MicroStrategy: A Bold Bitcoin Bet

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

In a sea of Bitcoin-centric headlines, it’s easy to overlook MicroStrategy’s essence as a thriving business entity. Pioneering business intelligence software, MicroStrategy empowers enterprises to dissect and visualize vast troves of intricate data, facing competition from Tableau, Microsoft Power BI, and Qlik.

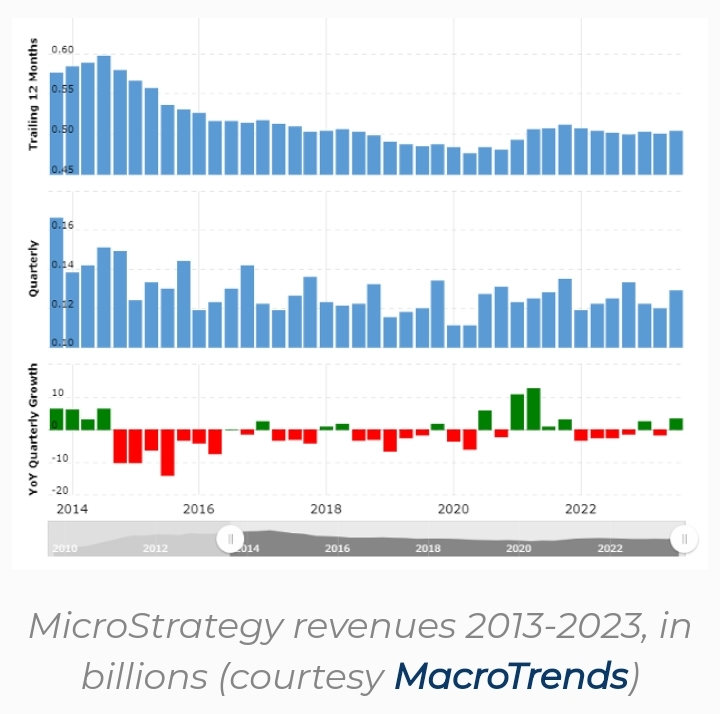

The company remains at the forefront of innovation, streamlining application development for seamless data integration, offering robust support for mobile users, and integrating cutting-edge AI capabilities. Despite a gradual decline in revenues over the past decade, recent years have witnessed a partial reversal of fortunes.

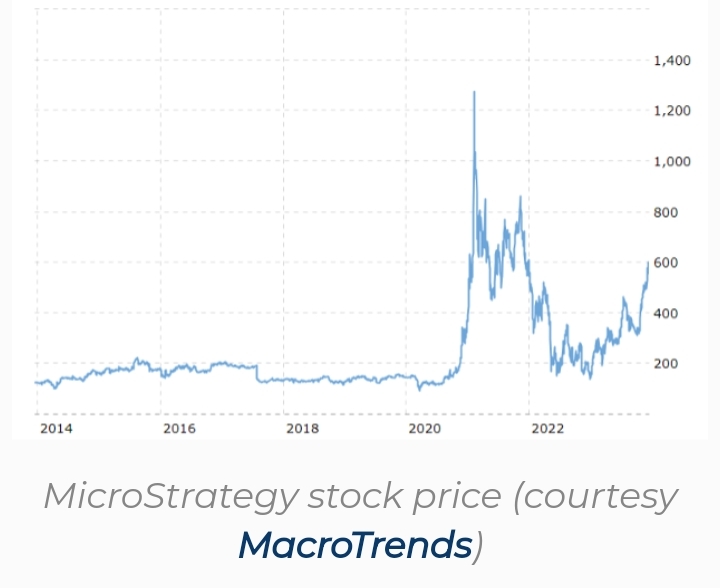

Simultaneously, MicroStrategy’s stock ($MSTR) has surged by over 200% since Michael Saylor’s strategic Bitcoin accumulation in 2020, outpacing the cryptocurrency’s growth. This phenomenon positions $MSTR as an enticing alternative for investors unable to directly engage in Bitcoin markets.

However, the substantial Bitcoin reserves introduce a new layer of volatility to $MSTR, akin to the unpredictability associated with direct Bitcoin investments. Saylor’s unwavering focus on Bitcoin has disrupted the company’s economic equilibrium, leading to a perspective where investing in $MSTR implies investing in Bitcoin, not the business itself. This unique dynamic underscores the intricate correlation between $MSTR’s stock and the price of BTC, creating a distinctive landscape for investors navigating the crypto-infused journey with MicroStrategy.

MicroStrategy’s Bold Bitcoin Odyssey

Venturing into the world of Bitcoin on a grand scale, MicroStrategy transcends the realm of conventional corporate investing strategies, challenging norms that have steered publicly traded companies for over a century. However, this audacious move isn’t without its hurdles, presenting significant challenges in regulatory compliance, stakeholder communications, and market optics.

Crafting a New Narrative

The leap from traditional assets to the crypto domain represents a monumental shift that could potentially estrange a sizable portion of investors and cast doubts among employees and stakeholders. Organizations embarking on this transformative journey must weave a compelling narrative. In a market with limited paths for exposure to BTC, MicroStrategy strategically positions itself as a conduit for investors seeking indirect exposure to the crypto realm. This strategic move has proven successful, with MicroStrategy stocks surging by more than 350% in 2023, outpacing BTC’s own impressive 160% gain.

Navigating the Financial Landscape

The presence of highly volatile crypto assets, such as BTC, introduces formidable challenges in corporate accounting and financial report disclosure. The elevated risk of impermanent loss in crypto investments necessitates MicroStrategy engaging in more frequent impairment testing. This financial accounting process assesses whether the carrying value of an asset on the company’s balance sheet exceeds its recoverable amount, providing a transparent reflection of the dynamic nature of crypto investments.

Navigating Crypto Risks and Rewards

In the realm of cryptocurrency, where transactions are irreversible and shrouded in near-anonymity, unique challenges emerge for corporate investors. While these traits offer strengths, they concurrently elevate the specter of theft, fraud, and inadvertent losses, demanding a meticulous approach to risk management.

MicroStrategy’s Evolution in BTC Holdings

MicroStrategy embarked on its Bitcoin journey with gusto, making its three most significant BTC purchases in the inaugural year of investment, culminating in a treasury valued at $1.125 billion by the end of 2020. The subsequent year witnessed a flurry of 14 diverse BTC acquisitions, with a monumental $1.02 billion transaction on February 24, tripling the company’s BTC reserves to $3.75 billion by the close of 2021. While 2022 saw a more restrained addition of approximately $250 million to the BTC reserves, the momentum surged in 2023, with seven major purchases propelling the reserves toward the $6 billion mark.

MicroStrategy’s Financial Tapestry

Evaluating MicroStrategy’s financial performance necessitates a nuanced understanding, considering the intricate impact of impairment charges and permanent losses. Despite operating revenues hovering around the $500 million mark since 2017, the onset of the BTC investment strategy precipitated a substantial dip in operating income due to reported impairment losses.

The reported net income losses of $535 million and $1.46 billion in 2021 and 2022, respectively, contrast sharply with a gross profit close to $400 million in both years. This discrepancy offers a somewhat skewed snapshot of the company’s current standing, especially considering its commitment to long-term BTC holdings. The prospect of a rebound looms as BTC prices ascend in the future.

This financial narrative finds resonance in the performance of $MSTR stock, surging from $166 in early January 2023 to $665 by year-end, reflecting a remarkable 1-year price performance of +400%. On December 29, the stock sported a P/E ratio of 489.44, underscoring the intricate dance between MicroStrategy’s crypto endeavors and its stock market dynamics.

Closing Thoughts

At its core, a business’s ultimate aim is to bring fresh value to the world. Perplexity arises when MicroStrategy’s acquisition of Bitcoin lacks clear reinvestment strategies, prompting investors to ponder the company’s true identity. Is it primarily a Bitcoin-holding entity with a subsidiary software business? Navigating atop a colossal $5 billion Bitcoin treasure trove thrusts MicroStrategy into the tumultuous realms of market unpredictability, akin to riding the Bitcoin roller coaster. The venture entails myriad risks coupled with nebulous rewards.

For those keen on Bitcoin investments, a straightforward solution emerges direct investment in Bitcoin itself, bypassing the complexities tied to MicroStrategy’s unique position.