Bitcoin Mining Difficulty Hits Record High as Price Surges

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin, the foremost cryptocurrency globally, has surged to unprecedented levels in both mining complexity and value, underscoring robust demand and trust in this digital asset.

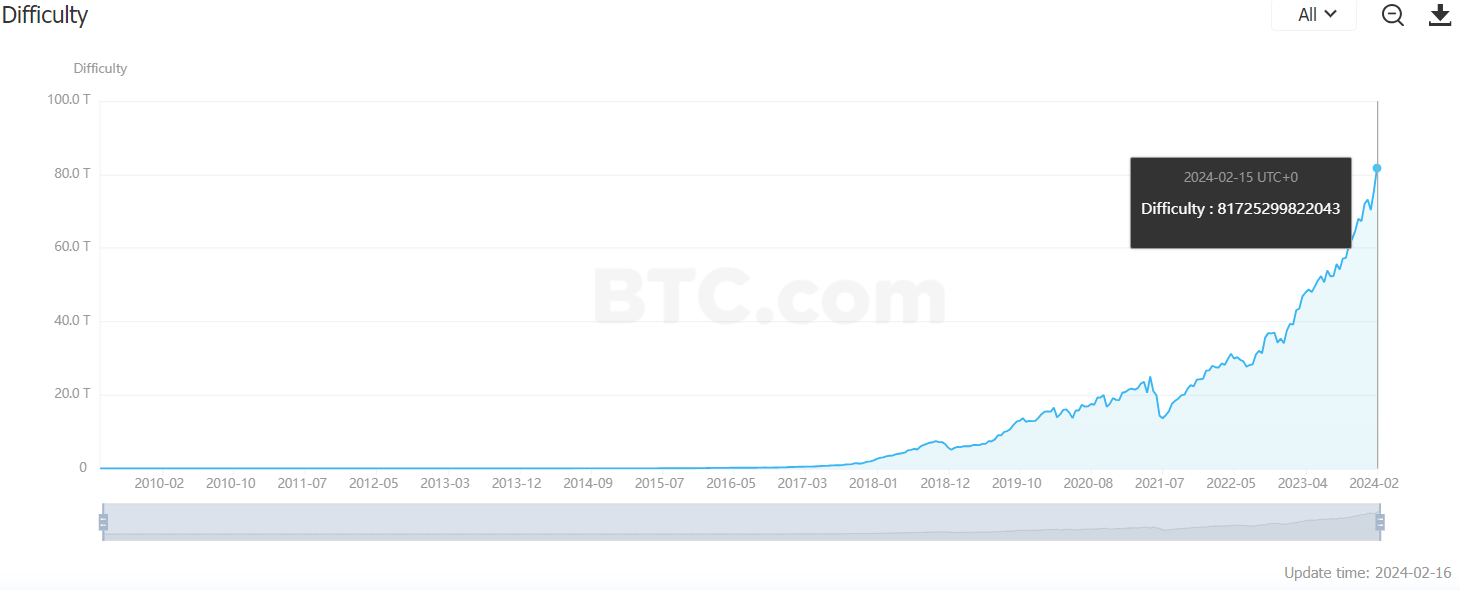

As reported by BTC.com, a prominent blockchain explorer, Bitcoin’s mining difficulty, which gauges the challenge of solving the mathematical puzzle associated with a block, peaked at 81.725 trillion on Friday, marking a historic high.

Concurrently, the hash rate, indicative of the cumulative computational power contributed by miners, ascended to 563.18 EH/s. This consistent uptrend since January 2023 positions Bitcoin’s mining difficulty on a trajectory toward breaching the 100 trillion mark in the near future.

Mining difficulty serves as a pivotal metric of the Bitcoin network’s security and vitality, reflecting the level of dedication and energy miners invest in validating transactions and reaping rewards. A higher difficulty denotes enhanced network security and competitiveness, albeit necessitating more potent and efficient hardware to match the escalating complexity.

This uptick in mining difficulty coincides with a surge in Bitcoin’s valuation, surmounting $52,850 on February 15, marking its zenith since November 2021.

The cryptocurrency’s ascent has been propelled by various factors, including heightened institutional adoption of Bitcoin Exchange-Traded Funds (ETFs).

Coinbase Says Bitcoin ETFs Could Change the Game in the Coming Months

In a related development, Coinbase, a leading cryptocurrency exchange, released a report delineating how Bitcoin ETFs could bolster the cryptocurrency’s price dynamics over the ensuing three to six months.

The report underscores the substantial net inflows into the eleven extant U.S. spot Bitcoin ETFs, aggregating over $4.2 billion year-to-date.

Also, Bitcoin ETFs have outpaced gold ETFs in net inflows during their inaugural month. For instance, standouts such as BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) ranked among the top 0.1% of new ETF launches in the past three decades, as per Bloomberg.

The trajectory of Bitcoin’s mining difficulty and price is anticipated to sustain its upward trajectory, buoyed by escalating investor interest and user adoption of the cryptocurrency. To capitalize on market fluctuations and partake in the Bitcoin revolution, consider subscribing to our crypto signals service for expert insights into profitable trading strategies.