Bitcoin Bulls Roar as Short Sellers Face $140 Million in Liquidations

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

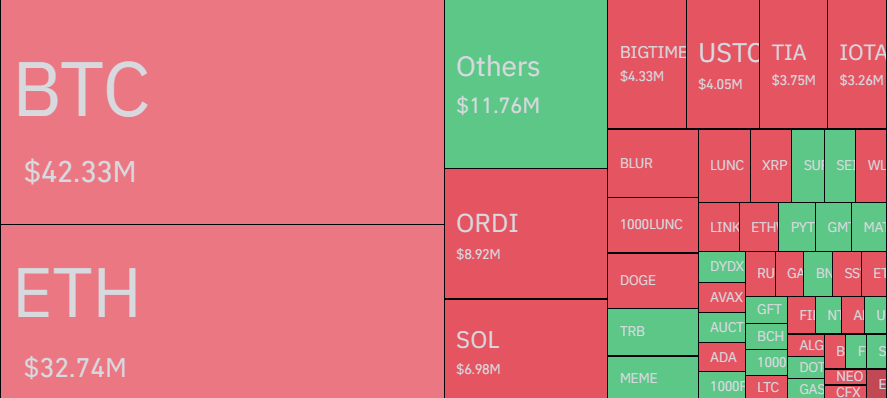

In a tumultuous 24 hours, Bitcoin (BTC) surged close to $40,000, leaving short sellers reeling in losses. Coinglass data reveals over $140 million in crypto positions liquidated, with shorts absorbing over $100 million—the second-highest daily tally since mid-November.

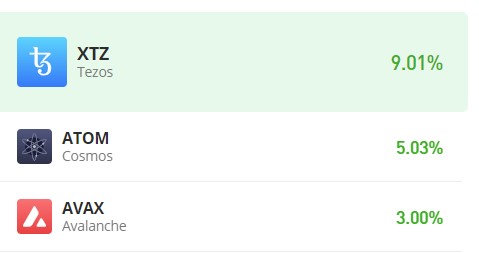

Leading the pack in liquidations were Bitcoin and Ethereum (ETH), with $42 million and $32 million in losses, respectively. Solana (SOL) bears also felt the heat as its price soared above $65, triggering approximately $7 million in liquidations.

Crypto exchanges bore the brunt, with Binance witnessing $54.5 million in liquidations, closely followed by OKX with $48 million and Huobi at $18 million. These events unfolded as Bitcoin continued its remarkable year-long rally, marking a staggering 130% increase since January.

Bitcoin Institutional Inflows Surge to 2021 Levels

Simultaneously, institutional interest in crypto witnessed a surge, according to CoinShares. The past week saw crypto asset funds receive their largest inflows since late 2021, totaling a record $346 million and pushing total assets under management to an 18-month high of $45.3 billion.

Giovanni Vicioso, the global head of cryptocurrency products at CME, remarked on the resurgent interest from institutional traders in crypto derivatives markets. He emphasized the increase in volume and open interest as a “clear indication that institutions are moving into this space.”

Adding to the optimistic outlook, crypto analyst Ali Martinez predicted a bullish trajectory for Bitcoin. Drawing parallels with previous bull cycles, Martinez suggested that, based on historical patterns, the next market peak could manifest around October 2025. With an optimistic tone, he concluded that Bitcoin still has 700 days of bullish momentum ahead.

#Bitcoin history might repeat itself!

If we mirror #BTC's past bull runs (2015-2018 & 2018-2022) from their respective market bottoms, projections suggest the next market peak could land around October 2025.

That means $BTC still has 700 days of bullish momentum ahead! pic.twitter.com/MOUS1CYOn0

— Ali (@ali_charts) November 19, 2023

As Bitcoin’s rally persists, the market dynamics underscore a shifting landscape with institutional players making substantial moves, adding a layer of complexity and anticipation to the crypto narrative.