Bitcoin Surges Above $51,000 Amidst Growing Investor Interest

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin, the leading cryptocurrency globally, surged above the $51,300 mark on Wednesday, driven by a surge in investor interest in exchange-traded funds (ETFs) and futures products tied to its price. This surge has now returned the benchmark cryptocurrency’s valuation to the $1 trillion club.

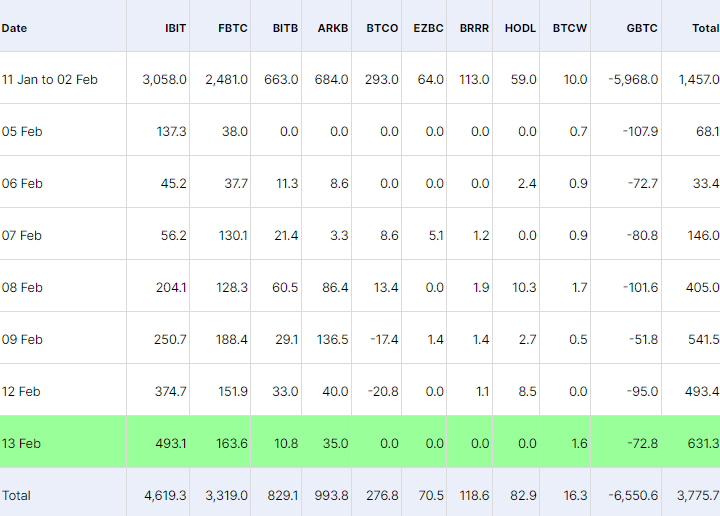

Market data reveals that approximately $631 million poured into spot bitcoin ETFs on Tuesday, with BlackRock’s IBIT taking the lead with $493 million in inflows. These ETFs offer investors exposure to bitcoin’s price movements without the need to directly purchase or store the digital asset.

Excluding Grayscale’s Bitcoin Trust, which has experienced outflows recently, spot ETFs have accumulated over $11 billion worth of bitcoin. This influx of funds has contributed to a bullish sentiment prevailing in the market, with analysts noting a reduction in selling pressure stemming from Grayscale’s product outflows.

Bitcoin Futures Driving BTC Towards $64,000

Simultaneously, demand for bitcoin futures, enabling traders to speculate on its future price, has soared to a 26-month high. Notional open interest, representing the dollar value of active futures contracts, now exceeds $21 billion, marking a 22% increase since the beginning of the year.

The escalation in futures open interest suggests a bullish market sentiment, coinciding with bitcoin’s rapid 30% surge in just three weeks. This rally has been fueled by substantial inflows into newly launched spot ETFs in the U.S., primarily attracting institutional investors.

However, futures trading involves leverage, magnifying both gains and losses. Elevated futures open interest indicates a heightened risk of price volatility, particularly if market movements oppose the majority of traders’ positions. Liquidations, triggered by exchanges due to margin shortages, can lead to significant price swings.

Despite this, the market’s overall leverage remains modest, indicating a reduced risk of major price crashes due to liquidations. Bitcoin continues to exhibit a robust upward trend, with some traders and options buyers setting their sights on an all-time high surpassing $69,000 in the foreseeable future.

For those interested in learning more about Bitcoin and other cryptocurrencies, along with the best crypto signals, visit our website today and sign up for a complimentary trial.