Uniswap (UNI/USD) Trade Is Below $5.50, Finding a Base

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Uniswap Price Prediction – November 18

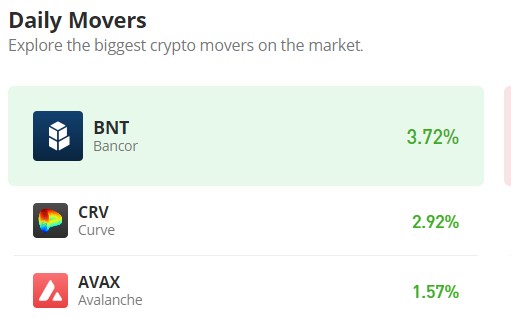

Significant price actions have surfaced around the point of the upper Bollinger Band trend line to show that buyers are in a state of relaxing muscles in the UNI/USD market against bears, given the crypto-economic trade is below the value of $5.50, finding a base.

As of the time this analysis was written, the market usually doesn’t wait to start creating lower-trading zones from scratch. An indicator has verified that a series of declines is likely to take center stage in the market around the $5.50 value line. Buyers should watch for regions where the trade will be rallying against additional drops in order to initiate back-buy orders when that assumption plays out.

UNI/USD Market

Key Levels:

Resistance levels: $5.50, $6, $6.50

Support levels: $4.50, $4, $3.50

UNI/USD – Daily Chart

The UNI/USD daily chart showcases that the crypto-economic trade is below the resistance of $5.50, finding a base around the point of $5.

The Bollinger Band trend lines are pointing northwardly from the middle part to the lower side. The upper part has been placed, curving southward slightly above the resistance point of $5.50, to assert that the value zone is going to play a crucial role in the motion of further rises. The stochastic oscillators have shifted southbound by using the blue line, stepping into the oversold region.

What kind of market activity is there right now in UNI/USD operations around the $5.50 mark?

A line of confluences also surfaces in the UNI/USD trade activities, as the price is trading below the point of $5.50, finding a base.

In contrast to the leading cryptocurrency in prior cycles, the market’s upward volatility speed has not been breaking through resistance with the same ferocity. For the time being, it seems that the market will continue to hold lower in order to provide a perfect baseline from which to rise above the $4.50 support line.

Sellers should exercise caution when taking on large holdings, as a powerful instrument has revealed that bears are on the verge of losing their ability to consistently drive the price lower than what the lower Bollinger Band strength would resist in the aftermath sessions.

UNI/BTC Price Analysis

In contrast, the Uniswap market is trading below the upper Bollinger Band against Bitcoin, finding a base around the middle of the Bollinger Band.

The Bollinger Band trend lines are briefly positioned northbound with a precautionary index against seeing free fall-offs based on the kind of pattern it maintains. The stochastic oscillators are in a southbound-crossing mode, placing them around the point of 40. It is likely that the base crypto trade would tend to relax for a while before rebounding forces

Note: Cryptosignals.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

You can purchase Lucky Block here. Buy LBLOCK