The Current Landscape of Stablecoins: Indications of Recovering Liquidity

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Stablecoins stand as a fundamental pillar in the ever-evolving digital asset landscape, offering a reliable store of value amid dynamic market shifts. Their resilience proves invaluable not only in stable markets but also in emerging economies grappling with inflation and limited financial infrastructure access.

The borderless nature of stablecoins facilitates seamless cross-border transactions, positioning them as crucial mediums of exchange. Beyond these roles, stablecoins serve as vital bridges between decentralized finance (DeFi) and traditional finance, supporting trading and lending operations and reflecting activity on public blockchains.

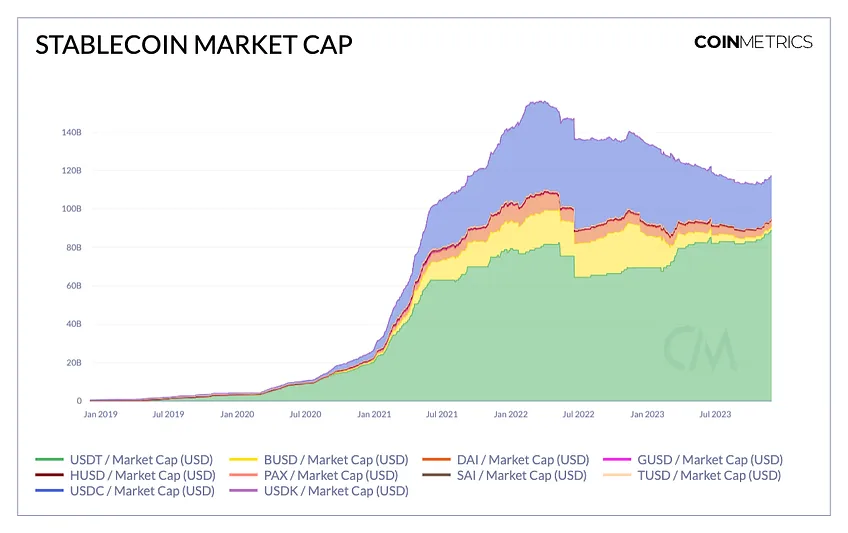

This distinctive value proposition fueled the growth of the digital dollar market, reaching a peak of $155 billion in market capitalization in 2022 before a decline to $112 billion, indicative of challenges hampering its progress. However, recent upswings in digital asset valuations hint at a resurgence in stablecoin supply, signaling a potential revival of on-chain liquidity and heightened demand for stablecoins in both bearish and bullish market conditions.

Exploring Market Capitalization and Supply Dynamics

The prevailing market capitalization within this asset class is predominantly shaped by USDT and USDC, commanding the majority of the total supply. Recent surges are attributed to Tether (USDT) flourishing on Ethereum ($41 billion) and Tron ($48 billion) networks, propelling Tether to an all-time high market cap of $88 billion, while Circle’s USDC stabilizes at $22.5 billion. Despite fiat-collateralized stablecoins’ dominance, the expansion of stablecoins collateralized by crypto-assets (e.g., ETH) and off-chain assets (e.g., public securities) highlights the evolving diversity and adaptability of this asset class.

Illustrated in the chart below, which captures weekly changes in stablecoin supply throughout the year, significant events like the Luna collapse in June 2022 and the Silicon Valley Bank (SVB) crisis in March led to discernible declines in total stablecoin supply, reflecting fluctuating market confidence.

Analyzing the trajectory of increased stablecoin supply, a focused examination of the supply held by smart contracts reveals intriguing insights. Notably, USDC, a popular asset in decentralized finance (DeFi) applications, had a substantial portion of its supply in smart contracts, peaking at over $20 billion in March 2022. However, over the year, this figure has contracted, halving from its March high to $7 billion as of December 2023. In contrast, Tether (ETH), primarily held in externally owned accounts (EOAs), has seen a different trend. Its presence in smart contracts has grown, rising from $4 billion at the start of the year to over $6 billion.

Surging Engagement in the Lending and Trading Spheres

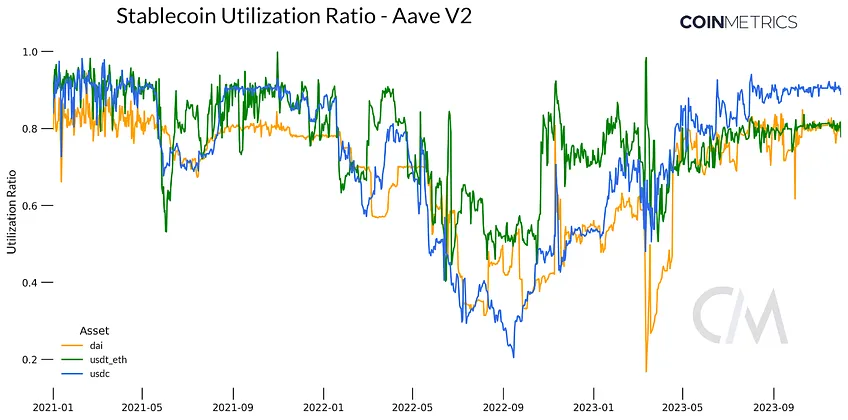

In DeFi, stablecoins, acting as collateral, facilitate interest earnings. The chart illustrates Aave’s stablecoin utilization rates, a key indicator of demand and capital availability. Aave and Compound serve as crucial proxies for overall DeFi activity.

An intricate interplay exists between pool utilization and interest rates. When a pool boasts abundant capital but experiences low borrowing demand (i.e., low utilization), interest rates are lowered to entice borrowers. Conversely, pools with scarce liquidity (i.e., high utilization) see rising interest rates to incentivize debt repayments and attract new deposits.

Despite the dislocation witnessed in March 2023, utilization rates for USDT, USDC, and Dai have surged to levels not seen since 2021, signaling heightened demand for stablecoin collateralized loans and a growing appetite for leveraging these assets for yield generation strategies.

Stablecoin spot trading volumes have registered a noticeable surge, underscoring their utility as a quote asset on both centralized and decentralized exchanges. Their stability as a reference point for valuing other assets makes them a preferred medium for entering and exiting positions.

Unfolding Dynamics in the Stablecoin Landscape

Having explored the current stablecoin landscape, let’s analyze overarching trends, focusing on yields from on-chain and off-chain sources. Yields play a crucial role in shaping capital flows and identifying potential avenues for attracting capital in varying economic conditions.

In the past two years, rising US Treasury yields during financial tightening led to an opportunity cost for stablecoin holders and issuers. Seeking yield and reacting to interest rate changes triggered the development of tokenized treasuries and interest-bearing stablecoins, addressing the demand for attractive returns in this evolving landscape.

Maple Finance’s USDC Cash Management Pool stands out as a prime illustration of the expanding trend aimed at facilitating yield-bearing offerings within the realm of DeFi. This innovative pool grants users access to yields originating from US Treasury bills, striving for a net APY aligned with the Secured Overnight Financing Rate (SOFR), catering specifically to accredited investors depositing USDC. Since its establishment, the pool has witnessed notable engagement, attracting a cumulative total of $75 million in USDC and accumulating an impressive capital amounting to $15 million.

This prevailing trend gains further traction as seen in the expansion of collateral foundations for stablecoin offerings, exemplified by MakerDAO’s Dai diversifying into tangible assets such as real-world assets (RWA’s), including public securities. Yet, the surge in stablecoin supply rates within platforms like Aave introduces an additional avenue for holders to strategically allocate their stable assets. This dynamic could potentially stimulate a capital shift towards DeFi applications and products, predominantly collateralized by on-chain assets.

Conclusion

The burgeoning supply of stablecoins stands as a definitive signal of heightened engagement and utilization within the digital asset ecosystem. Notably, this is exemplified in the trends of supply and adoption, with Tether on Tron taking a prominent lead. Despite regulatory challenges in the United States and a nuanced political landscape, stablecoin liquidity has demonstrated remarkable resilience.

This expansive growth highlights the extensive utility of stablecoins, evident in their integration across various avenues such as DeFi pools, exchanges, and diverse yield-generating opportunities. Against the backdrop of a broader market upswing, these trends not only accentuate increased usage but also underscore the pivotal role that stablecoins play in shaping the dynamics of the crypto-economy.