Uniswap (UNI/USD) Market Is in Ranges, Possessing a Hiking Impute

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Uniswap Price Prediction – September 28

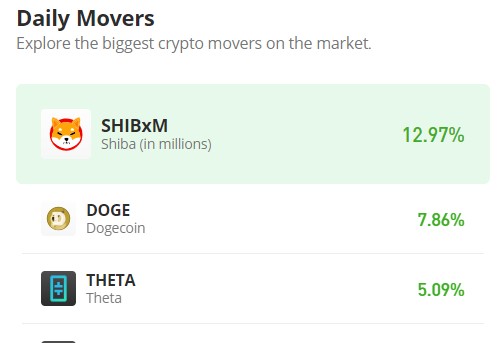

Formation of prices in the market operations in the UNI/USD have been holding above the support line of $4, given that the crypto-economic market is in ranges, possessing a hiking impute.

Prices have been moving more slowly in the range-bound areas of $4.5 and $4, showing indicators that sellers may be forced into a tight financial trading corner if they decide to continue moving prices lower after the lower point. As time goes on, we believe that purchasing will prevail over the upcoming trading line to be observed..

UNI/USD Market

Key Levels:

Resistance levels:$4.50, $5, $5.50

Support levels: $4, $3.50, $3

UNI/USD – Daily Chart

The UNI/USD daily chart reveals the crypto-economic market is in ranges, possessing a hiking impute within the points of $4.50 and $4.

The 14-day SMA indicator is placed at $4.4007230 underneath the $4.9376781 value line of the 50-day SMA indicator. The stochastic oscillators are holding floating in a slanting southbound position above the range of 50, trying to place back northbound from 59.24 to 64.24 values. Activities showcasing the transaction lines of buying and selling are now seen as the formation of a smaller bullish candlestick.

What does the current UNI/USD market operation indicate from below the SMAs?

In the first place, a loss of volatility has been experienced in the business dealings of Uniswap versus the US Dollar, as the situation has provided that the crypto-economic market is in ranges characterized by $4.50 and $4, possessing a hiking impute.

The bulls on the UNI/USD market will keep nursing various long positions that they should have initiated when the price first appeared below the smaller moving average. Activities that promote longevity should be continued on an ongoing basis.

Moving from a short position would require caution when trying to make a comeback at the value of the upper-range location. To give back a brighter note of correction to sound suspension of future rises, an active time to generate additional pull-ups in the direction of a higher line of the $5 is needed.

UNI/BTC Price Analysis

In contrast, Uniswap is in ranges, pairing with Bitcoin’s trending weight and possessing a hiking impute.

Even if the twin cryptocurrency market has been without definitive active price movement to push through, exceptional northward energy use has been achieved. In front of the 50-day SMA trend line is the 14-day SMA trend line. The stochastic oscillators are positioned between 94.48 and 92.35 values, which indicates that they are overbought. This suggests that the base cryptocurrency will probably take its time for a bit before advancing steadily against its counter-trading cryptocurrency after that.

Note: Cryptosignals.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

You can purchase Lucky Block here. Buy LBLOCK