Liquid Staking Derivatives

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Liquid Staking Derivatives (LSDs) were formed in response to the launch of the Ethereum Beacon Chain in December 2020. Ethereum’s transition from proof of work to proof of stake provides opportunities for crypto users to stake their holdings to generate additional income.

Through native tokens, liquid staking protocols offer the possibility of unlocking liquidity. Equal amounts of native tokens with values tied to ETH are distributed to users who stake ETH on these protocols. While their ETH continues to accrue staking rewards, these tokens can be further invested in DeFi projects.

In order to decide which top LSDs would be ideal for crypto investors, we will study four LSD protocols. We shall examine Lido, the leading LSD, as well as a few emerging protocols, including Frax Finance, and Rocket Pool, and Coinbase Wrapped ETH.

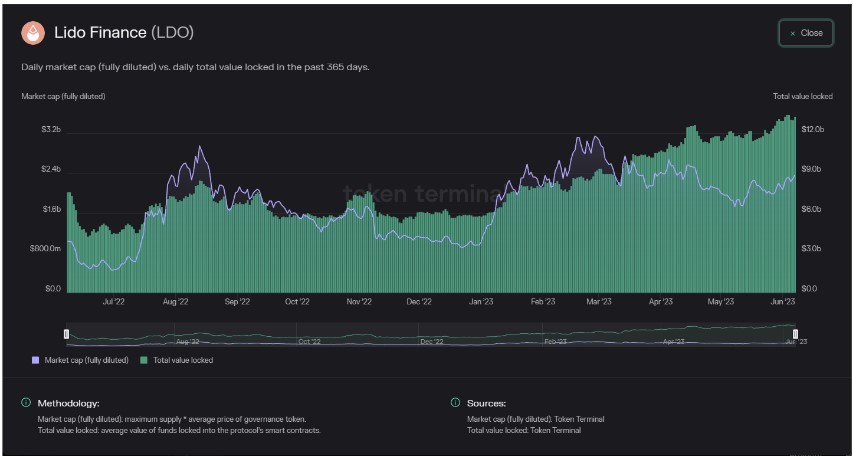

Lido (LDO)

The first non-custodial staking mechanism for ETH was Lido. It debuted shortly after the Beacon Chain and has since dominated the industry. 29% of the total ETH staking market is made up of Lido.

On Lido, the native staking token is known as stETH. On staking rewards, the protocol levies a customary 10% fee. The protocol’s governance token is LDO. Voting by holders will determine how the protocol will evolve in the future.

After the Shapella improvement, Lido has expanded greatly, but that expansion has a cost. The project is getting more and more centralized with its tiny pool of 30 validators. Some believe that this centralization could threaten Ethereum’s decentralized architecture as it increases its market dominance in staked ETH.

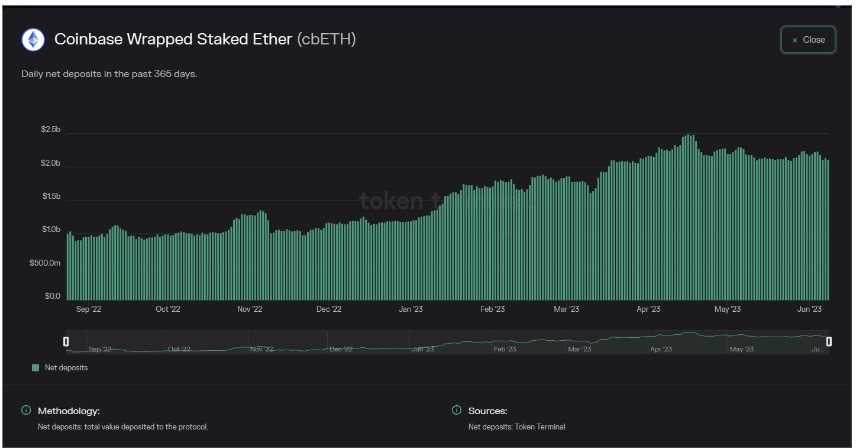

Coinbase Wrapped Staked Ether (cbETH)

The most popular cryptocurrency exchange in the US is Coinbase, which Brian Armstrong founded in 2012. In June 2022, the exchange made its liquid staking protocol public. The platform’s staked ETH token is referred to as cbETH.

Since the protocol’s introduction, its user base has grown quickly. While Lido is still out of reach, Coinbase has demonstrated significant growth to take second place ahead of more established, more dated protocols like Rocket Pool.

The system is owned by a centralized exchange and lacks a DAO or governance token. Along with cbETH, Coinbase has also released lsETH, an ERC-20 token that is a liquid staking platform for institutional investors.

Rocket Pool

Rocket Pool is the first significant liquid staking system that satisfies all requirements for a truly decentralized, non-custodial platform. In contrast to Lido, which depends on a small pool of validators, it has over 2,000 validators, and anyone can apply to be one. It’s far more difficult to use, though.

Rocket Pool is the best option for liquid staking for those who care about decentralization. The protocol is hindered, nonetheless, by its slightly lower yields and comparatively higher fees (15%) compared to other platforms.

Rocket Pool is in a good position for future expansion. The blockchain is not threatened by it, and a large percentage of users act as validators. Future regulations pose the biggest threat in this situation, which is a problem with all such protocols.

Frax Ether (FXS)

The TVL for the liquid staking procedures outside of the top three is all less than $1 billion. With a TVL of over $400 million, Frax Ether leads the chasing group. It was introduced by Frax Finance, a decentralized financial system that specializes in stablecoins with certain algorithmic components.

Frax Ether guarantees better APY payouts than its rivals thanks to its cutting-edge methodology. However, it will struggle to gain traction and expand because of protocols like Lido. However, the data indicates that Frax is on a stable growth trend.

The prior affiliation of Frax Finance with algorithmic stablecoins is a drawback. In February 2023, the Frax community decided to completely abandon algorithmic stablecoins in favor of fully collateralized alternatives. We think that taking this action will help increase confidence and trust.

Conclusion

However, there is a lot of regulatory ambiguity due to the new EU MiCA legislation and the SEC’s crackdown on CEXs in the US. Any investment decision should include the potential financial and legal ramifications that legislation might have on cryptocurrency (particularly liquid staking schemes).

The preferable strategy may be to purchase and keep a few of the underlying governance tokens if you want to invest in these protocols (for example, purchasing LDO to purchase shares of the Lido “Company”).