Bitcoin ETFs Gain Ground, Control 4% of Total Bitcoin Supply

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

In a landmark moment for the cryptocurrency sphere, U.S.-listed spot Bitcoin Exchange-Traded Funds (ETFs) are carving out a substantial niche, now holding an estimated 4% of Bitcoin’s total finite supply of 21 million coins. This shift signals a significant stride in digital currency investments, reshaping the landscape for both investors and the broader market.

According to recent data from BitMEX Research, these ETFs have witnessed a remarkable influx of funds, with a staggering $472.6 million pouring into the market just yesterday.

[1/4] Bitcoin ETF Flow – 07 March 2024

All data in. Net total inflow of $472.6m. Another strong day, with Fidelity performing well, with +$473.4m of flow

Over $10 billion withdrawn from GBTC since 11th Jan 2024 pic.twitter.com/rpWyaqGxhL

— BitMEX Research (@BitMEXResearch) March 8, 2024

Interestingly, Fidelity’s FBTC spot Bitcoin ETF stood out, experiencing an unprecedented single-day net inflow of $473.4 million. In contrast, Grayscale’s GBTC, renowned for its higher fees, faced a net outflow of $374.8 million on the same day.

The cumulative impact of these movements has propelled the total net asset value of all spot Bitcoin ETFs beyond the $54 billion mark, with net inflows reaching an impressive $9.37 billion. Analysts emphasize the significance of these ETFs now controlling just over 4% of Bitcoin’s entire supply, marking a pivotal moment in the digital currency market.

4% of the bitcoin supply backing etfs pic.twitter.com/8qyTgHRUOa

— hildobby (@hildobby_) March 8, 2024

Newborn Bitcoin ETFs to Surpass Grayscale Soon

Furthermore, the emergence of the ‘newborn nine’—a cohort of recently launched spot Bitcoin ETFs—signals a potential shift in market dynamics. These ETFs are poised to surpass Grayscale’s GBTC fund in Bitcoin holdings by the close of today’s market session.

As per Vetle Lunde, a senior analyst at K33 Research, GBTC held 400,186 bitcoins, while the ‘newborn nine’ collectively held 397,847 bitcoins as of yesterday.

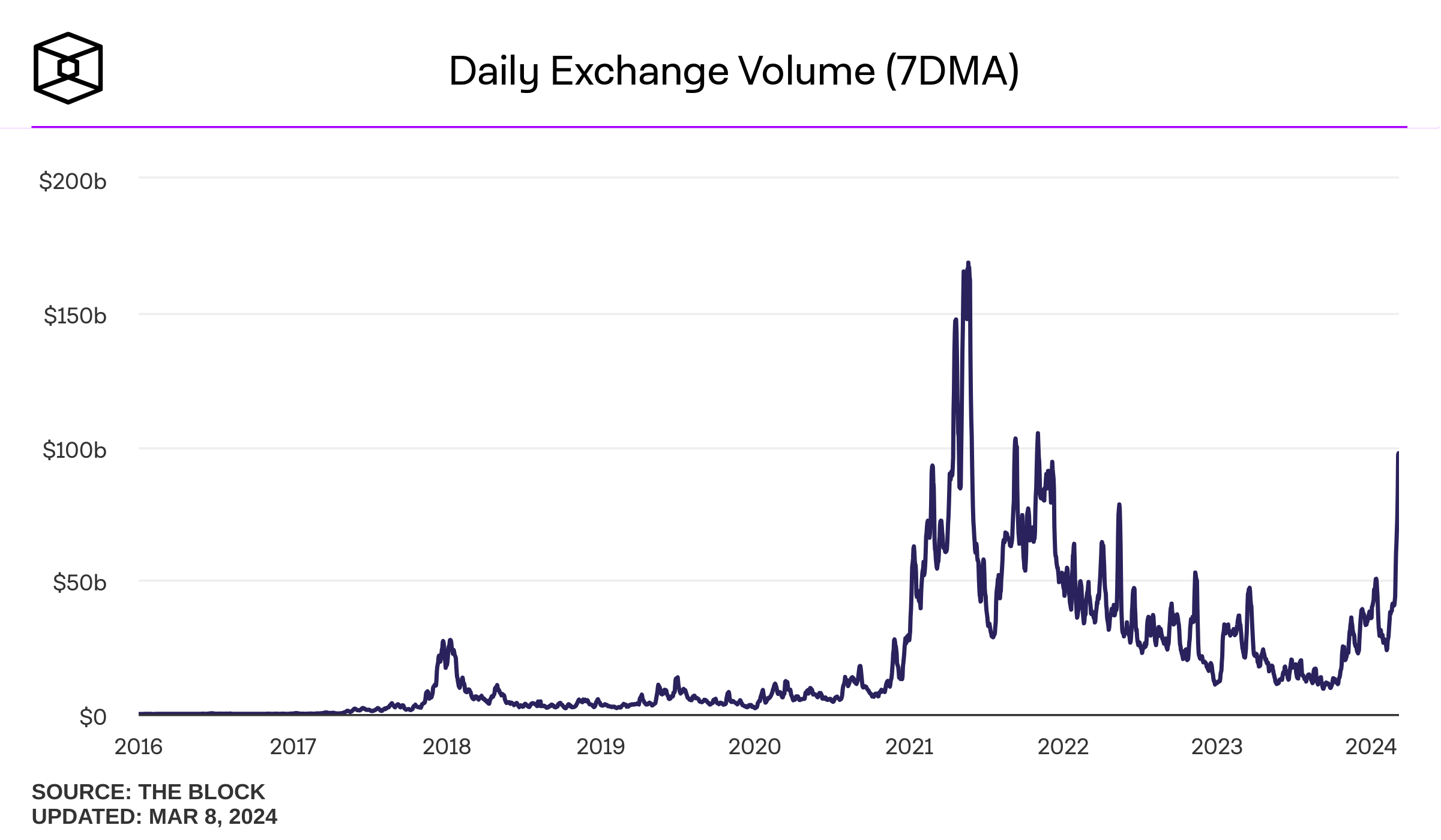

Bitcoin CEX Daily Volume Surge to $100 Billion

In parallel with these advancements, the daily trading volume on centralized cryptocurrency exchanges has surged to levels not witnessed since November 2021. Data from The Block’s Data Dashboard indicates that the seven-day moving average for daily trading volume hit $97.41 billion on March 6, a notable increase from the $23.86 billion low on February 7.

Binance leads the trading volume charge, commanding a 43% market share among exchanges, followed closely by UpBit, OKX, and Coinbase. As Bitcoin ETFs continue to gain momentum and reshape the investment landscape, industry observers anticipate further developments and shifts in market dynamics in the days ahead.

Interested in learning how to day trade crypto? Get all the information you need here