Solana Gets Listed on Bloomberg’s Terminal Amid Increased Network Adoption and Activity

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Solana (SOL) has become the third cryptocurrency listed on the Bloomberg terminal, behind Bitcoin and Ethereum. Termed “Bloomberg Galaxy Solana Index,” the crypto price tracker made its debut on the platform yesterday.

According to the head of Europe at Galaxy Digital, Tim Grant, the index has become “the first institutional-grade pricing source for Solana.”

Worth mentioning is Solana owes most of its realized gains to the recent decentralized applications (dApps) and non-fungible tokens (NFTs) boom. Confirming this hypothesis, the head of product at Blockasset.co noted that DeFi and NFTs were “the ultimate source of boosted demand” for SOL.

Interestingly, the DeFi industry currently boasts over $106 billion in total value locked (TVL), a whopping 307% jump from the $26 billion recorded in January this year, according to DeFi Pulse. Meanwhile, NFT sales volume grew eightfold between Q2 and Q3,2021, according to DappRadar.

CryptoSlam reports that Solana-based secondary NFT sales have spiked to about $500 million in volume. The platform also ranked Solana’s 24-hour NFT sales as the fourth-best, behind Ethereum, Ronin, and Wax.

That said, SOL making it to Bloomberg’s terminal indicates that institutional interest in the cryptocurrency has increased significantly. CoinShare reported in its latest weekly report that SOL recorded $9.8 million in institutional inflows last week alone. The figure places Solana as the fourth-highest in this regard, behind Bitcoin ($97.5 million), Ethereum ($17.3 million), and Cardano ($16.4 million).

Key Solana Levels to Watch — November 17

Along with the rest of the cryptocurrency market, SOL has suffered a defeating blow from bears since it printed a new record high at $260 last week. The fifth-largest cryptocurrency has slipped below the critical $216 support as bears keep their feet in the gas.

With the price approaching the 209 support, we could see a rebound off the line, pending the efficacy with which the 200 SMA repels the price.

Meanwhile, my resistance levels are $216, $220, and $230, and my support levels are $209, $200, and $190.

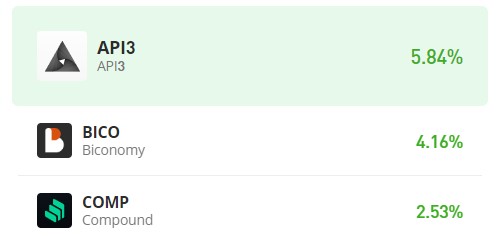

Total Market Capitalization: $2.57 trillion

Solana Market Capitalization: $64.3 billion

Solana Dominance: 2.5%

Market Rank: #5