Ethereum London Hard Fork: Exchanges Place Precautionary Measures to Forestall Volatility

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

With the Ethereum (ETH) blockchain preparing to launch the London hard fork, crypto exchanges are taking precautionary measures to ensure that customers’ funds are secure during the transition.

The hard fork should go live at block height 12,965,000, which should occur tomorrow (August 5). The hard fork will usher in one of two likely occurrences; either the chain gets split and a new competing network with a token emerges, or no new token emerges, and crypto exchanges resume ETH operating as usual.

Meanwhile, behemoth exchange Binance announced that it would temporarily suspend ETH and ERC-20 tokens deposits and withdrawals at 11:45 (UTC) 05-08-2021. This action forestalls trading risks if a new token gets created during the hard fork, which could trigger immense price volatility.

That said, some Binance trading products like Spot and Margin are exempt from the suspension. However, the exchange advised that users take utmost precautions considering how high volatility could get during the hard fork. Also, Binance Crypto Loans will get suspended for 42 hours.

Meanwhile, OKEx noted that if the upcoming hard fork causes a split in ETH, the platform will credit users with ETH from the chain. It also warned its users not to facilitate transfers during the “snapshot period,” which should last for 10 minutes.

Key Ethereum Levels to Watch — August 4

After an overwhelmingly bullish period last week, ETH appears to have entered correction mode following a rejection from the $2,650 pivot zone on Monday. That said, the corrective bias has faded around the $2,480 – $2,450 support area, cradled by the 4-hour 50 SMA.

That said, trading momentum is now in neutral conditions, indicating that a rebound to the upper-$2,600 area could occur in the near term. However, a break below the 50 SMA support could extend the bearish correction to the upper-$2,300 area.

Meanwhile, our resistance levels are $2,570, $2,650, and $2,700, and our support levels are $2,440, $2,400, and $2,300.

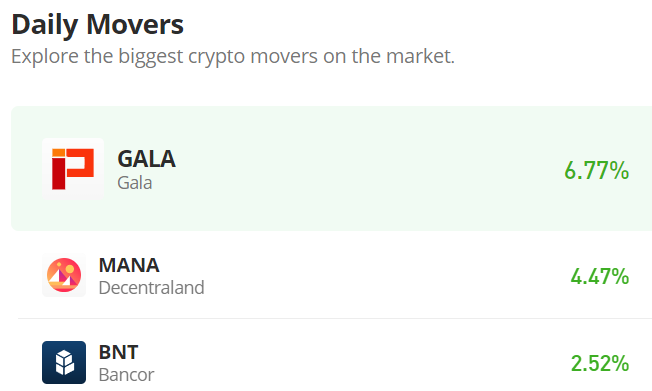

Total Market Capitalization: $1.55 trillion

Ethereum Market Capitalization: $290.3 billion

Ethereum Dominance: 18.7%

Market Rank: #2