What You Need to Know About Uniswap as an Investor

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

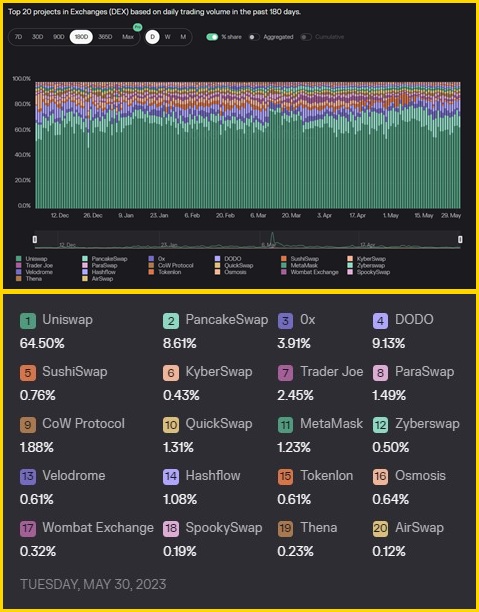

Uniswap stands as the biggest non-centralized exchange this year (2023) as it handles the biggest cut of decentralized exchange (DEX) trading volumes. The image below gives us a view of recent decentralized exchange trading volumes.

The usual centralized exchanges (CEX), examples of which include Binance and Coinbase, depend on order books to determine their own prices. Meanwhile, non-centralized exchanges like Uniswap use mathematical formulas to determine the prices of assets. The technology behind this is referred to as the AMM (Automatic Market Maker). The AMM efficiently eliminates the need for a go-between to determine the prices of assets.

Furthermore, while centralized exchanges (CEX) aren’t quick to add new cryptocurrencies, Uniswap will automatically support tokens that are compatible with Ethereum where there are sufficient fans and supply. The Uniswaps software approach provides scalability for the platform.

On November 2018, the initial version of Uniswap was launched on the ETH (Ethereum) mainnet. Subsequently, there have been more upgrades to the protocol.

Version 2 of Uniswap was launched in May 2020, and it has additional features compared to the first one that further make the protocol more decentralized. This includes flash swaps and the ERC-20 pool, which facilitates direct swapping between ETH-based cryptos.

Also, version 3 of Uniswap was launched in May 2021. This version has better efficiency and security, it also has concentrated liquidity, non-fungible tokens, flexible fees, and rage order features.

Meanwhile, version 4 of Uniswap, which is yet to be deployed, is expected to have better features than version 3. It is anticipated that it will have an improved user interface, non-fungible token aggregator, and a built-in wallet. It is also expected that it will be equipped with the ability to fight MEVs.

Uniswap’s native token is referred to as Uniswap (UNI). Its main purpose is to serve as the governance token for the project.

At takeoff, Uniswap did not conduct an Initial Coin Offering (ICO) sale. In place of ICO members of the community, liquidity providers, and users of the Uniswap protocol were given free airdrops worth $1,500 (400 UNI). Airdrop was an innovation that originated with Uniswap, and has been imitated by other protocols over time and, to date, by newly launched tokens.

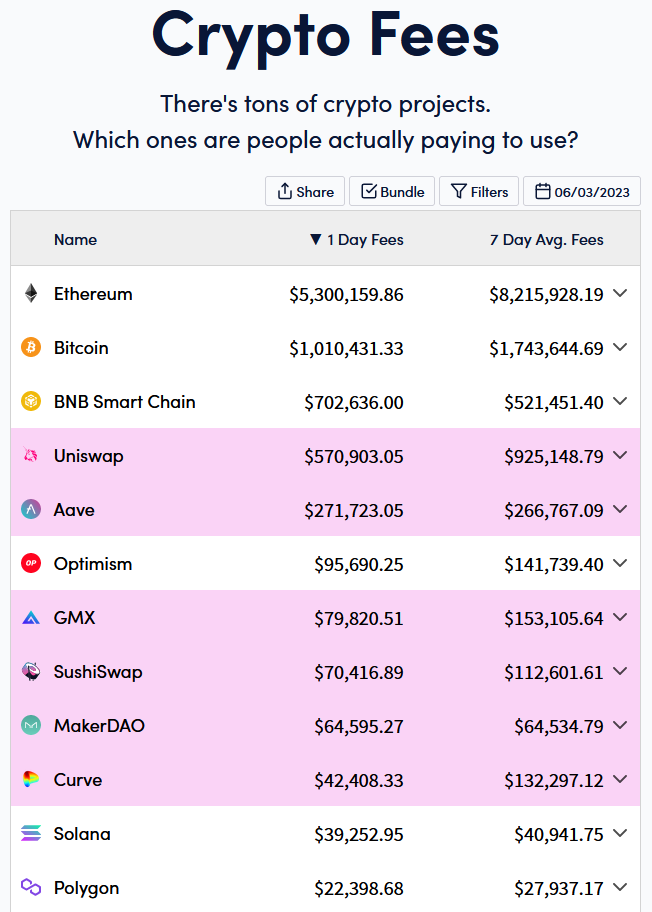

Uniswap Fees Versus Revenues

Uniswap, being a non-centralized exchange unlike Coinbase and Binance, has a differently structured revenue and fee system. This protocol usually charges 0.30% for every swapped token. However, the revenue produced via this means is used to pay liquidity pool providers. Consequently, token holders and the company itself do not directly benefit from the generated fees.

Version 2 of Uniswap introduces a fee switch. The fee switch essentially gives the protocol the opportunity to get a percentage of the fees generated from trades. In theory, this can be paid to holders of UNI tokens. As of now, this feature hasn’t been implemented, since it will have to pass through the process of community voting. Furthermore, in version 3 of Uniswap, the fee switch was kept in place. The only difference here is that there are various fee levels that range from 0.01% to 1%. Nevertheless, it will be left to liquidity providers to determine the fee structure that should be adopted.

Uniswap Fees Compared to Other Decentralized Exchanges

The emergence of other DEXs has introduced stiff competition for the position of the best DEX platform Consequently, Uniswap is not the only popular decentralized exchange. Below are some of Uniswap’s competitors.

SushiSwap and PancakeSwap: These are clones of Uniswap, which were developed using the latter’s open-source code and also provide features and fees as competitive advantages.

Compound: This is a decentralized exchange that specializes in creating tokens for locked assets on its platform. It was launched in 2017. The compound gives users the chance to earn interest while being able to use and transfer their tokens on the platform.

dYdX: This is another decentralized exchange that is focused mainly on stablecoins (USDC, TUSD, DIA, and USDT). Stablecoins can be staked in liquidity pools and exchanged between different tokens.

It is a fact that Uniswap clones such as those mentioned above have eaten into a significant part of Uniswap’s business. When considering TVL (Total Value Locked) Curve Finance is the king, as it has a TVL of $4.3 billion. Uniswap follows with a TVL of $4.1 billion, while PancakeSwap comes in third with $1.6 billion.

Owing to the advantages of derivatives trading, airdrops, and order books, dYdX is catching up with Uniswap over time. dYdX was launched in 2021, and it has steadily developed, eating up some of Uniswap’s market share. Nevertheless, Uniswap stands tall amongst other DEXs when it comes to fees generated during the second quarter of this year.

Those that Benefit From Uniswap Fees

People with available cryptocurrency can function as liquidity providers. As a matter of fact, no decentralized exchange can function without the help of liquid providers. Liquidity providers are the ones who make trades possible. Consequently, Uniswap aims to encourage individuals to become liquidity providers.

Tokens that are located on the Uniswap platform provide liquidity for smart contracts. So, when making a trade, instead of having buyers and sellers, there are buyers and a liquidity pool. Owing to the importance of liquidity providers, they are very well rewarded for their services. For instance, Uniswap generated about $612 million between May 2022 and April 2023, and all of this money was used to reward liquidity pool providers.

What Makes Uniswap Important to Investors

The year 2022 was a difficult one for the crypto industry. However, this year (2023) has shown some favorable indications that better days are ahead. Uniswap’s trading volume has increased significantly, and the company keeps attracting more than $1.5 million in an average of seven days. Also, liquidity providers are earning higher incomes on Uniswap than on other decentralized exchanges, mainly because of its generous fee framework.

Nevertheless, should this DEX choose to implement platform fees, this could negatively impact the confidence of investors, as some liquidity providers may choose to move to other platforms since these fees will be deducted from their share of the revenue.

Conclusion

The future is uncertain for Uniswap. Although it has a large user base, the stiff competition between it and other close competitors is causing it to lose market shares to these competitors that don’t use the AMM model. A lot of liquidity providers find it very difficult to keep their gains in AMMs because of the “impermanent loss” that is associated with this model. As DEXs that do not use the AMMs increase, Uniswap will have to stay innovative and keep making the user experience better. A huge part of Uniswap’s future also depends on the path of the cryptocurrency market.