Crypto Scam: How Bad Actors Stole $303M from Traders in July

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

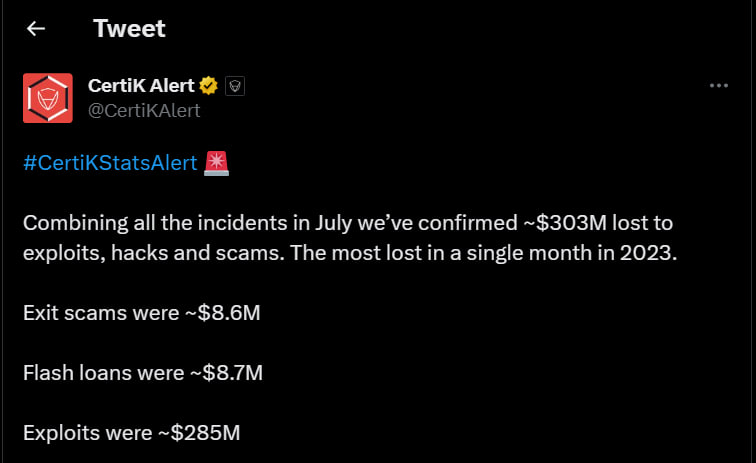

Crypto traders faced a challenging and tumultuous month in July, grappling with a staggering $303 million in losses resulting from a series of crypto scams and hacks. According to a report from the reputable security audit firm CertiK, this unfortunate string of events marked the worst month of the year in terms of stolen value, sending shockwaves through the crypto community.

Curve Finance and Multichain Suffer Significantly from Crypto Exploits

One of the most significant incidents that shook the foundation of the crypto world was the targeted attack on Curve Finance, a critical decentralized exchange within the burgeoning decentralized finance (DeFi) ecosystem.

Just on Sunday, July 30, an attacker exploited a vulnerability in specific versions of Vyper, a smart contract coding language, to cunningly drain a whopping $52 million worth of digital assets from the platform. The incident served as a stark reminder of the persistent vulnerabilities present in even the most reputable projects.

Meanwhile, Multichain, a blockchain bridging protocol lauded for its potential, was also hit hard by adversity. On July 13, the platform made the heartbreaking announcement of losing a staggering $125 million worth of assets due to a sophisticated hack.

Moreover, the revelation that the platform’s chief executive, Zhaojun, had been detained by Chinese authorities in May added an extra layer of complexity to the situation, leaving investors uncertain and concerned.

Crypto Scams Such as Flash Loans and Rug Pulls Rocked the Market in July

Beyond these headline-making attacks, CoinDesk reports that the crypto space experienced other alarming events, such as flash loans and exit scams. Flash loans, a feature designed to facilitate the convenient borrowing of unsecured funds using smart contracts, were abused by malicious actors to manipulate the price of smaller, less liquid tokens. This not only resulted in financial losses but also eroded trust in DeFi protocols.

Exit scams, better known as “rug pulls,” also cast a dark shadow on the crypto landscape during July. In these deceptive schemes, developers entice investors with lofty promises for a new project, collect funds, and then vanish into thin air, leaving investors high and dry. Sadly, investors fell victim to such scams, losing approximately $8.6 million during the month.

These distressing incidents have underscored the inherent risks and challenges that crypto traders face in a rapidly evolving and largely unregulated market. While the crypto space offers immense opportunities, it also demands heightened security measures, user education, and more robust regulatory oversight to protect the interests of the crypto community.

You can purchase Lucky Block here. Buy LBLOCK