The Surviving Stablecoins

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Stablecoins are the current crypto marketplace’s lifeblood. Because of their tremendous volatility, classic cryptocurrencies such as Bitcoin and Ethereum behave more like tech stocks than steady repositories of value.

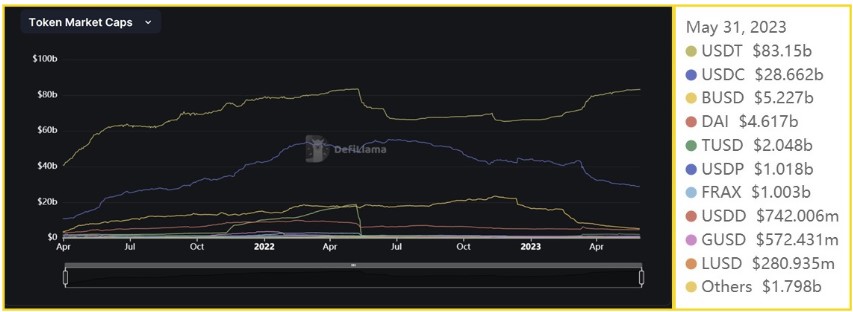

In 2017, the first major stablecoins gained traction. The market value of the top 10 stablecoins increased from almost $0 in 2017 to a whopping $186 billion in May 2022. Tokens such as Tether, Binance USD, and USDC were at the forefront of this charge.

Significant Challenges Faced by Stablecoins

Tether, the most popular stablecoin by market capitalization, was de-pegged twice in 2022, once after the Terra crisis and once after the closure of FTX. Similarly, due to its connection to the now-defunct Silicon Valley Bank, USD Coin was momentarily de-pegged in March 2023.

In 2023, the aftermath of the FTX catastrophe claimed another important fatality in the stablecoin market. Binance stopped minting Binance USD (BUSD) after frightened investors withdrew large sums of money from the Binance market.

Regulations for Stablecoins

In 2023, there will be two major crypto rules on each side of the Atlantic. The House Financial Services Committee in the United States has released a draft bill on stablecoin rules.

The requirement that all issuers retain reserves that back their digital assets at a minimum 1:1 ratio is the bill’s highlight. The proposed legislation also proposes moratoriums on stablecoins backed by other digital assets. This might mean disaster for algorithmic tokens such as DAI.

These regulations are a direct result of accidents such as the Terra/LUNA and FTX collapses. Legislators are working hard to prevent similar disasters and safeguard customers from big damages.

The three Most Famous Stablecoins

Tether (USDT)

Tether is a stablecoin initiative run by iFinex, a Hong Kong-based company. Tether, which was launched in 2014, is one of the market’s oldest stablecoin projects. It’s also the most popular stablecoin, with over 4.4 million active addresses and $83 billion. Tether has a market share of 63% as of this writing.

Tether is not without criticism. Several investigations and lawsuits have been launched by US regulators. The Commodity Futures Trading Commission (CFTC) fined Tether $41 million in 2021 for misrepresenting its currency reserves.

However, the stablecoin’s future may not be straightforward. Tether has been singled out by US lawmakers as an illustration of the risks posed by the stablecoin market’s lack of regulation. Strict stablecoin restrictions may have serious consequences for USDT, as they may rule out reserves other than cash or short-dated Treasuries. This appears to be the situation in Europe, where the MiCA crypto architecture stipulates rigorous reserve requirements.

US Dollar Coin (USDC)

USD Coin is a stablecoin created in partnership with the Center Consortium by Circle (a notable blockchain-based payments platform).

USDC has emerged as a key player in the stablecoin market since its inception in September 2018. It has a $29 billion market cap and daily transaction volumes of $2.1 billion. With around 1.6 million active addresses as of this writing, USDC is the second most popular stablecoin after Tether.

Due to its tight ties to Silicon Valley Bank (SVB), USDC encountered considerable volatility in 2023. When SVB failed last March, Circle’s exposure to the bank caused investor fear and a short depreciation of the USDC from $1 to $0.88.

Binance USD (BUSD)

Binance USD is a stablecoin issued by Paxos, a blockchain infrastructure business based in New York. It was introduced in 2019 as part of a partnership or licensing arrangement with Binance, the world’s largest crypto exchange.

BUSD, like Circle’s USD Coin, is a stablecoin established in the United States. Currency reserves are held by banks and financial institutions in the United States. Binance asserts that BUSD is 100% backed by fiat currencies and US Treasury bills.

At its peak in November 2022, BUSD had a market cap of $23 billion, but the fall of FTX created a confidence crisis among its rivals (including Binance). Investor withdrawal has reduced the BUSD market cap to $5.3 billion in 2023.

Conclusion

There’s no denying stablecoins have long-term value potential, but given the market’s high level of uncertainty, investment decisions should definitely take a back seat until we have more specific information on the progress of planned legislation (particularly in the US).