Short Sellers Hit Hard as Crypto Stocks Skyrocket to New Highs

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

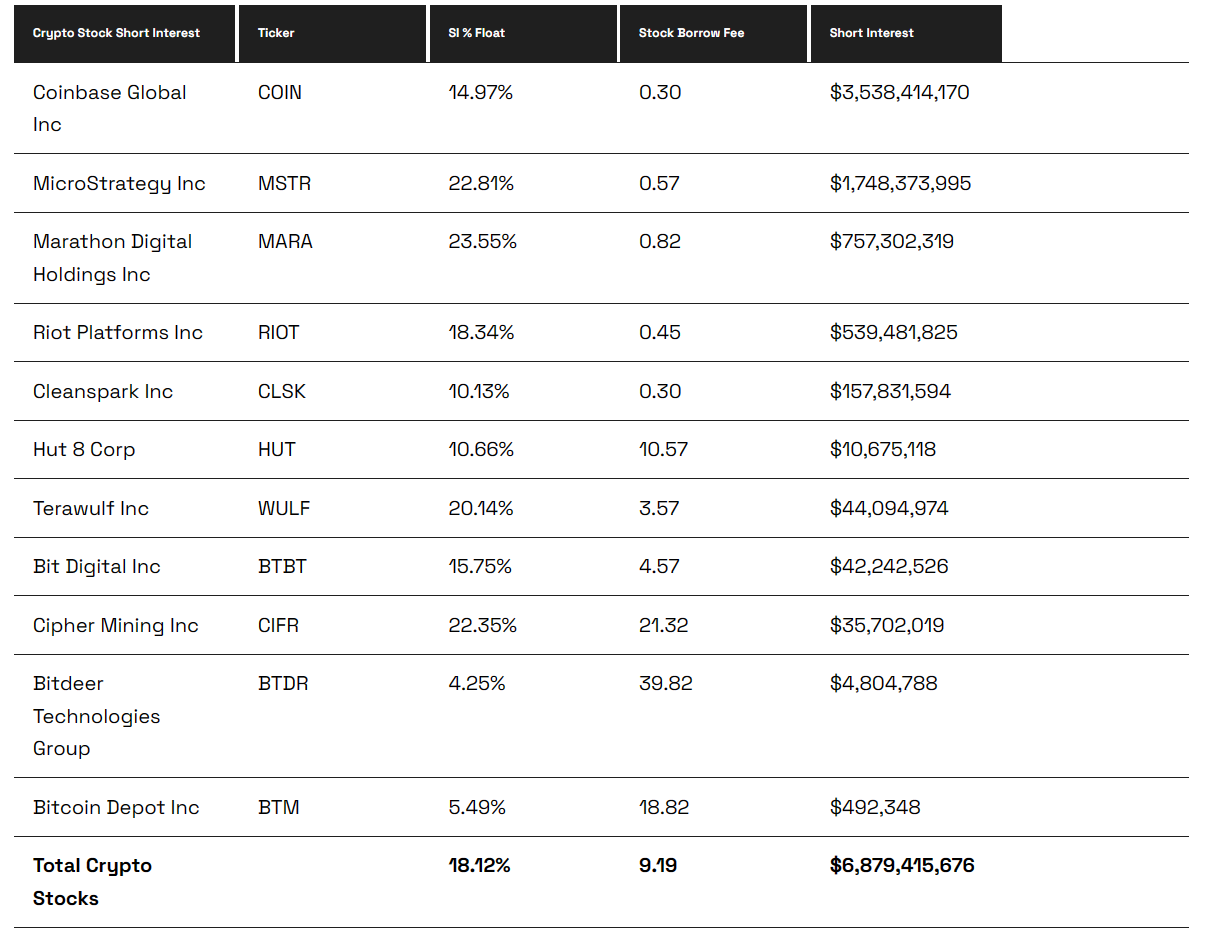

Crypto stocks are witnessing unprecedented highs, leaving short sellers grappling with massive losses. S3 Partners, a financial data firm, reveals that short sellers have incurred over $6 billion in losses this year on 11 U.S. crypto stocks.

The average short interest rate for these stocks stands at a significant 18.12%, well above the U.S. average of 5.00%, indicating a widespread expectation of a market correction. Contrary to these predictions, Bitcoin has witnessed a remarkable 160% surge this year, with a 65% climb since its quarterly low in early October.

This upward trajectory has extended to cryptocurrency stocks, with notable performances from Coinbase Global (COIN), MicroStrategy (MSTR), Marathon Digital Holdings (MARA), and Riot Platforms (RIOT).

Some Short Sellers Doubled Down on Crypto Stocks: Bad Idea

Short sellers, attempting to limit their losses, have covered $2.19 billion of their positions in 2023, predominantly in COIN and MSTR. However, some short sellers have opted to double down on their bearish bets, selling an additional $697 million of crypto stocks since September 11.

The risky strategy of short sellers is compounded by S3 Partners’ squeeze score, which gauges the likelihood of a short squeeze—a scenario where a sudden surge in stock prices forces short sellers to buy back at higher prices, intensifying demand and driving prices even higher. The average squeeze score for crypto stocks stands at an alarming 95.78, highlighting a substantial risk of a short squeeze compared to the U.S. average of 38.19.

As the crypto rally shows no signs of slowing down, short sellers could potentially face further pain and increased losses. Crypto stocks, presenting an alternative investment avenue for exposure to the booming crypto market, underscore the importance for investors—whether bullish or bearish—to be cognizant of the inherent volatility and potential rewards in this dynamic sector.