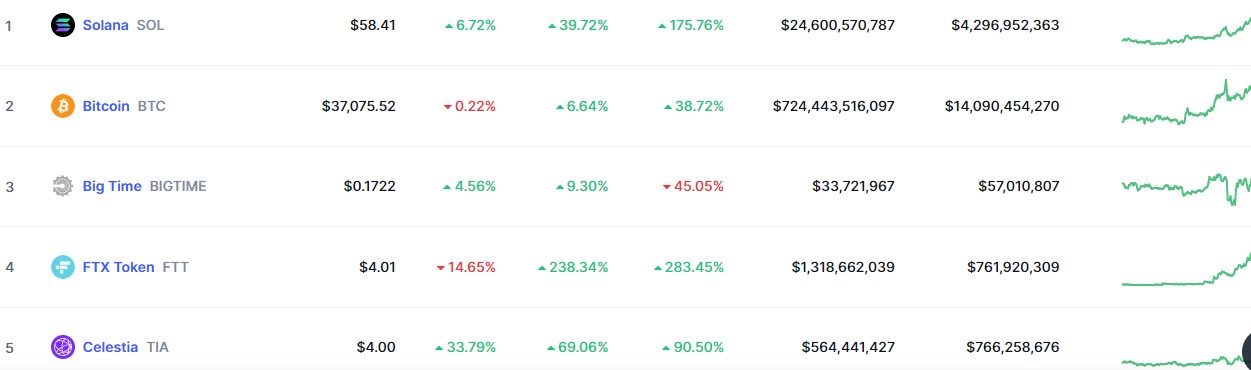

Top Trending Coins for Today, November 12: SOL, BTC, BIGTIME, FTT, and TIA

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Across the majority of the cryptocurrency market this week, a prevailing bullish trend is evident. Notably, Solana and Bitcoin have demonstrated impressive price performance in recent weeks. Despite speculative concerns about potential reversals, certain high-performing coins persist in reaching new, elevated price levels. Both investors and analysts are contemplating whether this signifies the initiation of a bullish season.

Solana (SOL)

Major Bias: Bullish

The Solana market has exhibited a consistent bullish trend since mid-October, making substantial progress in the higher price zones. Notably, the market has defied expectations of a reversal at $32, a recent high recorded on October 25. Instead, it has demonstrated robust upward momentum, surpassing both the $40 and $50 price levels and presently turning its focus towards the $60 price level. The market displayed particularly bullish behavior on November 10, contributing significantly to approaching the $60 price threshold.

While indicators suggest a continued upward trend, today’s long-legged doji candlestick introduces an element of indecision as bullish and bearish sentiments intersect, notably at the critical $60 price level. Typically, a strong resistance at this level would prompt a downturn, but the volume of trade indicator reflects surging investor interest, potentially sustaining the market’s upward trajectory.

Current Price: $58.32

Market Capitalization: $24,600,570,787

Trading Volume: $4,290,952,363

Bitcoin (BTC)

Major Bias: Bullish

Bitcoin has exhibited notable upward momentum in recent weeks, overcoming bearish resistance around the $35,000 price level. The bulls successfully pulled the market to the upside, reaching the $37,000 price level. Despite candlestick patterns suggesting a struggle between bulls and bears, bullish traders prevailed, driving the market to the $37,000 mark. However, it is prudent to acknowledge the potential for a reversal at this level.

Although the price action indicates an upward trend, the Bollinger Bands are contracting, signaling a temporary pause in the market trend and the potential for a significant, imminent movement. Today’s market performance leaned somewhat bearish, possibly indicating a shift in favor of the bears. However, the diminishing trade volume suggests that the feasibility of a sustained bear market is decreasing. Careful consideration of these factors is essential for a comprehensive analysis of the current market conditions.

Current Price: $36,809

Market Capitalization: $724,443,516,097

Trading Volume: $14,090,454,270

Big time (BIGTIME)

Major Bias: Bullish

Currently holding the third position on today’s trending list is the Big Time market. This position is attributed to a surge in interest observed in both bull and bear markets, particularly towards the weekend. Notably, the market exhibits a robust presence on both the supply and demand sides, albeit with a slightly subdued bullish momentum. Despite this, the market is considered bullish, maintaining a position above the 20-day moving average.

As of now, the market is actively pursuing the $0.200 price level, which marked the high point on the last day of October. This level is significant as it served as the trigger for the preceding bear market. The bear market was confined within the consolidation trend around the $0.1527 price level, with this key support level playing a pivotal role in sustaining the ongoing bullish trend.

Current Price: $0.1722

Market Capitalization: $33,721,967

Trading Volume: $57,010,807

FTX Token (FTT)

Major Bias:Bullish

The FTT token has experienced a prolonged period of stability, which may be attributed to a lack of catalysts, potentially indicating diminished investor interest in the market. However, a noteworthy shift occurred towards the weekend as the market surged in a bullish direction. Initiating from the $1.180000 price level, it ascended to $4.000 and achieved a peak of $5.5770925 before triggering a bear market.

The bearish movement appears substantial, with the descending prices nearing the 20-day moving average. There’s a possibility that the entirety of the preceding bullish gains could be eroded, especially as traders holding positions for an extended period may seize this opportunity to short their positions, potentially leading to a significant retracement.

Current Price: $3.689800

Market Capitalization: $1,318,662,093

Trading Volume: $761,920,309

Celestia (TIA)

Major Bias: Indecision

The Celestia market has experienced substantial growth following a breakout from indecision at the $2.352 price level. Remarkably, within the last 24 hours, the market has surged by an impressive 33.79%. Currently, efforts are underway to establish a foothold at the $4.00 price level. The market’s robust activity, evident in the substantial trading volume, suggests its potential to ascend further through additional price levels.

However, it is crucial to acknowledge that the bull market is encountering formidable resistance at the $4.00 price level. This resistance may lead to a reduction in trade volume, potentially signaling the onset of a consolidation phase. The market’s ability to surpass the $4.00 resistance level remains uncertain, particularly in light of the overbought condition indicated by the Relative Strength Index, which could contribute to a deceleration in the bullish trend.

Current Price: $3.995

Market Capitalization: $564,441,427

Trading Volume: $766,258,676