Bitcoin Holds $50K Amid Significant Exit of Whales

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

According to recent on-chain data from Glassnode, the total number of Bitcoin (BTC) whales is on a decline. In an unexpected turn of events, addresses holding 100 BTC or more have plunged to a yearly low of 15,958.

The Bitcoin ecosystem recorded a significant increase in both retail and institutional investment over the past year. That said, the unexpected drop in Whalen accounts accentuates the easy possibility of confusing network activity growth with coin accumulation. The recent decline implies that many whales have cashed out of the market. That said, whale accounts have dropped by 4.4% from the yearly peak of around 16,700 accounts.

That said, both whale accumulation (typically by institutional investors) and retail activities have distinctive far-reaching impacts on the price of BTC. Whales are responsible for injecting significant amounts of capital and thus volatility and value, like the effect of the Tesla BTC acquisition in February. Retail investors are responsible for heightened network/exchange activities, which maintain a positive trading volume for the crypto asset.

An increase in trading volume translates to daily price gains, an accumulation of which has maintained the price growth of the primary cryptocurrency, previous price correction.

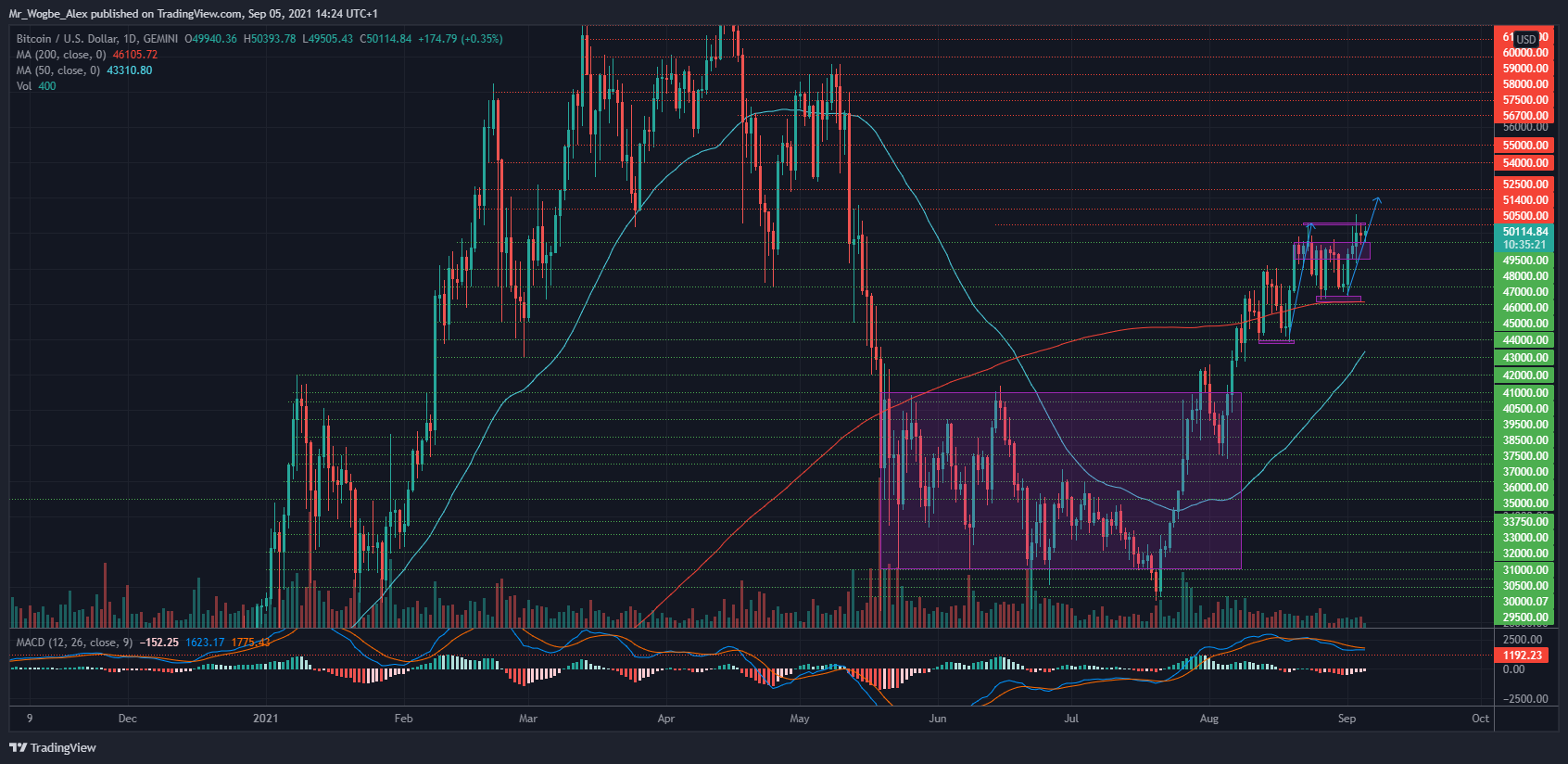

Key Bitcoin Levels to Watch — September 5

BTCUSD has held its grip above the critical $50K level as bulls prepare for a leg up in the near term. Following the previous double-bottom emergence at $44K, BTC saw a +5K surge to the $49.5K area (with a peak of $50.5K) before posting a correction.

That said, with the emergence of a double-bottom at the $46.5K level, BTC could post a leg up to the $52K region. We expect bulls to consolidate their strength and push the price higher in the coming days. Failure to execute along this activity projection could restrict the flagship cryptocurrency within a sideways momentum.

Meanwhile, our resistance levels are at $50,500, $51,400, and $52,000, and our key support levels are at $49,500, $48,000, and $47,000.

Total Market Capitalization: $2.30 trillion

Bitcoin Market Capitalization: $944.2 billion

Bitcoin Dominance: 41.2%

Market Rank: #1