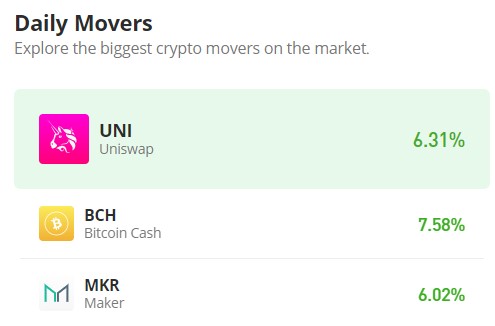

Bancor (BNTUSD) Still Trades in a Consolidative Outlook

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

BNTUSD Analysis-Price Consolidation Continues to Hold Ground

BNTUSD still trades in a consolidative outlook as the markets remain stable. There has been no recent development on the Bancor price. The crypto asset has been starved of liquidity flow, which could have caused a change in price structure. Prices have been observed to be redundant in consolidation for a long time. Nevertheless, traders are still hopeful that the Bancor price will eventually gain more ground before the end of this year. As prices continue to accumulate, our attention should also be on a possible shift in price structure.

BNTUSD Market Levels

Resistance Levels: $1.8990, $1.1690

Support Levels: $0.5380, $0.4060

The middle of July 2022 marked the beginning of Bancor’s strength deteriorating as prices continued to consolidate. Since then, no recent change has taken place at the moment. The bears accelerated with a strong bearish supply to cause a plunge from the 1.1690 key zone. Following the market volume display by the sellers, the Bancor price hasn’t made any further sprees of liquidity flow.

The Bollinger Band indicator gave out a short expansion, which brought about a bullish rise. However, the bullish rise is currently stochastic as sellers pose a threat to buying supply currently in the crypto market. The stochastic RSI (Relative Strength Index) combination is ridding lower back to the selling moment as price consolidation continues. Currently, there is no spike yet to be seen on the MACD (Moving Average Convergence and Divergence) indicator, as the price still gives a consolidative outlook.

Market Expectation

The market activity is currently full of trades disposing of digital assets lower in the crypto space. The sellers are pushing lower as the MACD is also trending lower. With the consolidation still in view, the price is expected to ride back to the 0.4060 key zone.

You can purchase Lucky Block here. Buy LBLOCK

Note: Cryptosignals.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.