Tether Reports Surge in Reserves, Strives to Eliminate Secured Loans

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

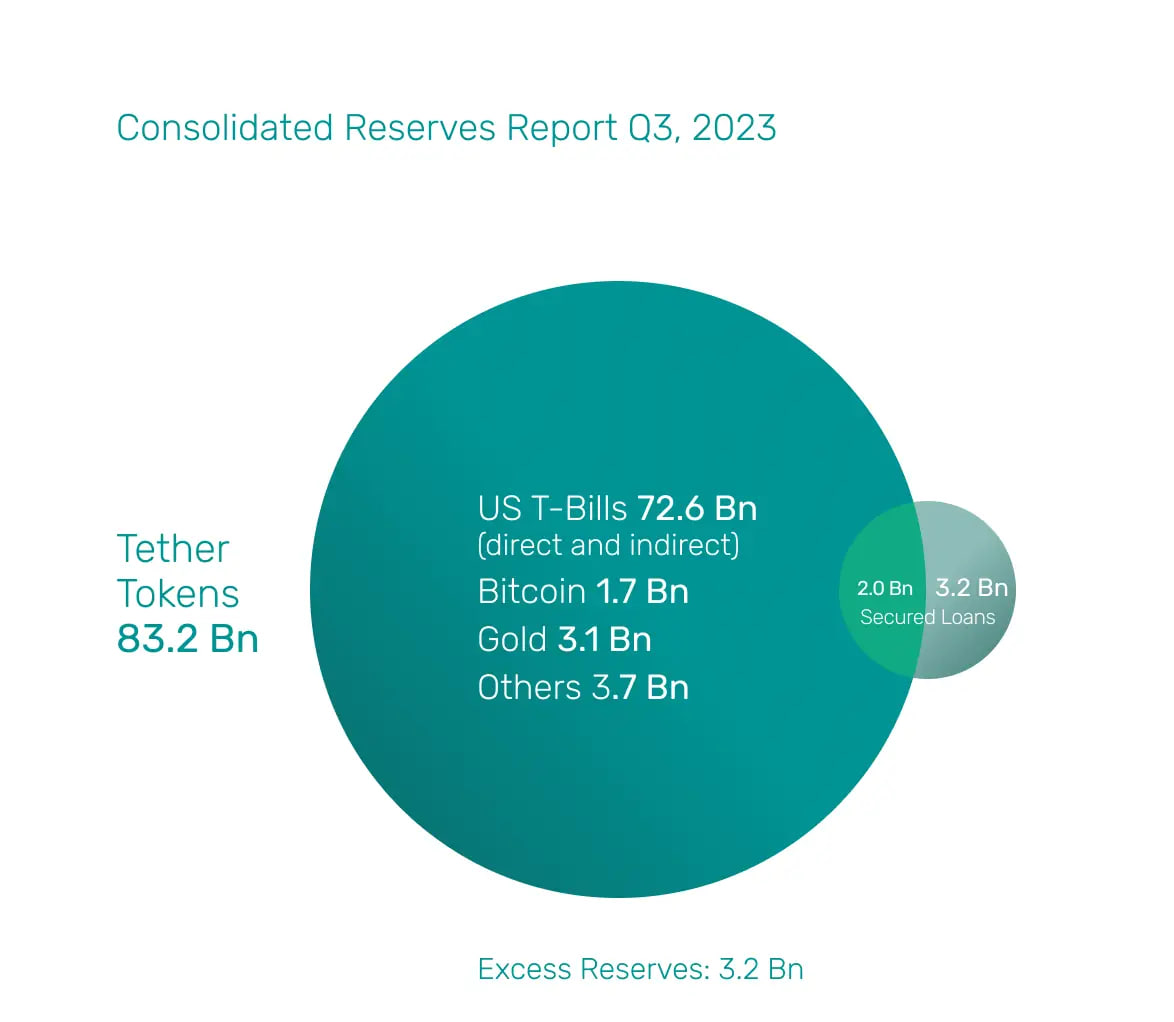

Tether, the leading issuer of the widely used stablecoin USDT, has unveiled its Q3 2023 report, showcasing robust financial health but with a looming challenge. As of September 30, 2023, Tether boasts a staggering $86.4 billion in assets to back its tokens, dwarfing its liabilities of $83.2 billion. This rock-solid one-to-one backing of every USDT token with reserves exemplifies Tether’s commitment to stability and liquidity.

The bulk of Tether’s reserves, a whopping 85.7%, are held in cash and cash equivalents (C&Ceq), encompassing US Treasury securities, repurchase agreements, and money market funds. These strategic investments have yielded Tether nearly $1 billion in quarterly returns, underscoring their financial prudence. However, Tether isn’t without its challenges.

Tether Holds $5.2 Billion in Secured Loans

In its quarterly report, the stablecoin revealed that it carries $5.2 billion in secured loans in its reserves, which have been a point of contention among critics. These loans are primarily linked to the Bitfinex exchange, sharing common ownership with Tether. While Tether pledged to eliminate these loans by the end of 2023, the reduction so far has been modest, totaling $330 million in the previous quarter.

To address this issue, the company has outlined plans to reduce an additional $1.1 billion of loans by the end of October, leaving just $900 million in reserves. The company aims to leverage its $3.2 billion excess reserves and undistributed profits to gradually phase out these remaining loans, fortifying its financial position.

The project, with a market capitalization exceeding $84 billion, remains the dominant stablecoin in the market, offering various tokens pegged to fiat currencies and even gold. Meanwhile, Paolo Ardoino is set to assume the role of CEO soon, and he has promised to introduce real-time data transparency regarding Tether’s reserves in the near future.

Tether’s latest financial report showcases strength and resilience, ensuring that it remains a significant force in the ever-evolving landscape of digital currencies. Investors can continue to rely on the stability and security that Tether provides in the cryptocurrency market.