Top 5 Blockchain Mutual Fund Options for 2024

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

While mutual funds have long been a staple investment in conventional finance, their presence and adoption in the cryptocurrency realm remain limited. Surprisingly, the U.S. market offers just a singular crypto mutual fund. For those seeking diversified investment avenues akin to mutual funds within crypto, exploring alternative options becomes essential.

Comparing Blockchain Mutual Funds to Blockchain ETFs

Why is the availability of blockchain mutual funds so limited? These funds operate under specific investment guidelines, often excluding high-risk assets like shares in emerging blockchain ventures or direct digital asset investments, a departure from the broader mandates of traditional mutual funds.

It’s crucial to differentiate between mutual funds and ETFs. While both encapsulate diversified portfolios, ETFs typically mirror the performance of specific indices through passive investments. In contrast, mutual funds often involve active management, blending various asset classes.

While there’s a scarcity of direct blockchain mutual funds, several ETFs offer a viable alternative. Notably, there’s a notable absence of spot ETFs tied to individual cryptocurrencies, despite mounting anticipation for a dedicated bitcoin ETF. Nevertheless, ETFs associated with blockchain initiatives provide investors with avenues to engage with this innovative sector.

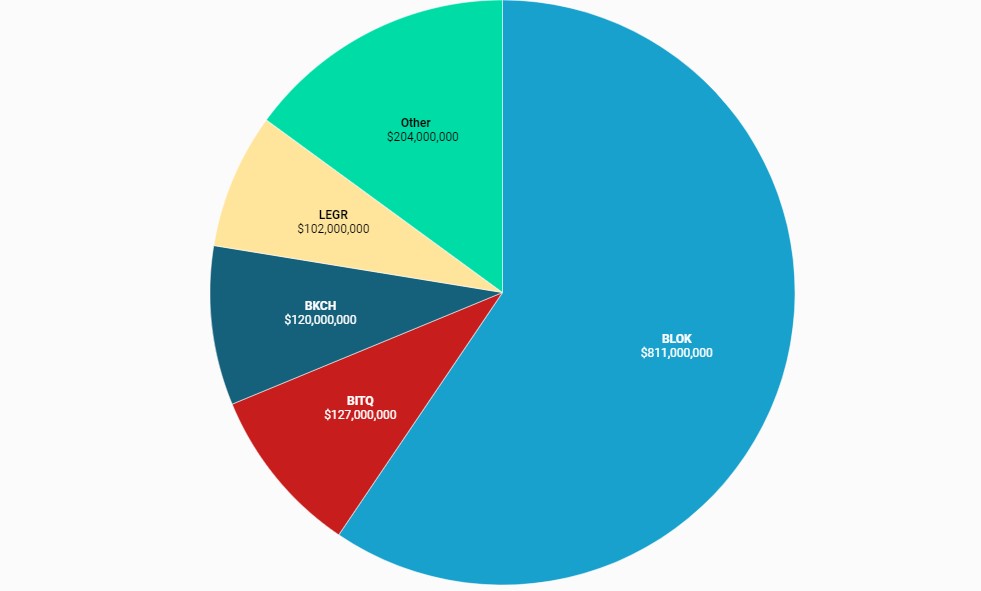

Some Favorite Blockchain ETFs

Blok

Currently leading the pack in blockchain ETFs based on assets under management is the Amplify Transformational Data Sharing ETF (BLOK), boasting an AUM of $441 million as of the latest data.

BLOK concentrates its investments on “transformational data sharing technologies,” with a keen emphasis on blockchain innovations. Debuting in 2018, it holds the distinction of being the inaugural blockchain ETF sanctioned by the SEC. Instead of direct exposure to blockchain tech or cryptocurrencies, this ETF channels its investments towards companies that either collaborate with or invest in entities pioneering and leveraging blockchain solutions.

BLCN

BLCN is a significant player in the blockchain ETF sector, with $61 million in AUM. Unlike BTCFX, BLCN targets companies at the forefront of blockchain research and application, making it a top choice for indirect cryptocurrency exposure. Its portfolio includes industry leaders like Coinbase, Microsoft, and PayPal, all actively advancing blockchain technology.

BITO and BKCH

In the blockchain ETF landscape, Proshares Bitcoin Strategy ETF (BITO) leads with $1.6 billion AUM, followed by Global X Blockchain ETF (BKCH) at $61 million AUM. BITO offers direct exposure to bitcoin’s value fluctuations, appealing to those interested in cryptocurrency trends. Notably, in October 2021, BITO became the first SEC-approved cryptocurrency ETF on a major U.S. exchange, solidifying its market credibility.

Advantages of BKCH:

BKCH, like BLCN, targets companies at the forefront of blockchain development. Notably, 30% of BKCH’s portfolio is invested in firms like Coinbase and Marathon Digital, compared to BLCN’s 6%. For investors keen on blockchain-focused companies, BKCH stands out. Additionally, blockchain ETFs offer efficient trading, cost-effective exposure, and broad accessibility compared to traditional blockchain mutual funds.

Exploring Exchange-Traded Products for Blockchain Investments

Consider investing in exchange-traded blockchain products like digital currency ETNs and tracker certificates. An ETN, akin to a bond, is a debt security backed by a bank with a set maturity. Investors profit from its appreciation upon maturity.

For U.S. residents, ETF options are limited, though European ETFs are available for some. Notably, VanEck stands out with its comprehensive crypto ETNs, covering major coins like Bitcoin, Ethereum, and Solana. Their ETNs emphasize safety and cost-efficiency. For instance, their “Leaders” ETN saw impressive returns exceeding 110% in the previous year.

Tokenized Blockchain Funds

Blockchain technology has birthed tokenized investment funds, offering a streamlined investment approach. By acquiring tokens like SpiceVC’s SPICE, investors gain indirect access to promising ventures like Bakkt and Securitize. For diversified exposure across top digital currencies and tangible assets, the newly introduced Wisdomtree Prime serves as a digital hub. This platform uniquely leverages blockchain to ensure secure and transparent ownership records for its users.

Numerous crypto hedge funds and venture capital entities offer avenues for blockchain investments, though many have high entry barriers, often targeting high-net-worth individuals with industry ties. Nonetheless, several funds cater to smaller investors.

PolyChain Capital, a prominent hedge fund established in 2016, focuses on early-stage blockchain startups but requires a hefty $1,000,000 minimum investment. Conversely, Pantera Capital, founded in 2003, shifted its focus to blockchain and crypto, demanding a more accessible $100,000 minimum. Noteworthy funds in this space include Digital Currency Group, Blockchain Capital, and Andreessen Horowitz (a16z).

Investing in crypto funds offers professional management and secure token storage, making them a viable alternative for hands-off investors seeking blockchain exposure.

Investing Directly in Digital Asset

Building a digital asset portfolio offers a comprehensive view of the blockchain technology sector’s potential. Begin by researching and selecting digital assets aligned with your risk appetite. Secure your investments using reputable cryptocurrency wallets, preferably offline.

Many start with established cryptocurrencies like Bitcoin and Ether, given their track record and market dominance. Notable alternatives include Cardano, Binance Coin, Tether, and Uniswap. Stay informed with dedicated resources like the Blockchain Believers Portfolio to guide your investment choices.

Lessons for Investors

Exploring crypto mutual funds may offer limited choices, but several alternatives can still offer substantial blockchain exposure for your investment portfolio, regardless of your decision on mutual funds.