Bitcoin Surges Past $45,000 Top Amidst ETF Approval Anticipation

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin, the largest cryptocurrency by market value, breached the $45,000 mark on Tuesday morning in Asia, reaching its highest level since April 2022.

The surge, a 3.8% increase since the market opened, unfolded against the backdrop of mounting expectations for a favorable decision from the U.S. Securities and Exchange Commission (SEC) regarding spot bitcoin exchange-traded funds (ETFs).

Investors witnessed Bitcoin peaking at $45,915, propelled by the anticipation that the SEC might signal approval to 14 asset managers as early as next week Tuesday or Wednesday. Among these firms are prominent names such as Ark Investments, 21Shares, Valkyrie, Bitwise, WisdomTree, Franklin Templeton, BlackRock, VanEck, and Invesco.

If approved, a spot bitcoin ETF would revolutionize the cryptocurrency landscape by enabling investors to directly buy and sell the cryptocurrency on a regulated platform.

This approach stands in stark contrast to tracking its value through futures contracts or other derivatives. The potential outcome is increased demand and liquidity for bitcoin, rendering it more accessible and appealing to mainstream investors.

In an interview with The Block, Justin d’Anethan, Head of APAC Business Development at Keyrock, a crypto market maker, emphasized the significance of recent announcements by major players like BlackRock and Fidelity.

These firms disclosed the brokers supporting their BTC operations, including Jane Street, JP Morgan, and Cantor Fitzgerald. According to d’Anethan, this information solidifies the prevailing narrative that ETFs are on the horizon and may arrive sooner than later.

Investors are on high alert, expecting an official decision from the SEC within the first half of this month.

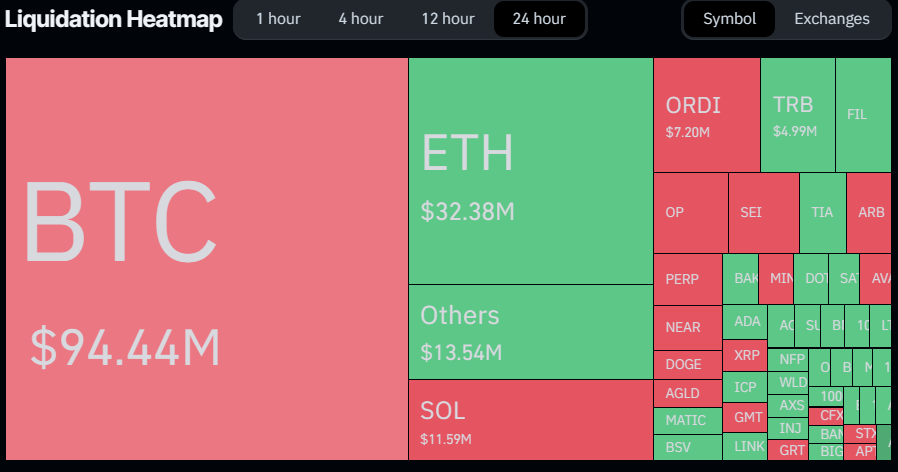

Bitcoin Surge Triggers Notable Liquidations

The surge in Bitcoin prices has also triggered a cascade of liquidations, primarily short positions, on centralized exchanges. CoinGlass data indicates that over $94 million worth of bitcoin positions ($76 million in shorts) were liquidated in the last 24 hours, out of a total of $207 million in crypto positions ($129 million in shorts).

As the market awaits the SEC’s decision, the cryptocurrency landscape remains dynamic, driven by the evolving narrative surrounding the potential approval of spot bitcoin ETFs.