Nasdaq Refiles Bitcoin ETF Application with Coinbase Partnership

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Nasdaq has resurfaced with renewed vigor, filing a spot Bitcoin ETF application on behalf of Valkyrie Funds. But what sets this application apart is the strategic partnership it brings to the table. Valkyrie has enlisted the support of Coinbase, the titan of US-based crypto exchanges, through an ingenious surveillance-sharing agreement.

JUST IN: Valkyrie has resubmitted their filing for a spot #Bitcoin ETF pic.twitter.com/bGTrjFAuog

— Bitcoin Magazine (@BitcoinMagazine) July 5, 2023

The Securities and Exchange Commission (SEC) has yet to give its nod of approval for any spot Bitcoin ETFs. However, industry analysts are buzzing with speculation that this unique surveillance-sharing arrangement could sway the regulators in favor of Valkyrie’s application. Having first proposed the fund in June, Valkyrie now awaits the green light to bring their offering to Nasdaq.

CME Revels in a Bitcoin Trading Frenzy

The buzz surrounding Bitcoin is not limited to ETFs alone. Institutional investors have been making waves in the cryptosphere, as evidenced by a recent report from CCData, according to Decrypt.

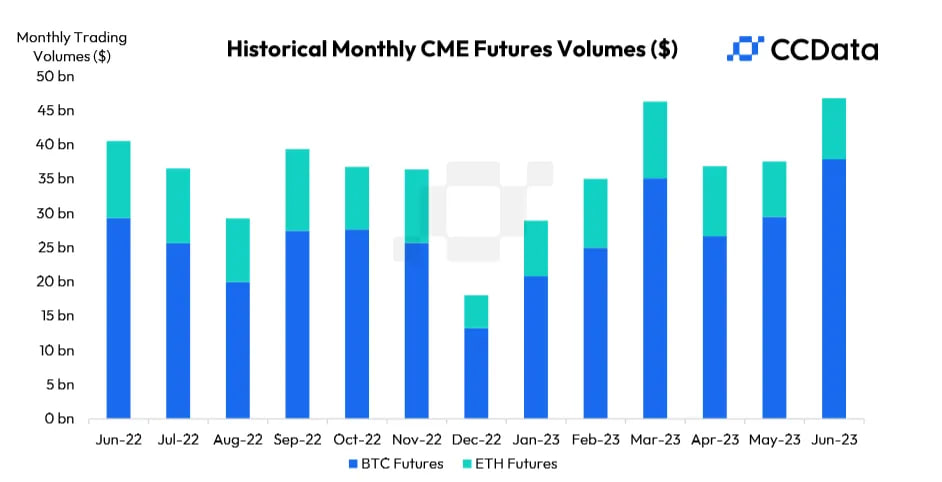

The Chicago Mercantile Exchange (CME) is basking in the glory of its highest Bitcoin futures trading volume ever recorded last month, surging by a jaw-dropping 8.6% to a whopping $37.9 billion. And it doesn’t stop there—Bitcoin Micro Futures, with their bite-sized contracts worth a mere one-tenth of the standard ones, enjoyed a staggering 21.1% leap, totaling a cool $702 million.

The value of BTC- and ETH-backed products traded in USD also experienced a remarkable surge of 24.6%, reaching an impressive $46.8 billion. This eye-popping figure represents the highest number since May 2022. The report suggests that the mounting trading activity could be fueled by the recent frenzy of spot Bitcoin ETF filings in the United States.

BTC Bears Feel the Heat as Fed Meeting Minutes Loom

As Bitcoin enthusiasts eagerly keep their eyes glued to the charts, they find the price languishing near the $30,000 mark. The cause? Market players anxiously await the release of the Federal Reserve meeting minutes scheduled for later today. These closely guarded minutes hold the potential to reveal vital clues about the Fed’s plans regarding interest rate hikes in the coming months.

Bitcoin: Riding the Rollercoaster of Market Forces

As the crypto landscape unfolds, it becomes evident that Bitcoin’s price is at the mercy of a tug-of-war between opposing market forces. On one side, the relentless rise of institutional adoption and the introduction of innovative products like spot Bitcoin ETFs and micro cryptocurrency futures and options add an air of excitement.

Yet, on the other side, the volatile macroeconomic environment and the looming specter of the Fed meeting minutes sow seeds of uncertainty. The clash of these opposing influences paints a vivid picture of the unpredictable path that lies ahead for Bitcoin.

You can purchase Lucky Block here. Buy LBLOCK