Ethereum Soars Past $3,000 as Liquidations Pile

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Ethereum has seen substantial gains over the past week, surging over $400 to break above the key $3,000 resistance level today for the first time since April 2022. While Bitcoin also increased to $53,000, a more robust and consequential surge, Ethereum has significantly outperformed the largest cryptocurrency this week.

That said, Ethereum’s price rise seems driven by hype around potential approval for spot Ethereum ETFs in the US. Analysts point to May as the most likely approval period for the novel investment instrument in the US.

Interestingly, this price action mirrors the exact sequence of events that happened in late 2023 and early this year, when anticipation around Bitcoin ETF approvals sent its price surging. As an active crypto trader and investor for a while now, I understand how positive regulatory developments can catalyze major rallies.

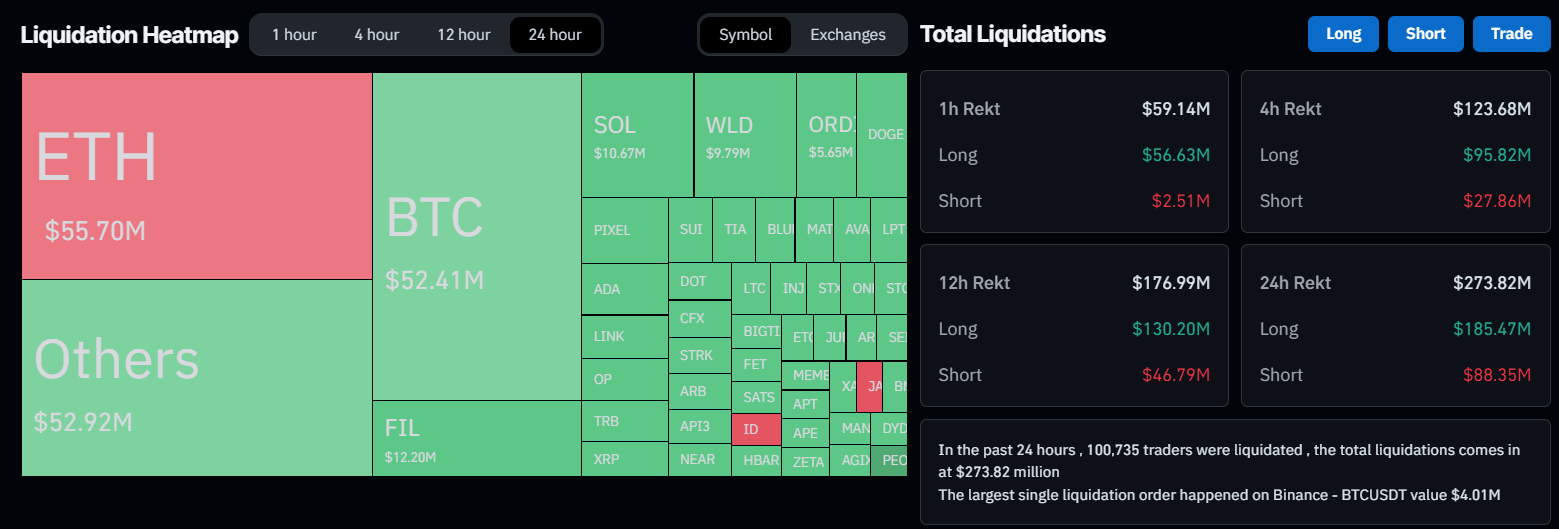

However, ETH’s new 2-year high has come at the expense of overleveraged traders. Per data from CoinGlass, over $273 million worth of positions have faced liquidations over the past day. Around 70,000 traders were liquidated, with Ethereum accounting for over $55 million ($33 million in shorts).

This liquidation figure outpaces that of Bitcoin ($52.9 million), which is a notably unusual occurrence given the stark difference in trading volume between both assets.

Ethereum Struggling with $3,000 Mark

The ETHUSD chart provided shows the token facing strong rejection around the $3,000 mark, pulling back slightly as of the time of this report. This emphasizes the risks highly leveraged traders face during volatile moves.

One must set appropriate stops to limit the downside when aiming to profit from speculative upside targets.

Having tracked previous crypto market cycles, my assessment is that Ethereum often leads rallies. So, this breakout could signal further upside across altcoins.

I look to capitalize through disciplined trading aimed at outpacing Bitcoin’s gains. Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested in learning how to day trade crypto? Get all the information you need here