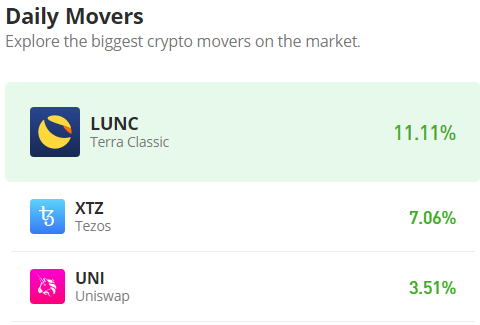

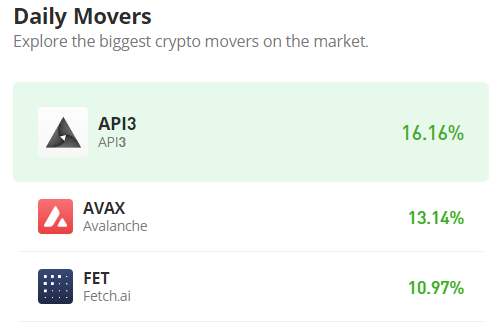

Avalanche (AVAX/USD): December Brings Optimism for the Market

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

After a period of price consolidation around the $10.00 level, the market initiated an upward breakout in early November. By the second half of the month, Avalanche had firmly established itself above the $20.00 mark, consolidating its position. As December unfolds, the bull market has experienced a substantial breakout. In today’s trading session, a significant battle between bulls and bears is underway at the $40.00 price level as they vie for control.

Avalanche Market Data

- AVAX/USD Price Now: $40.56

- AVAX/USD Market Cap: $14,730,774,842

- AVAX/USD Circulating Supply: 365,754,300 AVAX

- AVAX/USD Total Supply: 433,787,210 AVAX

- AVAX/USD CoinMarketCap Ranking: #9

Key Levels

- Resistance: $45, $50, and $55.

- Support: $30, $0.25, and $20.

Avalanche Price Forecast: Analyzing the Indicators

The robust bullish activities observed in December accelerated the market’s ascent to higher price levels swiftly, concurrently elevating market volatility, as reflected in the noticeable divergence of the Bollinger Bands indicator. While the heightened Avalanche price volatility may attract more traders to the bull market, it has concurrently fortified bearish resistance around the $40 mark.

In conjunction with the increased volatility, the Relative Strength Index (RSI) readings indicate a pronounced overbought condition. Additionally, the presence of an inverted hammer candlestick formation in today’s trading activities signals caution. This combination of factors may lead traders to initiate short positions, potentially resulting in a significant decline in prices.

For the bullish trend to persist, it is imperative for bulls to identify a higher support level to sustain the current trajectory.

AVAX/USD 4-Hour Chart Outlook

Upon analysis of the 4-hour chart, it seems likely that bulls will establish the $40 price level as a support. Notably, as the bear market approaches the $40 threshold, there is a noticeable decrease in momentum. However, a key concern arises from the Relative Strength Index (RSI), which continues to register momentum in the overbought region. This suggests that the market is being traded above its intrinsic value, raising the possibility of a correction that could lead to a decline in prices.