KuCoin Market Share and Trading Volume Plunge Amid Legal Charges

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Popular cryptocurrency exchange KuCoin has experienced a significant downturn in its market share and daily trading volume. This comes in the wake of charges by the U.S. Department of Justice (DOJ) and the Commodity Futures Trading Commission (CFTC), alleging violations of anti-money laundering laws.

Market Turbulence for KuCoin

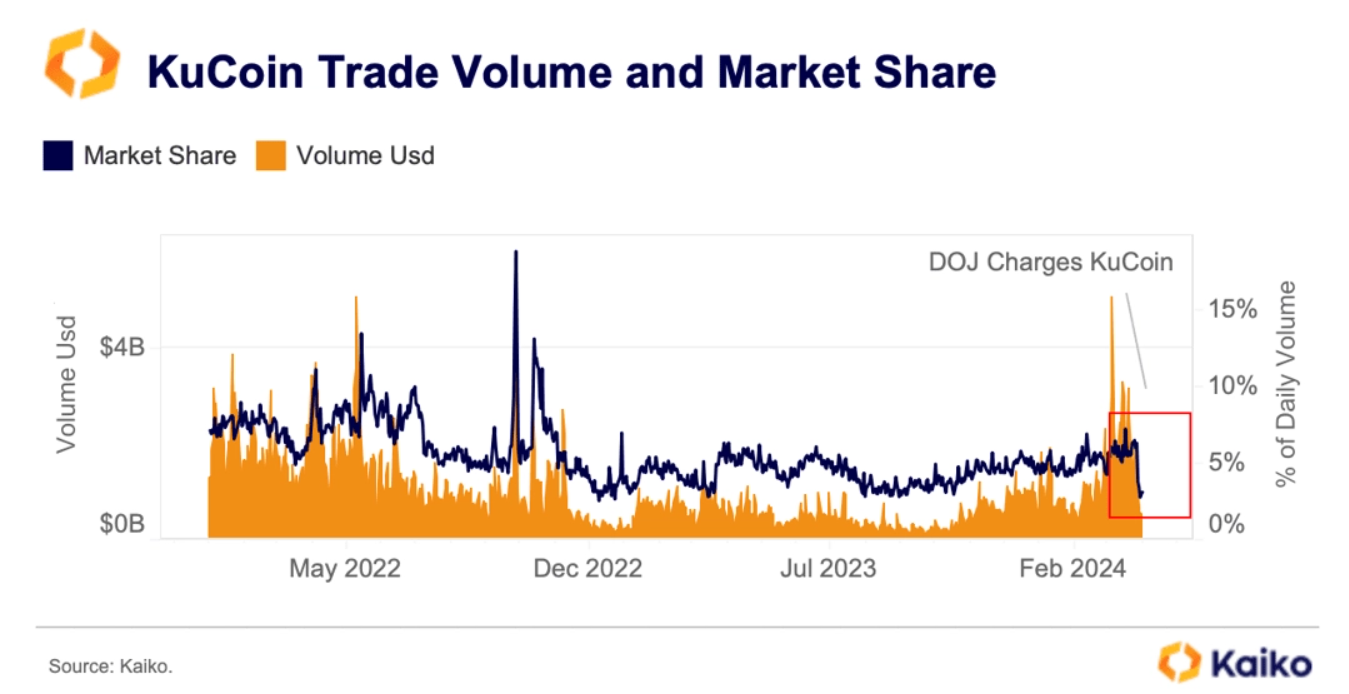

Prior to the announcement of the charges on March 26, KuCoin boasted a daily trading volume of approximately $2 billion. However, the exchange has since experienced a dramatic 75% decrease, plummeting to just $520 million.

This steep decline reflects the apprehension within the crypto community, prompting users to withdraw their tokens rapidly, leading to delays and congestion on the platform.

In response to these challenges, KuCoin has launched an $8.95 million airdrop program designed to assist users affected by withdrawal delays. Despite this initiative, KuCoin’s market share has more than halved from 6.5% to 3%, according to data from Kaiko, a blockchain research and analytics firm.

User Exodus and Onchain Activity

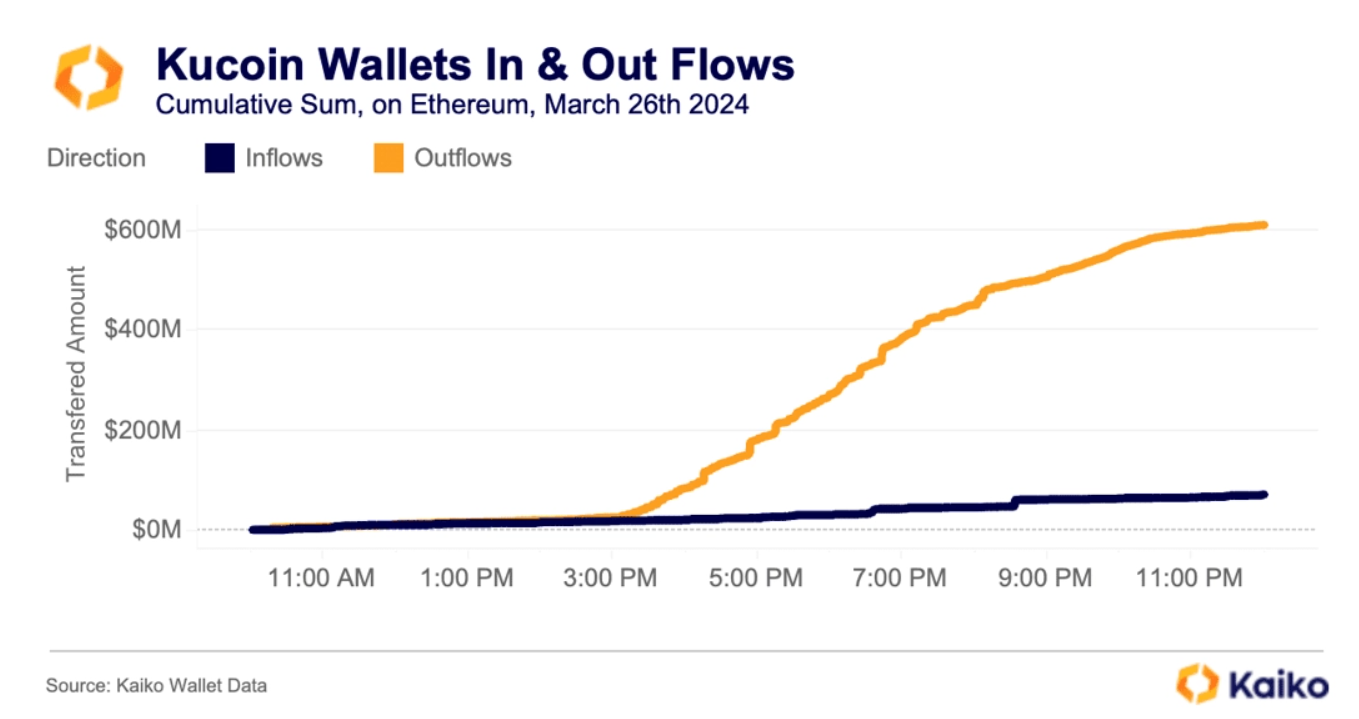

The fallout from the legal charges has resulted in a significant exodus of funds from KuCoin to other exchanges perceived as more secure, including Coinbase, Binance, and OKX. Analysts suggest that this outflow, which also includes transfers to self-custodial wallets, may be attributed in part to market makers leaving the platform.

On March 26, the day the charges were made public, KuCoin-labeled wallets witnessed outflows of $600 million, primarily in ether and USDT. Nansen, a blockchain analytics platform, reports that net daily outflows have since surpassed $1.21 billion.

Legal Challenges Ahead for KuCoin

The DOJ’s accusations against KuCoin are grave, alleging that the exchange and its founders, Chun Gan and Ke Tang, facilitated over $9 billion in money laundering activities.

The indictment contends that KuCoin circumvented U.S. AML and KYC regulations by falsely asserting that it had no American customers, despite having a sizable user base in the country.

As developments unfold, the crypto community remains vigilant, keenly observing KuCoin’s efforts to address these legal challenges and restore user confidence, crucial factors that will shape its future in the competitive cryptocurrency exchange landscape.

Interested in learning how to day trade crypto? Get all the information you need here