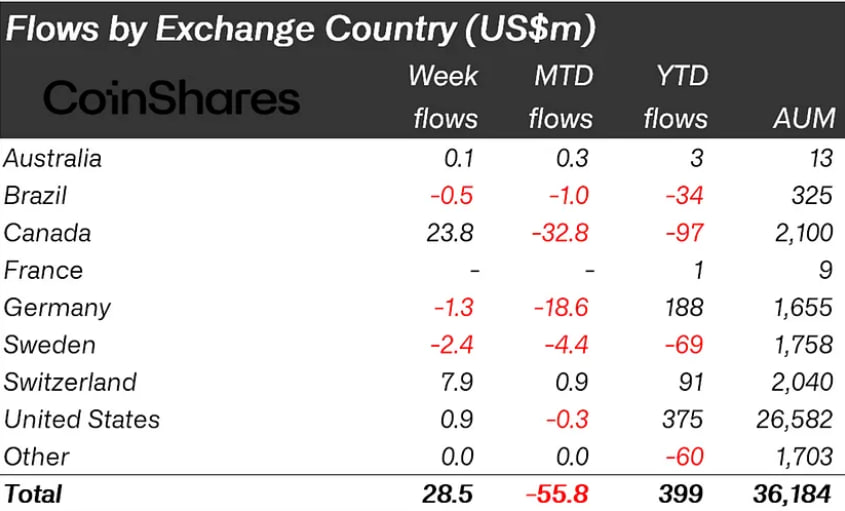

Looking geographically, it’s Canada that has taken the reins in embracing this newfound positivity, with a substantial inflow of $24 million. Yet, in the grander picture painted by the year-to-date (YTD) figures, Canada is evidently playing catch-up to its global counterparts. Switzerland, on the other hand, has also stepped into the spotlight with notable inflows totaling $8 million.

Bitcoin Claims Majority of Last Week’s Crypto Investment Inflow

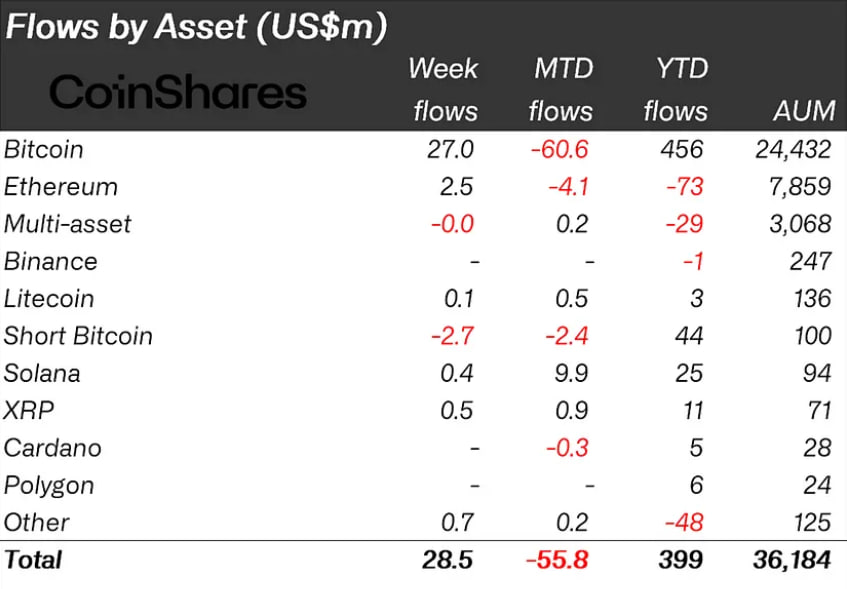

Of course, standing prominently at the forefront of this market resurgence is Bitcoin. The poster child of cryptocurrencies has captured a staggering $27 million in inflows, gracefully following a trio of weeks that witnessed a sizable exodus, accounting for an impressive $144 million.

It’s worth noting that even short positions on Bitcoin, which experienced a marginal influx of $2,000 the week prior, have reverted to their outflow pattern, with $2.7 million exiting this asset class last week. Remarkably, this trend positions it as the lone asset experiencing such an outward movement.

These figures eloquently narrate the unwavering investor faith not only in Bitcoin but also in the broader panorama of cryptocurrencies, even in the face of a season characterized by subdued trading volumes.

You can purchase Lucky Block here. Buy LBLOCK