Crypto Inflows Stall as Investors Take Profits

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

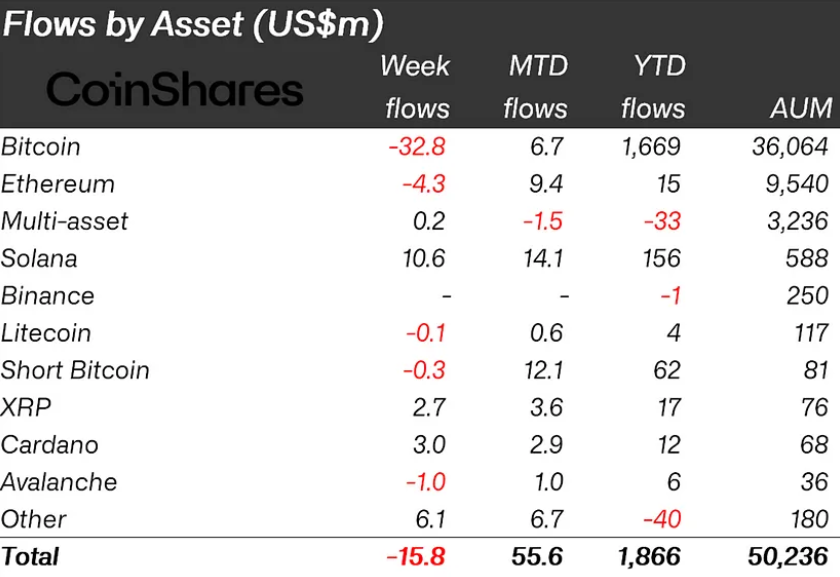

After 11 weeks of steady growth, the inflows into digital asset investment products slowed down last week as investors cashed out some of their gains. According to CoinShares, a leading provider of digital asset data, the total outflows amounted to $16 million, while the trading volume remained high at $3.6 billion.

The outflows were mainly concentrated in the US and Germany, which saw $18 million and $10 million, respectively. On the other hand, Canada and Switzerland continued to attract more funds, with $6.9 million and $9.1 million, respectively. CoinShares attributed the mixed regional flows to profit-taking rather than a change in market sentiment.

Solana, XRP, and Cardano Record Decent Crypto Inflows

Among the different digital assets, Bitcoin was the most affected, losing $33 million last week. Even short-bitcoin products, which allow investors to bet against the price of bitcoin, saw minor outflows of $300,000.

However, not all cryptocurrencies suffered the same fate. Altcoins, which are alternative cryptocurrencies to Bitcoin, saw $21 million in inflows last week. The most popular ones were Solana, Cardano, XRP, and Chainlink, which received $10.6 million, $3 million, $2.7 million, and $2 million, respectively. Ethereum and Avalanche, two other prominent altcoins, saw slight outflows of $4.4 million and $1 million, respectively.

Another segment that performed well was blockchain equities, which are stocks of companies that are involved in the blockchain industry. These equities saw inflows of $122 million last week, bringing the total inflows in the last nine weeks to $294 million, the highest level ever recorded by CoinShares.

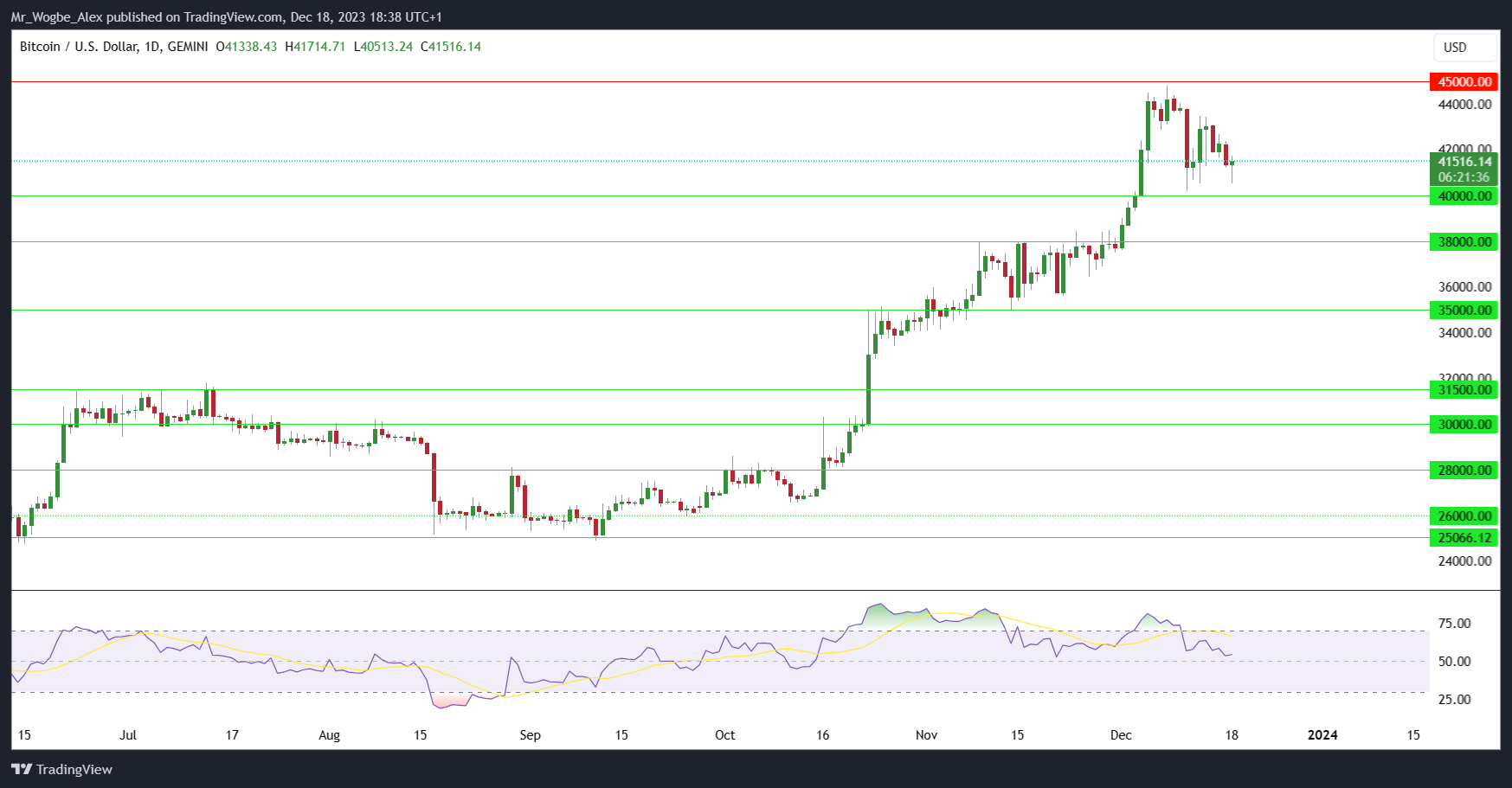

The slowdown in crypto inflows coincided with a drop in the price of Bitcoin, which fell by almost 8% over the past week, breaking an eight-week streak of gains. As of the time of this report, Bitcoin is currently trading at around 41,500 as bulls fight back.