Bitcoin Shrimps Aggressively Accumulating: Reports Glassnode

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The world of Bitcoin investment is buzzing with intriguing developments, as data from Glassnode, a prominent on-chain analytics firm, reveals a fascinating trend. While the smallest cohort of Bitcoin investors, affectionately referred to as shrimps, are eagerly accumulating the digital currency, larger investors, like whales, are swimming in the opposite direction, reducing their holdings. These findings shed light on the ever-evolving dynamics within the Bitcoin ecosystem and their potential implications for the market.

In a recent tweet, Glassnode proudly proclaimed that the Bitcoin shrimps are riding the wave of accumulation, and their momentum shows no signs of waning. These pint-sized investors, holding anything less than 1 Bitcoin each, have managed to accumulate an impressive monthly increase of +24,600 Bitcoins.

Furthermore, Glassnode’s data reveals that approximately 4.3% of trading days have seen shrimp holdings surpassing the specified volume. This shrimp-induced frenzy has propelled the supply held by these enthusiastic investors to an all-time high (ATH) value of 1.31 million Bitcoins.

Glassnode Reports Shifting Bitcoin Supply Distribution

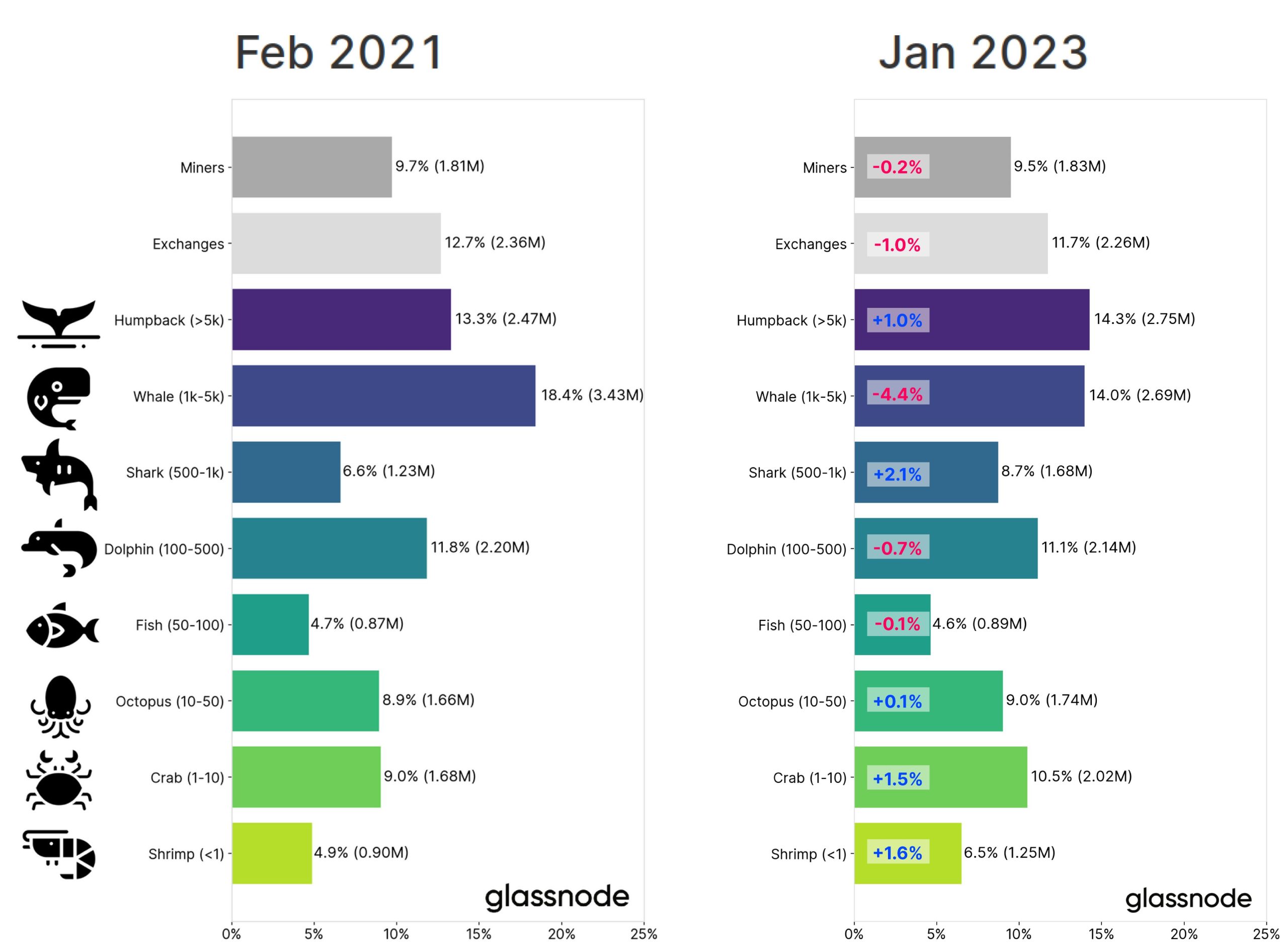

Not content with mere shrimp-related revelations, Glassnode dives deeper into the Bitcoin sea, surfacing with another set of data showcasing the changing distribution of BTC supply. Comparative tables spanning from February 2021 to January 2023 highlight an interesting pattern.

Retail investors, including shrimps, crabs, and octopuses, have increased their holdings, while larger investors like sharks and humpbacks have also jumped on the accumulation bandwagon. However, it appears that some whales, fishes, and dolphins have decided to swim against the current, reducing their Bitcoin stash as of January 2023.

While the spotlight has been on the investors, miners are not forgotten. Glassnode’s data reveals a decline in the distribution of BTC holdings among these dedicated miners over the years. Currently, BTC miners are making a tidy sum of $1.7 million in fee revenue. Sure, it’s a drop of roughly $16.1 million from the recent peak, but let’s keep things in perspective.

You can purchase Lucky Block here. Buy LBLOCK