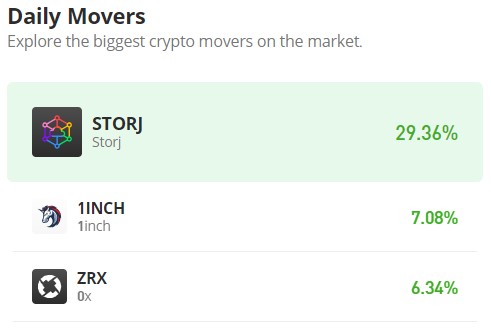

The Storj Market (STORJ/USD): Bullish Activity Sparks Market Enthusiasm

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The Storj market started to shift its trajectory towards the upside during early September, following a breakout from a period of indecision. In the same month, prices gained additional bullish momentum, testing the $0.500 level. However, they were unable to maintain a position above this threshold, and since the beginning of October, the resistance level has remained steadfast at $0.500.

Nonetheless, in today’s market, the $0.500 resistance has succumbed to a substantial bull run, propelling the market close to the $0.6 price level.

The Storj Market Data

- STORJ/USD Price Now: $0.5913

- STORJ/USD Market Cap: $194,560,724

- STORJ/USD Circulating Supply: 371,100,048 STORJ

- STORJ/USD Total Supply: 424,999,998 STORJ

- STORJ/USD CoinMarketCap Ranking: #162

Key Levels

- Resistance: $0.600, $0.650, and $0.700.

- Support: $0.400, $0.350, and $0.300.

The Storj Market Price Forecast: Analyzing the Indicators

The significant breakthrough of a month-long resistance level is poised to pique the interest of investors, potentially attracting more traders to join the bull market. This influx of interest may lead to heightened volatility, providing the Storj bull market with an opportunity to drive further price gains. The Bollinger Bands are showing divergence, affirming the anticipation of increased market volatility.

The next development to anticipate is the establishment of a higher support level, which may materialize in the upcoming daily session. Given that the market has encountered a major resistance level, a price retracement is highly likely. This is reinforced by the Relative Strength Index (RSI) reading of 75, indicating an overbought market and signaling the potential for a price correction. However, this correction is expected to result in the formation of a higher support level above the $0.500 price mark, which will now serve as a new key support level.

STORJ/USD 4-Hour Chart Outlook

The 4-hour chart analysis of the Storj market reveals a divergence in the Bollinger Bands, signifying increased market activity. This surge in liquidity is impacting both bullish and bearish sentiments, resulting in rapid price fluctuations. Consequently, investors should anticipate heightened price volatility in the near term as market participants seek to establish a support level, a pivotal factor in sustaining the ongoing bullish trend.