Exploring Bitcoin ETFs: A 2024 Investment Guide

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

In a groundbreaking move on January 10, 2024, the US SEC gave the green light to Bitcoin spot ETFs, unleashing a surge of excitement throughout the cryptocurrency market. Often hailed as the “holy grail” for institutional acceptance, the approval of bitcoin spot ETFs marked the realization of a long-held aspiration for crypto enthusiasts.

A decade ago, the Winklevoss brothers’ initial spot bitcoin ETF application was swiftly rejected by the SEC. Fast forward eight years to October 2021, and the introduction of bitcoin futures ETFs brought celebration to three distinct funds. Today, history repeats itself as the recent SEC approval paves the way for an impressive eleven-spot bitcoin ETF.

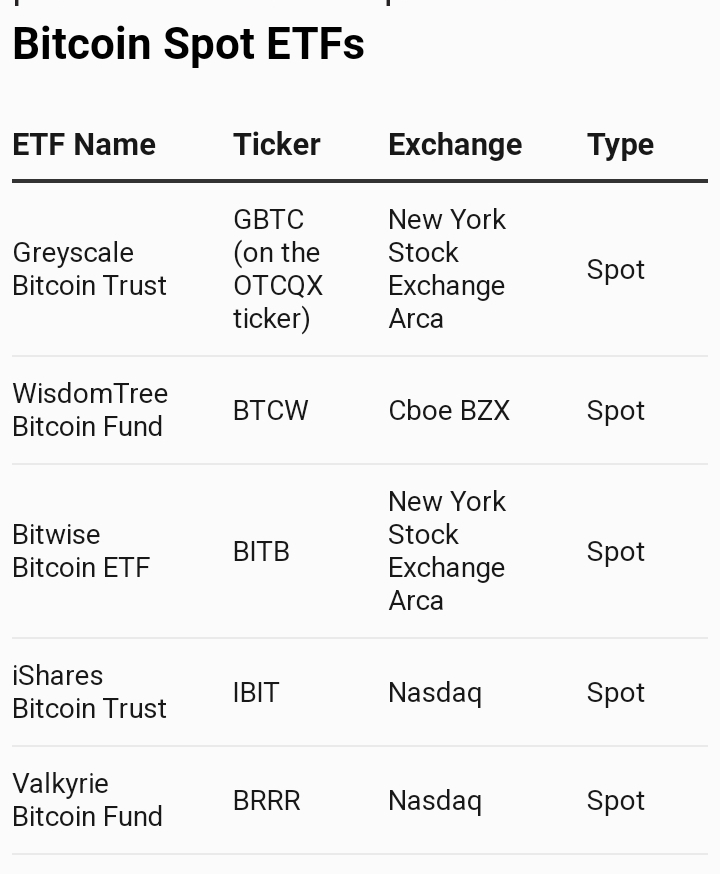

Leading Bitcoin ETFs

At present, investors have access to three bitcoin futures ETFs, along with the recent launch of eleven spot bitcoin ETFs across three distinct exchanges. Highlighted below are some of the standout examples in this evolving landscape.

Grayscale Bitcoin Trust (GBTC)

Established in 2013, GBTC transformed from a private trust for accredited investors to a public entity on over-the-counter markets in 2015. Pursuing SEC approval for a spot ETF, it now reigns as the world’s largest bitcoin ETF with $26.9 billion AUM, holding 617,000 bitcoins (nearly 3% of the total supply). Despite an expense ratio reduction of 1.50%, some investors still find it comparatively high.

Bitwise Bitcoin ETF (BITB)

Unlike GBTC, BITB offers a novel perspective. Introduced by Bitwise just 24 hours after SEC approval on January 11, this ETF joins Bitwise’s diverse portfolio of 18 crypto products, including the largest crypto index fund.

BITB, with a $242.9 million AUM, positions itself as cost-effective, boasting a low 0.20% expense ratio. Bitwise further enhances the appeal with a 100% fee waiver for the initial six months on the first $1 billion in assets.

iShares Bitcoin Trust (IBIT)

Established in 1996, iShares, a BlackRock acquisition from Barclays in 2009, introduced its inaugural crypto ETF, IBIT, on January 5, 2024, just before SEC approval. Boasting $497.9 million in BTC holdings, 4.6 million outstanding shares, and a 0.25% expense ratio, IBIT offers allure with a 50% fee waiver for the initial 12 months on the first $5 billion in assets.

Valkyrie Bitcoin Fund (BRRR)

BRRR, initially owned by Valkyrie Investments, shifted to CoinShares after SEC approval on January 12, 2024, contributing $112 million in assets to CoinShares’ $4.5 billion portfolio. CoinShares also acquired Valkyrie’s additional crypto ETFs. Following the January 2024 Bitcoin ETF trend, BRRR offers appealing fee discounts, including a three-month sponsor fee waiver and a subsequent 0.25% fee. Coinbase serves as the designated Bitcoin custodian for BRRR.

ARK 21Shares Bitcoin ETF (ARKB)

Cathie Wood’s ARK Invest pioneered bitcoin investments in 2015. Despite an unsuccessful 2021 attempt for a spot bitcoin ETF with 21Shares, a triumphant second application in April 2023 led to ARKB’s early SEC approval. Launched on January 10, 2024, ARKB, with $75 million in bitcoin holdings, resides on the Cboe BZX exchange. It boasts a competitive 0.21% management fee and a 100% waiver for the first six months or until assets reach $1 billion—whichever comes first, demonstrating a commitment to investor value.

What Is a Bitcoin ETF?

An ETF is a versatile investment vehicle that mirrors the price movements of assets like gold, oil, indices, or a basket of stocks. In the cryptocurrency realm, a bitcoin ETF specifically tracks bitcoin’s price trajectory.

ETFs operate like stocks on exchanges, offering a level playing field for both retail and institutional investors. This accessibility facilitates the fluid buying and selling of ETF holdings among investors, enhancing the exchange of assets in the stock market.

Buying Bitcoin ETFs vs. Buying Bitcoin

A bitcoin ETF, like the Winklevoss twins’ proposal in 2013, has bitcoin as its underlying asset. Investing in a bitcoin ETF indirectly means holding bitcoin in a portfolio instead of directly acquiring and holding the digital currency.

However, as the ETF would closely track the price of bitcoin, for the investor, it should make little difference whether they are holding a bitcoin ETF or the actual digital currency. The main difference between buying a Bitcoin ETF and Bitcoin is that investors purchase a regulated investment vehicle instead of buying and owning a crypto asset.

A bitcoin ETF presents a host of advantages for investors, adding a layer of convenience that reshapes the landscape of cryptocurrency investment. Foremost among its merits is the elimination of concerns related to securing Bitcoin, sparing investors from grappling with the complexities of wallets and crypto exchanges. Opting for an ETF streamlines the entire cryptocurrency investment process, making it more accessible.

A regulated bitcoin ETF offers legal safeguards, steering clear of the decentralized and unregulated aspects of direct bitcoin ownership. Trading on mainstream exchanges under institutional oversight enhances tax efficiency, addressing regulatory complexities in various jurisdictions.

ETFs provide risk diversification for volatile bitcoin investments. The structure allows funds to blend Bitcoin with popular altcoins, traditional commodities, AAA stocks, and more for strategic diversification, buffering against the potential impacts of market fluctuations on investors’ portfolios.

Bitcoin Futures ETFs vs. Bitcoin Spot ETFs

A Bitcoin spot ETF directly mirrors the value of Bitcoin, enabling buyers to invest in crypto without holding actual tokens. This eliminates the need for cumbersome processes like registering on crypto exchanges or dealing with Bitcoin wallets.

Bitcoin futures ETFs track the bitcoin price differently by investing in bitcoin futures contracts. Unlike direct bitcoin transactions, futures contracts involve committing to buy or sell the commodity at a predetermined price on a future date, hedging a bet on favorable prices at contract expiration.

Spot ETFs accurately reflect BTC market price changes, whereas futures ETFs introduce variability, deviating from direct mirroring. The complexity of expiration dates complicates their performance, and the contracts’ expiration requires users to allocate additional funds for the rollover process.

Conclusion

The arrival of bitcoin spot ETFs in the US, following the SEC’s 2024 decision, is a pivotal moment, hinting at broader adoption and potential Ethereum spot ETFs, marking a stride toward legitimizing cryptocurrencies.