Bitcoin ETF: Fidelity Investments Pressures SEC for Approval

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

American financial services corporation Fidelity Investments has urged the SEC to approve its Bitcoin Exchange-Traded Fund filing. The investment company argues that the Commission needs to greenlight the initiative as there is an increased demand for an ETF from investors.

Reports state that a multinational investment giant made its pressuring case to the U.S. Securities and Exchange Commission in a private meeting last week. The meeting hosted the President of Fidelity Tom Jessop, six other top officials of the company, and several SEC staff.

The Fidelity representatives cited several reasons for the need for a Bitcoin (BTC) ETF, including the recent massive increase in trading volume. They added that there is an increased appetite for digital assets exposure via an exchange-traded product (ETP).

Finally, the investment company executives noted that many regulators across the globe, including those in Canada and parts of Europe, have approved BTC ETFs and that the U.S. now has to play catch-up.

Fidelity ventured into the crypto works in 2014 and has since committed its resources in the custody, mining, and private BTC investment funds sectors. The behemoth investment firm filed for a BTC ETP called the Wise Origin Bitcoin Trust in March this year.

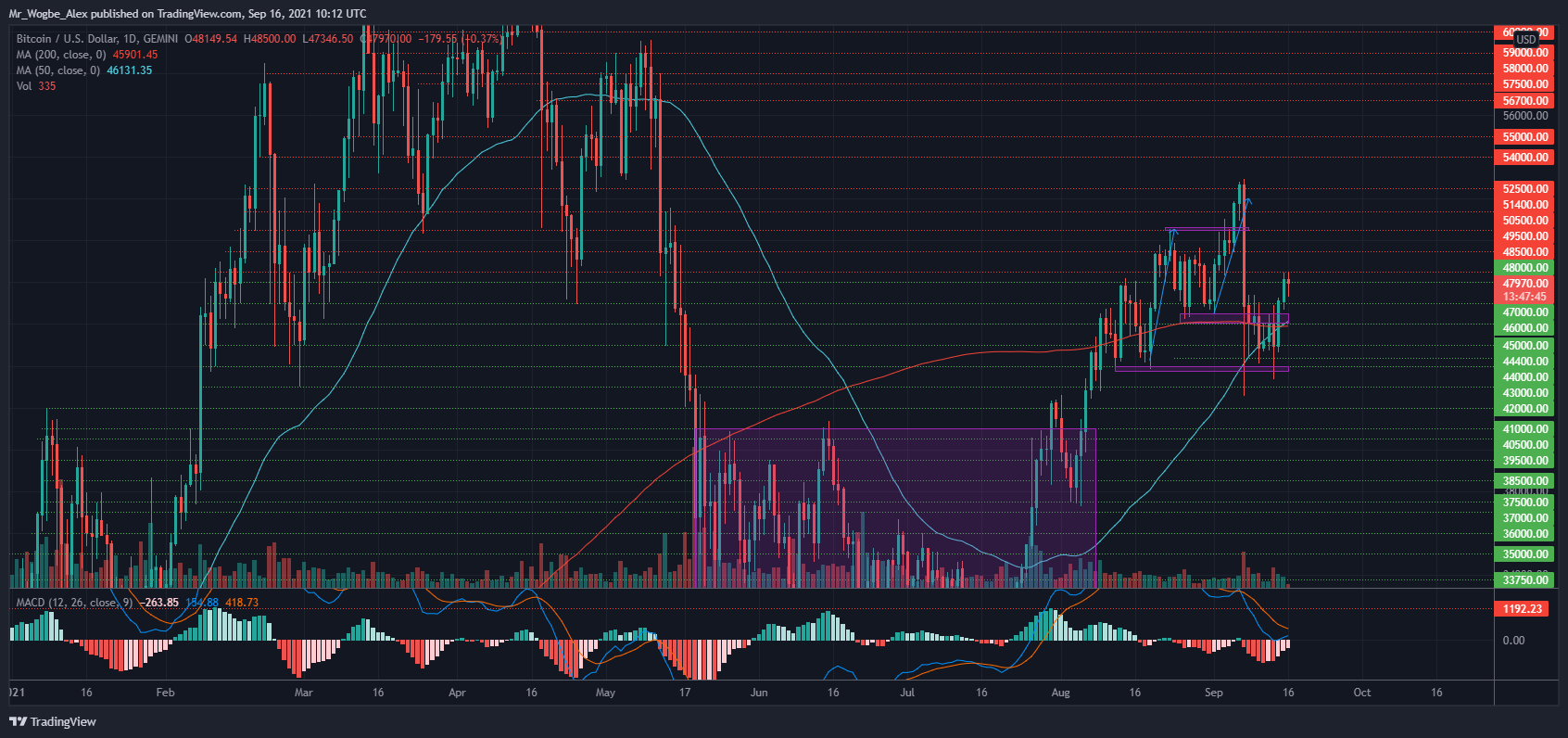

Key Bitcoin Levels to Watch — September 16

Following its revisit to the lower-$43K area, Bitcoin appears to be on a renewed bullish momentum towards $50K. That said, we have recorded the complete formation of a golden cross pattern at the $46K axis.

However, BTC is having a rather tough time clearing the $48.5K resistance, causing the bullish momentum to stall. With the confirmation of a golden cross pattern and the resurfacing above neutral trading conditions, we expect to see a decisive break above the $48.5K level and a bullish continuation towards $50K in the coming days.

Meanwhile, our resistance levels are at $48,500, $49,500, and $50,000, and our key support levels are at $47,600, $47,000, and $46,000.

Total Market Capitalization: $2.18 trillion

Bitcoin Market Capitalization: $898.2 billion

Bitcoin Dominance: 41.1%

Market Rank: #1