Crypto Outflows Continue Amid High Trading Volumes and Price Volatility

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

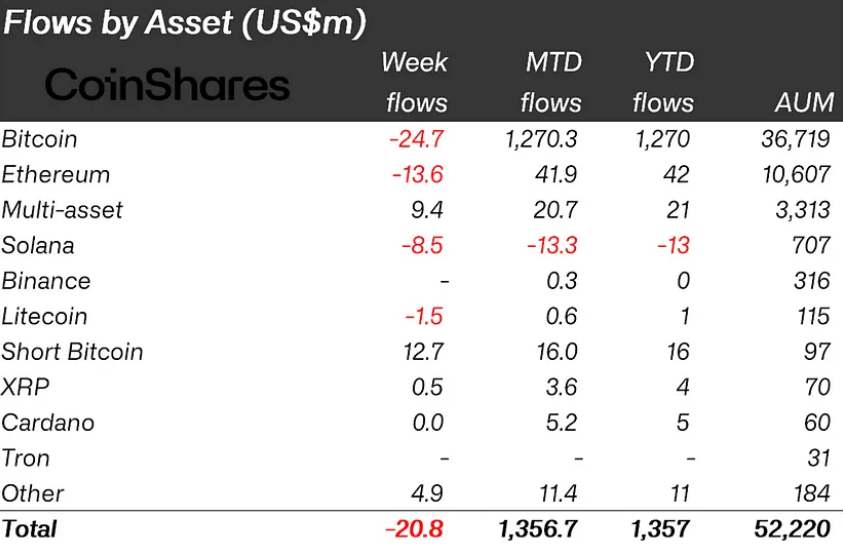

The past week was marked by heightened trading volumes and price volatility. We witnessed massive crypto outflows, with $21 million leaving digital asset investment products, according to CoinShares. The majority of these losses were concentrated in Canada and Europe, reflecting a strategic adjustment in investors’ portfolios.

Despite this outflow, the crypto space was characterized by intense trading activity, particularly in Bitcoin, which recorded a staggering $11.8 billion in transactions for the week. This figure, seven times higher than the average weekly volume in 2023, underscores the dynamic nature of the current market conditions.

CoinShares highlighted that these transactions accounted for 63% of all Bitcoin volumes on trusted exchanges, signaling the prominence of exchange-traded products (ETPs) as the primary drivers of crypto trading at present.

Meanwhile, the newly introduced spot Bitcoin ETFs, designed to track the spot price of Bitcoin rather than its futures contracts, have attracted a significant $4.13 billion in inflows since their debut. This inflow surpassed the $2.9 billion outflow from the higher-cost incumbent ETPs.

Bitcoin Slumps Below $39,000; Crypto Outflows Plague Altcoins

Bitcoin, the market’s largest cryptocurrency by market capitalization, faced downward pressure on its price, dipping below $39,000 for the first time since December 2.

Taking advantage of the price dip, some investors increased their exposure to short-Bitcoin products, resulting in $13 million in inflows last week. Ethereum and Solana, among other cryptocurrencies, experienced outflows of $14 million and $8.5 million, respectively, aligning with the bearish trend set by Bitcoin.

Conversely, blockchain equities, representing stocks of companies engaged in the crypto and blockchain industries, continued to draw investor interest. Inflows of $156 million were observed last week, contributing to a total of $767 million in the past nine weeks.

This sustained influx suggests that investors maintain a bullish outlook on the long-term prospects of the crypto sector, demonstrating resilience amid short-term fluctuations.