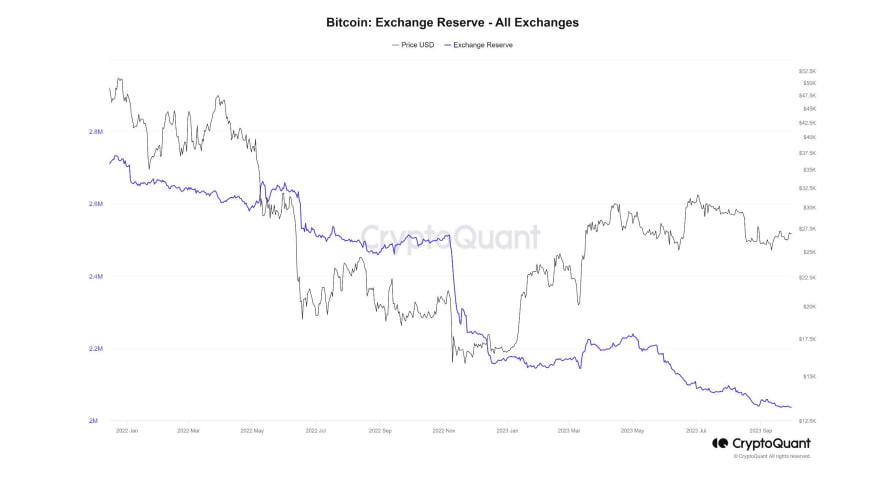

Bitcoin Prepares for Bull Run as Exchange Reserves Hit 3-Year Low

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin (BTC) is on the cusp of a bullish surge as data from Bitfinex Alpha reveals a remarkable trend: BTC reserves on centralized exchanges have plummeted to a three-year low. This key market indicator suggests that the dwindling supply of BTC on trading platforms may be a driving force behind the cryptocurrency’s price surge.

Since March 2020, BTC reserves on exchanges have been in a steady decline, aligning with the onset of a remarkable bull market. Intriguingly, this trend appears to highlight an inverse relationship between BTC’s price and exchange reserves. When investors anticipate higher prices, they tend to withdraw their coins from exchanges, further fueling the upward trajectory.

Even the November 2021 price dip failed to interrupt this decline in exchange reserves, indicating that investors are increasingly viewing BTC as a long-term asset, a shield against inflation, and a store of value.

Long-Term Bitcoin Holders Convinced Price Drop Highly Unlikely

Delving deeper, the report dissects the behavior of various investor groups, including long-term holders, short-term holders, and those with BTC stashed away for 12–18 months. Surprisingly, all these cohorts are resolutely in a ‘HODL’ phase, confident that BTC is unlikely to experience a major price plummet.

Historical data further underscores BTC’s favorability in October, particularly after a green September. Adding to the optimism, market volatility and futures metrics point toward potential upside for BTC in the upcoming weeks.

In summary, BTC finds itself in an enviable position as demand for the digital asset consistently outpaces its supply on exchanges. The report advises investors to closely monitor exchange reserves as a critical market sentiment indicator.

As the crypto world braces for a potential bull run, BTC enthusiasts have ample reason to be excited. The stage seems set for Bitcoin to continue its upward trajectory, with a scarcity-driven rally potentially on the horizon. Stay tuned for more exciting developments in the world of cryptocurrency.