Bitcoin Investors Brace for Increased Volatility as FTX Liquidations Loom

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin (BTC) investors are navigating choppy waters as the cryptocurrency’s price and implied volatility move in opposite directions, hinting at a potential downturn. Recent data from Velo Data reveals a 60-day trailing correlation between Bitcoin’s price and its 30-day implied volatility has plummeted to -0.29, a stark reversal from previous patterns. Bitcoin itself has experienced a 10.7% decline over the past four weeks, dipping to a three-month low of $24,915.

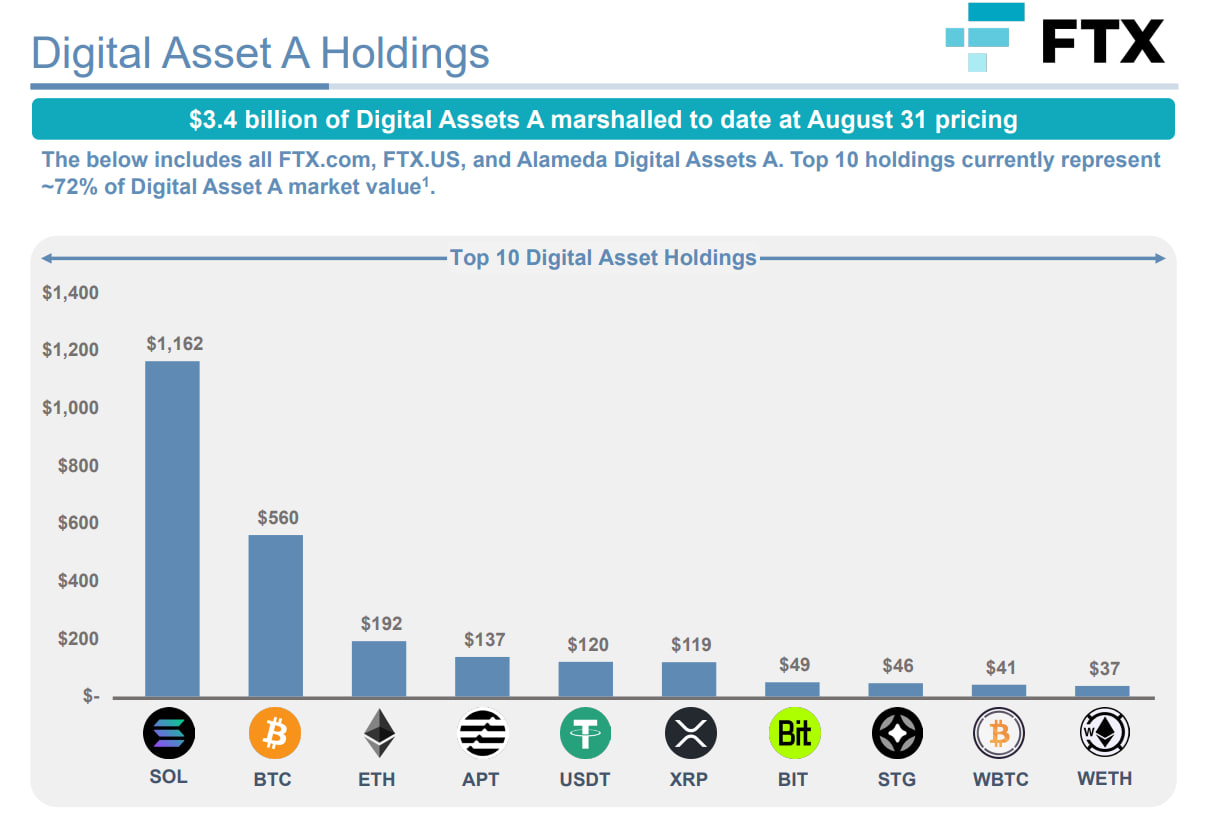

Several factors contribute to this unsettling trend. Firstly, looming FTX liquidations have triggered anxiety. The now-defunct FTX crypto exchange holds approximately $3.4 billion in crypto assets and seeks bankruptcy court approval to offload these holdings, potentially triggering a significant market sell-off.

Bitcoin Investors Rush to Hedge Positions with Put Options

Furthermore, investors are flocking to purchase put options, providing protection against price downturns. Concerns revolve around the Federal Reserve’s actions. The Fed has begun tapering bond purchases and might raise interest rates earlier than anticipated to curb inflation, potentially reducing demand for riskier assets, including cryptocurrencies.

Jeff Anderson, a senior trader at STS Digital, notes a shift in market sentiment from bullish to bearish, according to CoinDesk. He emphasizes that recent sentiment pivots stem from FTX’s impending liquidation and fears of a precipitous drop in spot prices.

Also, Griffin Ardern, a volatility trader at crypto asset management firm Blofin, highlights concerns about liquidity withdrawals from the crypto market. He explains that during liquidity redistribution, cryptocurrencies tend to be prioritized last, possibly leading to the withdrawal of liquidity from crypto assets and redirection into cash or U.S. stocks.

This negative correlation between Bitcoin’s price and volatility suggests investors are bracing for a turbulent ride ahead. However, some analysts see a silver lining, suggesting that this market turbulence may present opportunities for savvy investors seeking potential rebounds.