Crypto Outflows Persist for Second Week Amid Interest Rate Concerns

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

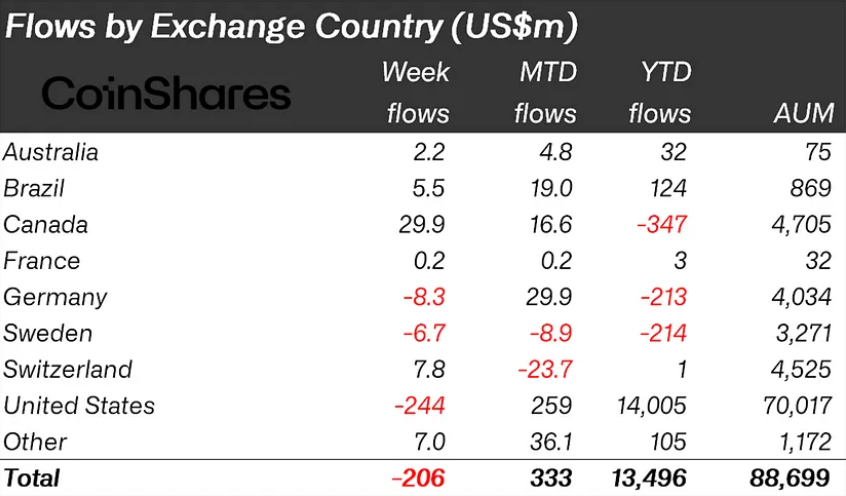

Crypto investment products have witnessed a second consecutive week of crypto outflows totaling $206 million, as reported by CoinShares. This decline coincides with a slight decrease in trading volumes of Exchange-Traded Products (ETPs), now standing at $18 billion. Interestingly, these figures represent only 28% of total Bitcoin trading volumes, contrasting sharply with the 55% recorded just a month earlier.

Analysts attribute this waning interest among ETP and Exchange-Traded Fund (ETF) investors to the Federal Reserve’s indication of maintaining current high-interest rates for an extended period.

US Records Notable Crypto Outflows: $244 Million Trickle Out of Bitcoin ETFs

In the United States, sentiment remains predominantly negative, with ETFs experiencing outflows of $244 million. Established ETFs have been hit hardest, while newly issued ETFs continue to attract capital, albeit at a slower pace compared to previous weeks. In contrast, Canada and Switzerland have seen inflows of $30 million and $8 million, respectively. Germany, however, reported minor outflows totaling $8 million.

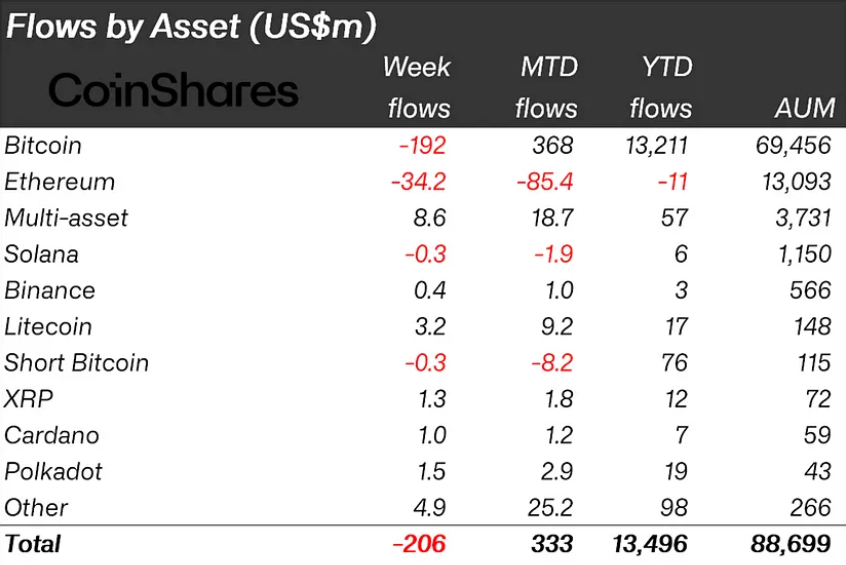

Bitcoin, the leading cryptocurrency, has also seen outflows, amounting to $192 million. Surprisingly, this has not led to a significant increase in short-Bitcoin positions, with only a $0.3 million outflow from such positions. Ethereum, on the other hand, has continued its six-week streak of outflows, totaling $34 million.

There has been renewed interest in the altcoin sector, with inflows of $9 million last week. Litecoin and Chainlink have seen particularly significant inflows, with $3.2 million and $1.7 million, respectively.

Blockchain equities have faced pressure as well, marking their 11th consecutive week of outflows totaling $9 million. Concerns regarding the impact of the upcoming halving event on mining companies have contributed to investor apprehension.

Standard Chartered Maintains $150,000 Bitcoin Price Forecast

Despite these challenges, Geoff Kendrick, head of digital assets research at Standard Chartered, remains optimistic about Bitcoin’s prospects. He reaffirms the bank’s ambitious price target of $150,000 for Bitcoin by year-end, citing the influx of capital into U.S. Bitcoin ETFs as a key factor.

U.S. Bitcoin ETFs have attracted approximately $12 billion in net inflows since their inception in early 2024. Speaking to BNN Bloomberg, Kendrick said:

“The ETF inflows in the U.S. have really dominated the demand-supply metrics so far in 2024. This is significant in terms of the ETFs’ performance to date.”

This report highlights the intricate relationship between investor sentiment, regulatory expectations, and market dynamics in the ever-evolving landscape of cryptocurrency investments.

When trading the crypto market, it doesn’t have to be “hit or miss.” Safeguard your portfolio with trades that actually yield results, just like our premium crypto signals on Telegram.

Interested in learning how to day trade crypto? Get all the information you need here