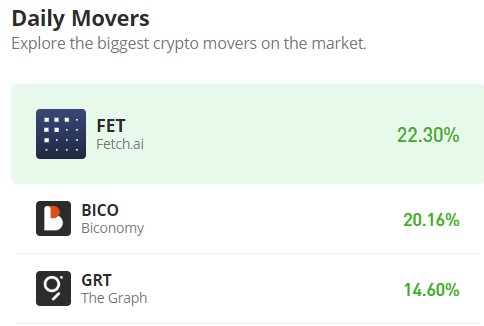

Biconomy (BICO/USD) Surpasses $0.400 Resistance and Aims for Stronger Support Beyond $0.500

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The $0.4 and $0.5 price levels have presented formidable resistance since December of last year, effectively forming a significant resistance zone in the Biconomy market. Notably, today’s trading session has exhibited robust bullish momentum, successfully breaching these key resistance barriers. As a result, this bullish surge has triggered an uptick in volatility levels, with the $0.5 resistance, in particular, now establishing itself as a formidable barrier to further upward movement.

Biconomy Market Data

- BICO/USD Price Now: $0.497

- BICO/USD Market Cap: $328 million

- BICO/USD Circulating Supply: 667 million

- BICO/USD Total Supply: 1 billion

- BICO/USD CoinMarketCap Ranking: #192

Key Levels

- Resistance: $0.50, $0.53, and $0.55.

- Support: $0.40, $035, and $030.

Biconomy Market Analysis: The Indicators’ Point of View

The current trading session has witnessed a notable surge in bullish activity, with the price movement effectively establishing the $0.40 level as a support threshold, thereby aligning the Biconomy market with its overarching bullish trend. Furthermore, this crypto signal indicates a sufficient volume of trade, as evidenced by the indicator histogram, bolstering confidence in the strength of this bullish market movement. Despite heightened volatility, particularly evident in the robust bearish resistance at $0.50, there remains potential for the continuation of this bullish momentum. Noteworthy is the significant Biconomy price correction observed following the breach of the key resistance level.

Although the Bollinger Bands signal escalating market volatility, the 20-day moving average maintains its bullish trajectory. Consequently, the market’s actual performance may see a close near, above, or at the $0.50 mark.

BICO/USD 4-Hour Chart Outlook

At the $0.5 price level, there is a notable tug-of-war between bullish and bearish forces vying for dominance in the market. The robust volume of trade histogram, indicative of the current trading session, underscores heightened investor interest. However, both bullish and bearish sentiments appear to be in a deadlock, resulting in a market impasse. Should the bullish side fail to secure a stronger support level in close proximity to $0.5, a market reversal could be imminent.