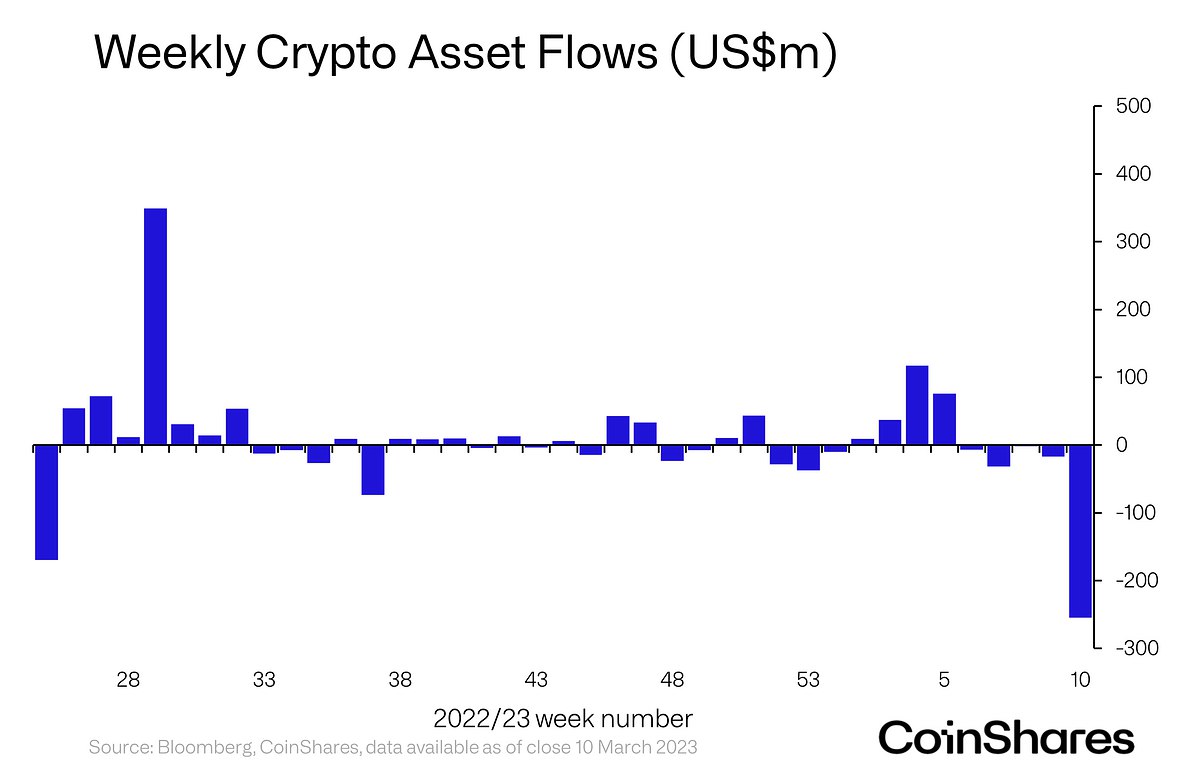

Crypto Funds Experience Biggest Weekly Outflow as Investors Withdraw $255 Million

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The crypto market is in a state of panic, as investors pulled a whopping $255 million out of exchange-traded crypto funds last week. CoinShares, a cryptocurrency investment firm, reported that the recent outflow is the largest weekly withdrawal they have ever recorded.

It’s not just the size of the outflow that has investors worried; it’s also the fact that assets under management (AUM) fell by 10% over the past week to $26 billion. The recent drawdown has undone the progress made in crypto-based funds since the start of the year. Bitcoin funds took the biggest hit, accounting for $244 million of the money flowing out of crypto funds. Ethereum funds lost $11 million, while altcoin funds like Litecoin and Tron accounted for less than $1 million of the total outflow.

Recent Crypto Funds Outflow Highest in Historical Volume

Adding to the unease of investors is the fact that weekly inflows into Solana, XRP, Polygon, and multi-asset funds totaled just $3 million. However, James Butterfill, the head of research at CoinShares, has a different perspective. He points out that the weekly total outflow is not the highest when expressed as a percentage of total assets invested in crypto funds.

Back in May 2019, a $51 million weekly outflow represented about 2% of all assets invested in crypto funds at the time. “It highlights just how much total AUM has risen since May 2019—816%,” Butterfill wrote in the report. In other words, while the recent outflow is significant, it’s not necessarily a reason to panic.

What Now?

So, what should investors do? Is it time to panic and cash out or HODL on? The answer depends on your investment strategy. If you’re a long-term investor, you may want to consider holding on to your crypto assets and waiting for the market to bounce back. If, on the other hand, you’re a short-term trader, you may want to cash out and wait for the market to stabilize.

You can purchase Lucky Block here. Buy LBLOCK