Crypto Investment Soars to Record High Amid ETF Hopes

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Crypto investment products have witnessed a nine-week streak of inflows, reaching an unprecedented $346 million, the highest since the late 2021 bull market, as revealed by the latest report from CoinShares, a leading provider of crypto investment products.

Total assets under management (AuM) for crypto investment products have skyrocketed to $45.3 billion, marking the highest level since February 2021. This surge is attributed to the robust performance of major cryptocurrencies, particularly Bitcoin, which has reclaimed the $37,000 threshold following a prolonged slump.

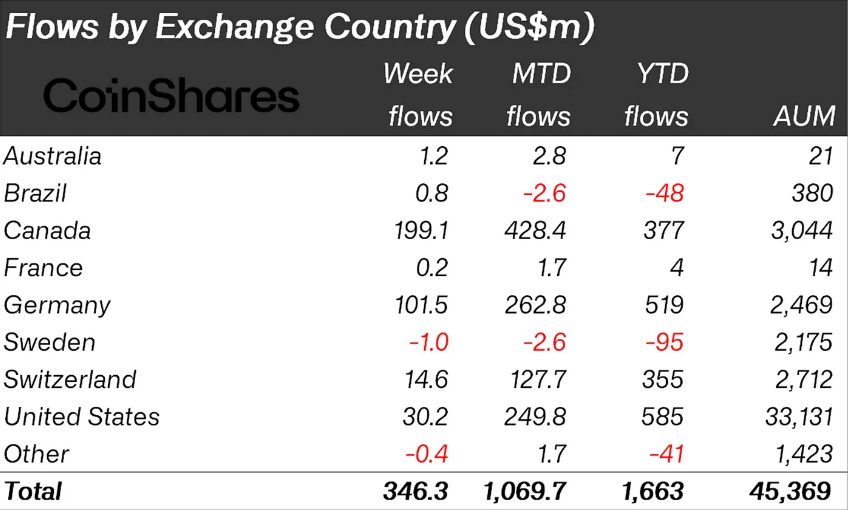

Canada and Germany Responsible for 87% of Total Crypto Investments

The CoinShares report underscores Canada and Germany as the primary drivers behind the inflows, constituting a significant 87% of the total. These countries have been notably supportive of crypto ETFs, boasting several approved and traded products. In contrast, the US market has seen relatively low participation, with a modest $30 million in inflows last week, as investors eagerly await the SEC’s decision on pending ETF applications.

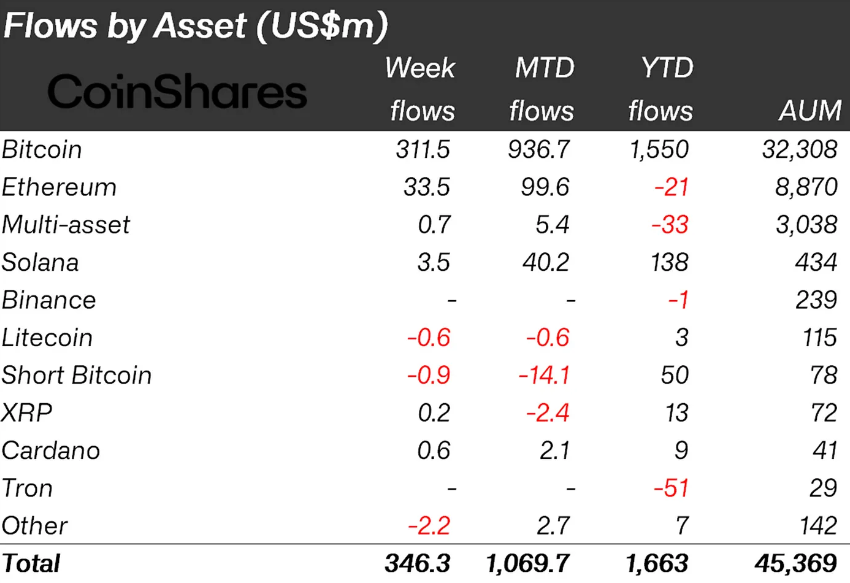

Bitcoin remains the favored crypto asset, drawing $312 million in inflows last week and an impressive $1.5 billion year-to-date. Noteworthy is the decline in short-sellers, with the AuM of Bitcoin ETPs designed for betting against prices plummeting by 61% since April 2023. Evidently, ETP volumes as a percentage of total spot Bitcoin volumes surged to 18% last week, signifying an increasing trend of investors using ETPs to gain exposure to the crypto market.

While Bitcoin takes the lead, other crypto assets also experienced positive inflows on a smaller scale. Ethereum, the second-largest crypto asset by market cap, welcomed $34 million in inflows last week, marking a reversal of sentiment after experiencing net outflows earlier this year. Solana, Polkadot, and Chainlink also recorded inflows of $3.5 million, $800,000, and $600,000, respectively, last week.

The crypto market is displaying signs of maturity and resilience as investors diversify portfolios and seek regulated products to access the digital asset space. With anticipation building around the potential launch of a spot-based ETF in the US, the market is poised for further evolution in the coming weeks.