Crypto Inflows Hit Record High as Bitcoin Breaks $50,000

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The crypto market is booming as crypto inflows into digital asset investment products surge dramatically, especially the new spot-based Bitcoin ETFs in the US.

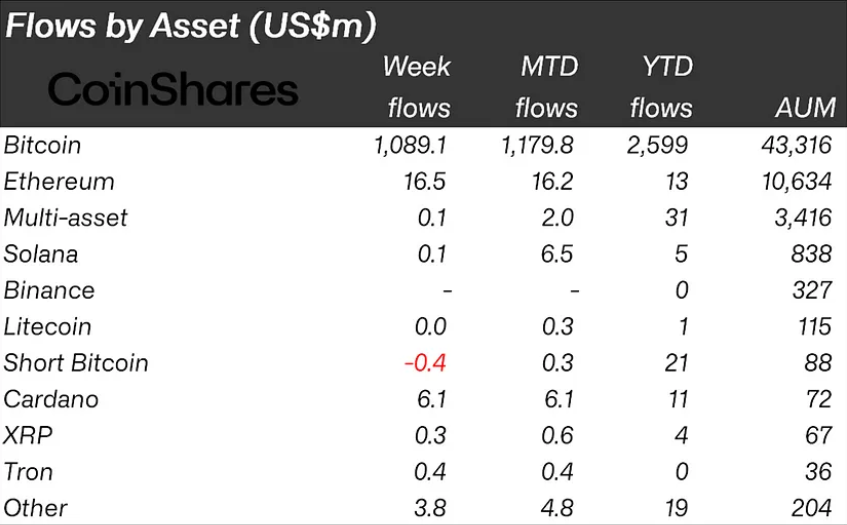

According to CoinShares, a leading digital asset manager, crypto inflows totaled $1.1 billion last week, bringing the year-to-date inflows to $2.7 billion. This also pushed the total assets under management (AuM) to $59 billion, the highest level since early 2022.

Bitcoin Dominates in Crypto Inflows, Accounts for Almost 98%

Bitcoin dominated the inflows, accounting for almost 98% of the total. The price of the leading cryptocurrency also soared to over $50,000 on Monday, for the first time since December 2021. The benchmark cryptocurrency jumped by almost 4% on Monday as traders took advantage of the surge.

The rally was fueled by strong demand from traders and institutional investors, amid the lingering enthusiasm around Bitcoin ETFs in the US.

Other cryptocurrencies also benefited from the positive sentiment, with Ethereum and Cardano seeing inflows of $16 million and $6 million, respectively. Some emerging coins, such as Avalanche, Polygon, and Tron, also attracted minor inflows.

However, not all regions and products saw inflows. Canada and Germany experienced minor outflows of $17 million and $10 million, respectively.

Uniswap and Short-Bitcoin also saw outflows of $0.5 million and $0.4 million, respectively. Moreover, the potential sale of the Genesis holdings of $1.6 billion could cause further outflows from the incumbent products in the US.

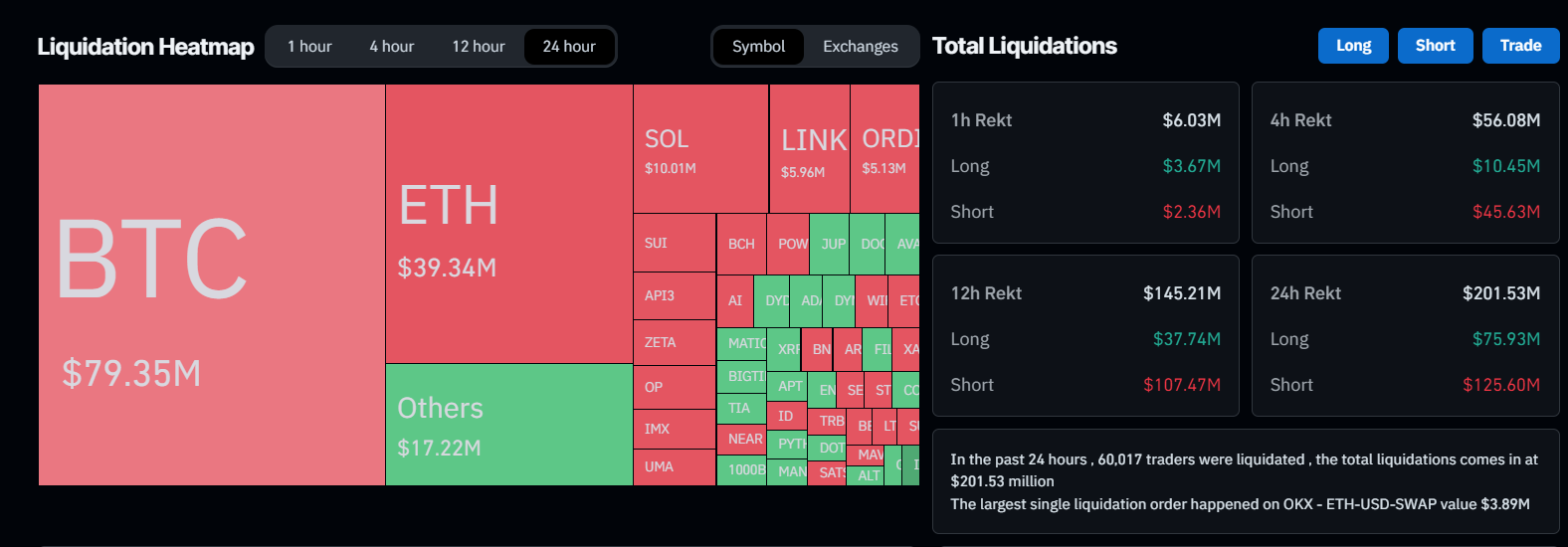

The crypto market also witnessed high volatility and liquidations, as data from Coinglass showed that $201.5 million in positions was liquidated on Monday, with Bitcoin shorts bearing the brunt of the losses.

Millions of Dollars Get Liquidated With Recent Bitcoin Surge

The crypto market also witnessed high volatility and liquidations, as data from Coinglass shows that the recent rise in Bitcoin has triggered massive liquidations in the market, especially for bears. The data shows that $201.5 million in positions was liquidated on Monday, with Bitcoin shorts alone accounting for $79.3 million of this figure.

If you are interested in learning more about crypto and Bitcoin, you can sign up for our Telegram channel and get the latest crypto signals delivered to your inbox.